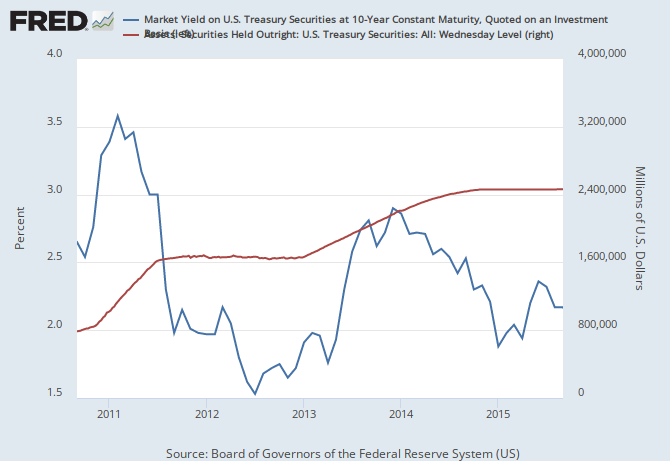

In mid-2013, the FOMC announced its intention to taper its ongoing asset purchase program. We can see that this announcement represented a dramatic change in policy from the sharp upward movements in long-term bond yields that it engendered. Personally, I interpret this policy change back in 2013 as the onset of what the Committee currently intends to be a long, gradual tightening cycle. As I noted earlier, we would typically expect that such a change in monetary policy should affect the economy with a lag of about 18 to 24 months. Viewed through this lens, the slow rate of labor market improvement in 2015 is not all that surprising.Now I dunno what the Fed said to cause all the consternation in the algorithms but the chart above says it all. Rates rose all the way through 2013, along with Fed purchases. Rates did not decline until 2014 as the Fed taper began. And we can see that the ten year was adjuste up, not down,for a very g00d reason .The Fed was applying a bond tax so rates rose to cover the bond tax. The bond tax is in those remits back to Treasury.

Kocherlakota makes up a story to fit the equations he learned.

No comments:

Post a Comment