Lower Rates!

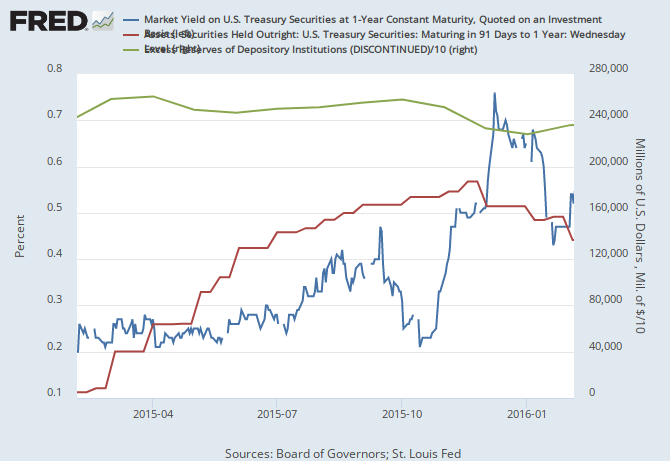

See that Blue line, the one year treasury rate? Waddya know, it dropped right after the Fed raised the IOER. Also, lo and behold, the green line, excess reserves has dropped noticeably.

Wht was the Fed really trying to do in 2015? Lower the one year, as we see the Fed almost tripled its portfolio of short term securities (The red line). The Fed gave up, the market is too big, so the one year jumped to .75 at its peak. So, the Fed, as it has always done, simply set the IOER to match the market yield for the one year. Almost immediately the one year began declining and money continued to leave the excess reserve account. Finally the one year collapses as a global downturn takes hold.

How do the Kanosians explain this? They say it all happened because pof a bizarre expectation function in our brains, and tis function always works top make the Kanosian assumption true.

How do I explain it?

The Fed effectively closed an internal regulatory flow comprising the GHSEs, regulated lenders, and Treasury. And the loop costs returned to the economy, an easing.

No comments:

Post a Comment