A shock to revenues and its the drum beat to follow.

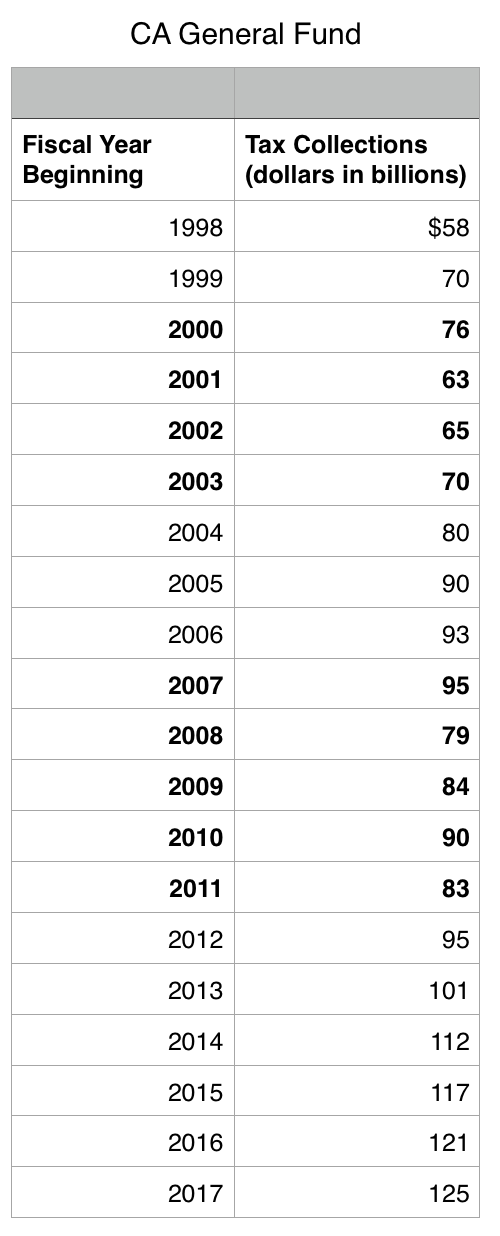

Dave Crane at Stanford made the list of Cal government revenues by year, and noted that it falls, quite rapidly, during market down turns.

We can see that California provides the bulk of the boat anchor during a US downturn.

And, Dave notes, our Medicaid liabilities are way up, hard to repress those costs, so expect big deficits and high interest charges across the municipals.

And, we get this interest wallop hitting Illinois at just the wrong time, they have a ton of debt to roll over. California is 15% of the economy, we can see additional interest charges tacked onto the senators. And, not to forget, the California county school districts have been on a school building spree, debt based; it is going to roll over.

Notice the periodicity? That is the central bank effect. The loans to deposits, deposits wiggle, loans don't. The loans are all Treasury bonds. That boundary condition basically takes away half the path options, through the net, pricing is restricted artificially in deviations. Then the seigniorage effects masks the implied bit error, transferring it to the government budget. So the thing will simply orbit from one presidential regime to the other.

No comments:

Post a Comment