Tuesday, October 31, 2017

Another Tesla

If not for its cloud business, Amazon would be posting big losses

The cloud business will depreciate fairly fast as we produce the sandbox. I doubt that Jeff Bezos knows what we are doing and his techies are not all that smart.

The problem of deranged, Arab camel jockies armed with a psychotic religion?

TRUMP: Time to ramp up 'Extreme Vetting Program' after New York City attack

Look at central Asia. Its defining moment was when a cowardly Persian nation gave into the onslaught, and the Muhamodites kept slaughtering their way north.

Now we have this cowardly horeshit nation called Iran, and their leaders run around looking for magic in water holes, like a bunch of retarded children.

Look at central Asia. Its defining moment was when a cowardly Persian nation gave into the onslaught, and the Muhamodites kept slaughtering their way north.

Now we have this cowardly horeshit nation called Iran, and their leaders run around looking for magic in water holes, like a bunch of retarded children.

Bubble

A regular 6% yearly housing gain in the face of a 1.5% inflation. It is a housing bubble, a very large skew of the consumer basket.

Will it crash a bit? You bet, the question is how much. But if anyone yells you that the downtrend is symmetrical to the uptrend, then they are lying.

Will it crash a bit? You bet, the question is how much. But if anyone yells you that the downtrend is symmetrical to the uptrend, then they are lying.

Backwards evolution

AIRBAGS PUT ON LAMPPOSTS TO PROTECT ‘SMARTPHONE ZOMBIES’

Lampposts are being covered in airbags to stop so-called ‘smartphone zombies’ bumping into them as they walk around staring at their screens in an Austrian city.Salzburg authorities say tourists are increasingly hurting themselves by not looking where they are going while checking their devices.Locals have described mobile phone users as Smombies, the short form for a ‘smartphone zombie’, and civic chiefs are taking action to stop them getting injured.The next step is to plug their ears with rubber so they cannot hear anything. It's like being a meth head using digitally induced brain disease.

Let us select a crash point

Commentary on high evaluations, a pension manager proposes:So, the plot is to plan the crash. Everyone pile up the money at the same time, for example, pensions need do-re-me today because of a pension stampede.

"Right now assets are very expensive," said Keohane, whose firm manages more than C$70 billion ($54 billion). "We need to be patient, to wait for better opportunities. Whenever the next crisis comes, assets are going to be on sale. You can buy them a lot cheaper than you can buy them today, but you have to have patience to be able to do that."

Why to pensioners stampede? Everything is invested and they can see the default. They discover a better value of Pi.

The universe has a bunch of proton pensioners and they cause big bangs in our local multi-verse. Protons do the same thing, let everything expand until we get the better value of Pi then rush to the center to requant.

Google edits my documents!

People Are Getting Locked Out of Their Google Docs, and They Are Annoyed

I have proof. I used google docs to write:

"The Alphabet concept was pure horseshit and now Alphabet is selling off their worthless investments."

Their censor robot changed the text, It now reads:

"The Alphabet concept was a great horse run and now Alphabet is selling off their worthwhile investments at a profit."

That is why their stock remains high. Any financial statement gets a review and upgrade if it's an Alphabet analysis.

Islamic entitlement slave escapes, rampages

6 Killed After Truck Plows Into NYC Crowd; Suspect Yelled Allahu Akbar Before Shooting

Serving pina coladas to boomers is a drag and causes the entitlement slaves to go religious psycho.

Microsoft and Intel owe me a check

Dow is now up 4.2% in October, powered by Intel, Microsoft and Wal-Mart

I explained why we need Intel SGX before Intel read my blog and invented it. Then Microsoft geeks read my blog and invent COCO on top of SGX. The crowd goes wild because they think the key to Fintech has been found. Not quite, they still need the auto-pricing algorithm.

But they should send me a big fat advertising check, including WalMart.

