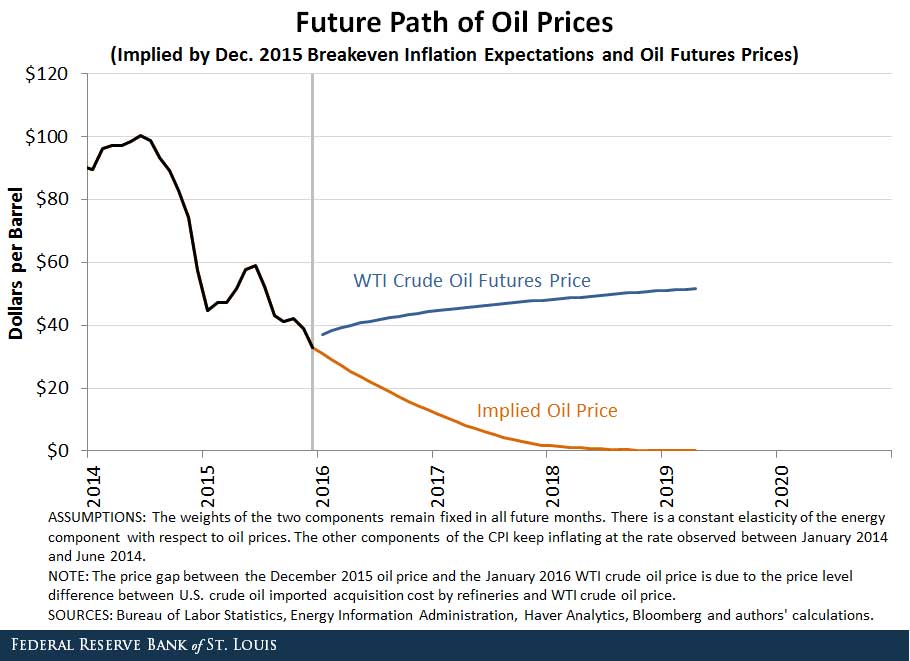

The St Louis Fed performed a neat statistical trick. They look at inflation protected bonds and get the forward looking rate of inflation. Then using the elasticity of oi with respect to consumer spending, they find oil prices are predicted to be zero!, the red line. The blue line is the future price of oil as estimated in the future market.

So, if I am a human portfolio balancer, why would I have two contradictory futures in my head? Because I don't, I am using the inflation protection bond as an insurance policy. I am protecting against the worst case, not predicting the mean result. Some economists know this, including Yellen. It's like an fire insurance deductable. The trader can cover the first 20k of a house fire, bur if the whole house goes up, he wants insurance.

No comments:

Post a Comment