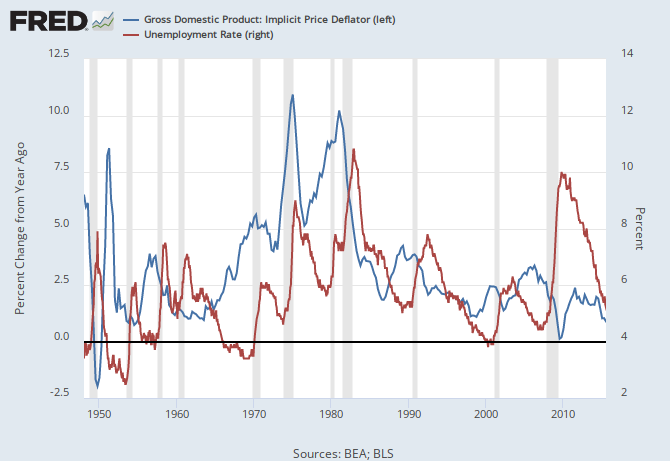

Money velocity, the red, tells us how many times money exchanged during one time period. The more velocity, the greater is the economic transaction rate. The red line is dropping, as we see.

What happens when money changes hands? DC collects a tax and pays interest on some 19 Trillion in debt, the blue line.. So the fewer times the DC collects the tax, the more volatile is the tax income. And we see interest payments become volatile. In fact, all sorts of measurements become volatile, relative to time. There are simply fewer transactions everywhere so aggregate measures, over time, will be more volatile.

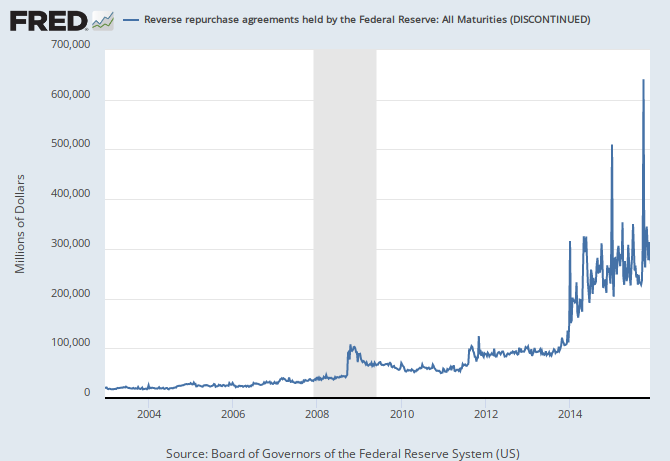

Thus we have an additional cost for using the government's money, about 1% in ATM charges, to cover the interest payment volatility as velocity dropped. So, the curve is flat out to a term that generates a positive yield, to cover the total transaction cost of ink and paper. The total cost of ink and paper is somewhere around 2%, remember all that roll over debt has become an ink and paper rental business for the debt cartel.

Central banking is bad banking and we have a Kanosian/Republican mess.

How banker bot does it:

When the deposit and loan tree is out of balance, the bot rebalances and takes its gains or losses. The bot has no prior claim and shares risk. In the new system of pure cash, bankers have loads of opportunities to monetize transactions, as the total cost of ink and paper drops to nearly un-measurable levels. Bankers just write python account managers, and these apps make virtual coins. No cost, the bots in our pockets are honest tree balancers, so the banker has a real time portfolio rebalancer, designed for some class of transaction having high mutual entropy.

The bot, really, is just two sided,

maximum entropy compression machine. It finds the encode/decode probabilities that define the tree grammar.(Marcolli?) or the most likely bipartite graph (Keevash?). The user, owner of the bot card, sees the transaction space as a surface, a lens, to correct his vision for the unseen. And the unseen are the redundancies left in to cover variation from that lens. Remember, self adapted statistics, the physics change to make a Ito compatible, nearly cotangent space. The key to the TOE, ask how could nature make a yard stick, and you have the key to everything. The physics of everything is all about making Pi, a cotangent space, usin only local knowledge.