The sandbox has moved beyond this blogger

The Fintech market is inventing the proper stuff before I can even blog, like I lost my job. Viewership is back way down. In my boredom we are going to get more political incorrectness.

Monday, October 30, 2017

Islam is a nutcase religion

Philosophy Professor Tells Bisexual Student Who Criticized Islam 'We're Not Going to Let You Damage the Program'

Why would any intellectual believe otherwise?

Are we saying that the Philosophy department should teach the reality of ghosts and goblins?

Donald Trump Jr was initially truithful

Donald Trump Jr. initially told the press that the meeting was held to discuss adoptions of Russian children by Americans. On July 8, 2017, Trump Jr. tweeted that he agreed to the meeting with the understanding that he would receive information damaging to Hillary Clinton, and that he was conducting opposition research.[3] Goldstone had stated in his email that the Russian government was involvedI think that this was one of the sanctions:

The Magnitsky Act, formally known as the Russia and Moldova Jackson–Vanik Repeal and Sergei Magnitsky Rule of Law Accountability Act of 2012, is a bipartisan bill passed by the U.S. Congress and signed by President Obama in November–December 2012, intending to punish Russian officials responsible for the death of Russian tax accountant Sergei Magnitsky in a Moscow prison in 2009.Putin was willing to trade Hillary secrets for help on the sanctions. When news of the meeting came out, this was the stated treason and no one doubted it. It is the truth.

Manafort is the typical political wheeler dealer, and good at it evidently. He also lobbies for foreign leaders and crooks. The meeting sounds more like a fishing expedition, as I have difficulty seeing Putin betting candidate Trump can guarantee the sanctions relief.

Investors have already written off their losses

"Investors Can't Stop Buying Every Dip": The WSJ Explains Why Markets Soar To New Highs Every Day

Didn't read this but here is my guess.

Wealthy investors have the edge, the rig, and they know it is unsustainable and will reverse. They already expect this. So, any dip or increment they can nab is a small risk relative to the losses they already expect, on the correction.

Should central banks warehouse shoes?

An important point, actually, since the Fed likes a trimmed median estimate of retail prices. The optimum consumer index has to be the price of the median casual shoe.

But central bankers, like any currency banker, shares risk; the Fed will have to temporarily buy and sell lots of shoes. It can do this indirectly by creating the shoe warehouse index, then buying and selling it as an ETF.

I will speculate that this will actually work, then Mankiw can prove it. Shoe warehousing is very closely related to clothing and general retail. Coherent is the proper term, shoes share the truck space with bunches of regularly bought retail goods. The shoe box, like the cigar box before, has become a standard carrying basket, a key vector in the container algebra, especially at department stores. Four make a shopping basket, it fits in every shelf of the house. and will hold a nice lunch.

The denomination algebra for paper cash

It is: In Shoe We Trust. The standard unit of currency is the median shoe paper bill. It shows, it some detail, the typical median shoe on one side, on the other is a government promise that this bill will buy one pair of median casual shoe in 30 metropolitan districts of the USA.

But central bankers, like any currency banker, shares risk; the Fed will have to temporarily buy and sell lots of shoes. It can do this indirectly by creating the shoe warehouse index, then buying and selling it as an ETF.

I will speculate that this will actually work, then Mankiw can prove it. Shoe warehousing is very closely related to clothing and general retail. Coherent is the proper term, shoes share the truck space with bunches of regularly bought retail goods. The shoe box, like the cigar box before, has become a standard carrying basket, a key vector in the container algebra, especially at department stores. Four make a shopping basket, it fits in every shelf of the house. and will hold a nice lunch.

The denomination algebra for paper cash

It is: In Shoe We Trust. The standard unit of currency is the median shoe paper bill. It shows, it some detail, the typical median shoe on one side, on the other is a government promise that this bill will buy one pair of median casual shoe in 30 metropolitan districts of the USA.

Watch the power of secure element

It is that moment when the Cayman Island's government mandates use of the secure, sandbox compatible, element for banks. Then, it is all over, the $150 intelligent, counterfeit proof, honest cash card is here.

