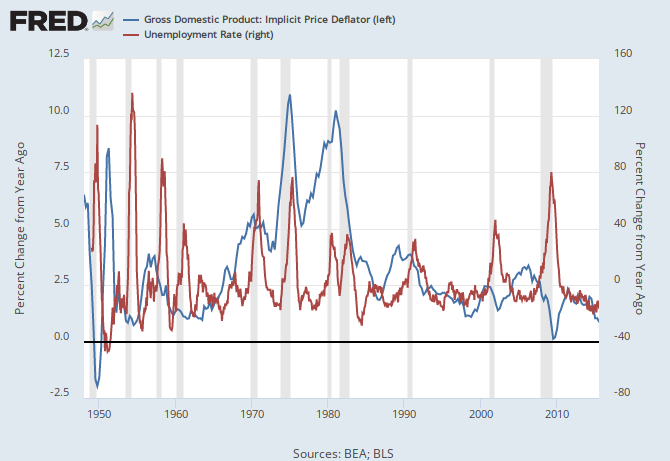

On misunderstanding economics: Most of us have long lamented the general public's lack of understanding of economics. A new paper by David Leiser and Zeev Kril sheds interesting light upon this. The human mind, they say, "is not particularly equipped to think about economics"...Faced with this..., say Leiser and Krill, people resort to metaphors - the most notorious being that governments should manage the public finances as if it were a household. Worse still, they are often overconfident about the applicability of these metaphors. ...There is, though, another heuristic laypeople use, which Leiser calls the "good begets good heuristic" (pdf). He shows that people believe that good things cause good things to happen, and bad things to cause bad things. For example, they think a rise in unemployment is associated (pdf) with a rise in inflation because both are bad... What might be more problematic is that people think government spending is bad, and so associate it with rising unemployment.

I did not read the paper. But it seems clear to me that inflation precedes a recession. If Leiser and Krill can prove that the chart above is wrong, then fine.

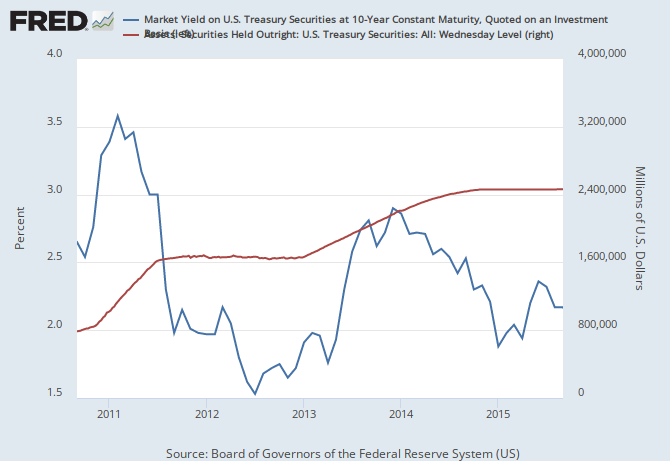

Does government spending associate with the grey bars above? They land at presidential regime changes, and are almost always caused by bedly estimate3d costs of the previous regime.

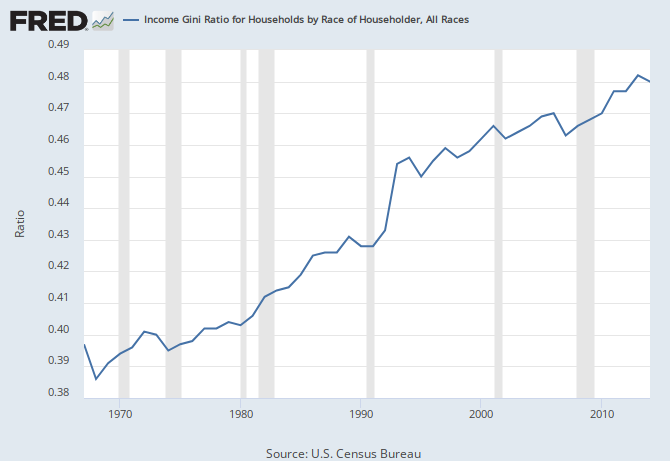

So there is pleny of evidence the Leiser and Kril have no clue.