In his interview with Martin Wolf, Ben Bernanke expresses exasperation with claims that quantitative easing is a giveaway to the rich (at the same time that it hurts savers — go figure):This is the fourth or fifth argument against quantitative easing after all the other ones have been proven to be wrong.It is, indeed, kind of amazing. In the eyes of critics, QE is the anti-Veg-O-Matic: it does everything bad, slicing and dicing and pureeing all good things. It’s inflationary; well, maybe not, but it undermines credibility; well, maybe not but it it causes excessive risk-taking; well, maybe not but it discourages business investment, which I think is a new one.

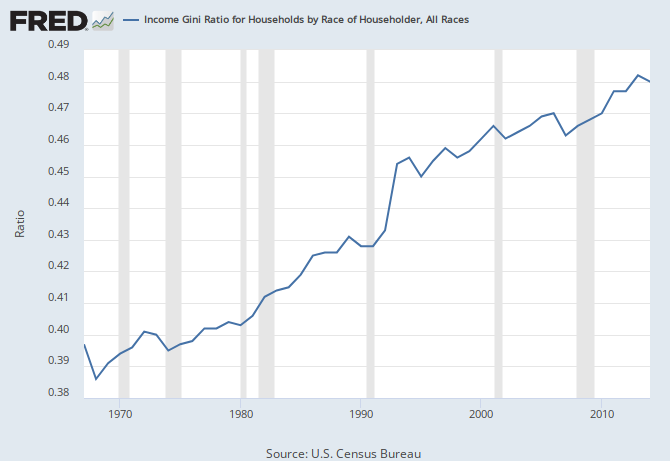

Manure.n Look at tyhe GINI index, it just up and nearly exactly follow3s the QE purchases. We see the same effect in 1992,

Here is is, the GINI index. The higher the value the richer the rich. Se it jump in 1992? That was when the MIT BNumbskulls advocate dropping rates below their market clearing value. The would be a Krugman, MIT fraud. Then we see the second largest jump in GINI in late 2011. The jump exactly coi8ncided with Bernankes's QE.

The Fed is dead, has been dead for 30 years. It only excists because a bunch of embarrased MIT profs discovered their math is complete horse shit, and its currently being replace by the maximum liklihood theory of self adapting statistics. That is forty years of a bunch of idiots from MIT thinking the world is full of Euler police, enforcing price controls.

Modern technology has eliminated the need for central banking, and it is central bankers who are stupidly dragging down the economy as the transaction cost of using their money has gone way up.

No comments:

Post a Comment