The price point for a billion in unit sales is about $150. That is equivalent to the cost of 1500 rectangles of high quality currency paper. But, add in capital costs of the cash trucks, physical vaults in ATM's, security guards. Compare that to the automated counterfeit hunter bots prowling the sandbox, hunting down counterfeits. You find plastic and silicon beat ink and paper.

Let us not forget humanity

What makes us human? The ability to hold a rock in our dominant hand and bang the shit out of something. Exactly what the intelligent cash card offers.

In economics, Gresham's law is a monetary principle stating that "bad money drives out good". For example, if there are two forms of commodity money in circulation, which are accepted by law as having similar face value, the more valuable commodity will disappear from circulationtIgnore the connotation from 'bad money', they really mean cash in which material costs of transactions is lowest. The intelligent cash card beats paper money in carrying costs, likely by an order of magnitude.

The price point for a billion in unit sales is about $150. That is equivalent to the cost of 1500 rectangles of high quality currency paper. But, add in capital costs of the cash trucks, physical vaults in ATM's, security guards. Compare that to the automated counterfeit hunter bots prowling the sandbox, hunting down counterfeits. You find plastic and silicon beat ink and paper.

Let us not forget humanity

What makes us human? The ability to hold a rock in our dominant hand and bang the shit out of something. Exactly what the intelligent cash card offers.

Sunday, October 29, 2017

Why not?

South Korean Political Leader to Trump: Give Us Nukes!

It solves the problem, North and South can deter each other. The other harmed party is the dipshit Commie rats in China, but Xi likes nuclear proliferation all around China.

Wealthy folks need more do-re-me

As in, investors are running out of it, and the shortage could threaten the 8 1/2-year equity bull market that we've come to know and love.

It's a new reality facing investors of all types. While money market assets make up a record-low 17% of long-term funds, the cash balance of equity mutual funds also sits at an all-time low of 3.3%, according to data compiled by INTL FCStone.

And the firm doesn't mince words when discussing the increasingly dire situation.

"A decade of financial repression has turned cash into trash," the firm's macro strategist Vincent Deluard wrote in a recent client note. "There are a lot of fully-invested bears out there. There is not much sidelines cash left to push stocks higher."

The wealthy are guaranteed advanced knowledge of volatility because they form the key component of the Goldman-Sachs debt cartel. The cartel is not sustainable because keeping low volatility requires keeping a flat curve, and the economy cannot sustain a flat curve.

So, all the money is invested and the curve is flat and government can borrow at affordable interest.

Trump colluded to create a bank?

The FBI's investigation of Donald Trump's former campaign manager, Paul Manafort, includes a keen focus on a series of suspicious wire transfers in which offshore companies linked to Manafort moved more than $3 million all over the globe between 2012 and 2013.Much of the money came into the United States. These transactions — which have not been previously reported — drew the attention of federal law enforcement officials as far back as 2012, when they began to examine wire transfers to determine if Manafort hid money from tax authorities or helped the Ukrainian regime close to Russian President Vladimir Putin launder some of the millions it plundered through corrupt dealings.So, if the Mueller and the teAm have their conspiracies right, this had nothing to do with Trump selling hotels, more like Trump's buddy testing the banking market. He should have used bitcoin for the transfers.

Another 'wallet' vendor goes full sandbox

This is a mobile device wallet, basically adding the intelligent cash card functionality to our telephones. Skip the tech talk and note the multi-currency support and direct integration with a major exchange. The multi-currency part will become a standard layering of crypto certificates. All of the major exchanges will upgrade to the trading bot architecture as the best and fairest trading architecture.

Sometime in 2018, complete sandbox capability will be available to the wealthy. The mal-coordination happens when Kanosians tell us that only wealthy people can have this tech, to protect their Magic Walrus.

Sometime in 2018, complete sandbox capability will be available to the wealthy. The mal-coordination happens when Kanosians tell us that only wealthy people can have this tech, to protect their Magic Walrus.

With Segwit transaction support for bitcoin and litecoin, the new wallet “will ship with support for Bitcoin, Ethereum, Litecoin, Bitcoin Cash, Augur REP, Wings, and Matryx tokens,” Edge claims. Another purported feature is allowing users to “seamlessly convert funds between the various digital currencies and tokens” with “tightly integrated support for Shapeshift.”

What happened to voters' regret?

Kevin Drum quotes a farmer unhappy with the Cal Choo Choo project:

OK, the guy made a bonehead voter move.Jeff Martin, an olive oil rancher in the area, said he could lose his entire 30-acre grove and new milling plant if the state decides it needs his land. “I voted for high-speed rail and I found out it is all smoke and mirrors,” he said. “This project puts hundreds and hundreds of people like me in limbo.”

But he admits to making this bonehead move to a friggin reporter who then quotes him in the paper as the usual ignorant assed California voter. Why embarrass yourself, blame it on the other guy. Like those voters who admitted to voting for Obamacare, then seeing their premiums triple.

Just a touch of SALT

House Tax Writer Gives Ground on a State and Local Tax Break

Congressman Brady says he’ll allow deduction for property taxes in bill Flare-up shows difficult path forward for tax overhaul plan Bowing to concerns from Republican House members in high-tax states, the chamber’s chief tax writer said he’ll preserve a federal income-tax break for property taxes.

“At the urging of lawmakers, we are restoring an itemized property tax deduction to help taxpayers with local tax burdens,” House Ways and Means Chairman Kevin Brady said in a statement Saturday afternoon.

Talk about your housing bubble.

Are we tipping the technology?

The FANGs had a good earnings report for a good reason, they are micro-pricing automatically and can transaction in quantities only dreamed of in the older technology.

All the trading technology and searching technology is already in place in traditional digital money, the dollar trading sites. The sandbox is mostly a reordering if layers to take advantage of crypto.

Fintech and sandbox are becoming the one thing, and leaving the central bankers too far behind. The central bankers are mostly pricing government goods, mainly entitlements, and government money being left in the dust..

All the trading technology and searching technology is already in place in traditional digital money, the dollar trading sites. The sandbox is mostly a reordering if layers to take advantage of crypto.

Fintech and sandbox are becoming the one thing, and leaving the central bankers too far behind. The central bankers are mostly pricing government goods, mainly entitlements, and government money being left in the dust..

Saturday, October 28, 2017

Mueller self indicts

Random News Reports: A federal grand jury in Washington on Friday approved the first charges in the investigation led by special counsel Robert Mueller, according to sources briefed on the matter.

The charges are still sealed under orders from a federal judge. Plans were prepared Friday for anyone charged to be taken into custody as soon as Monday, the sources said.

Robert Mueller, however gave a statement:

" After careful evaluation of my actions one day, in the shower, I self indicted, suddenly discovering my crime. I now vigorously deny it. I will fight these charges from myself to myself with great vigour."

Hillary to be charged with war crimes

In an interview with Qatari TV Wednesday, bin Jaber al-Thani revealed that his country, alongside Saudi Arabia, Turkey, and the United States, began shipping weapons to jihadists from the very moment events "first started" (in 2011).Al-Thani even likened the covert operation to "hunting prey" - the prey being President Assad and his supporters - "prey" which he admits got away (as Assad is still in power; he used a Gulf Arabic dialect word, "al-sayda", which implies hunting animals or prey for sport). Though Thani denied credible allegations of support for ISIS, the former prime minister's words implied direct Gulf and US support for al-Qaeda in Syria (al-Nusra Front) from the earliest years of the war, and even said Qatar has "full documents" and records proving that the war was planned to effect regime change.There we have iy. Obama dumb as shit and Hillary engaging in genocide.

Let us give auto cash its own web suffix

A domain suffix is the last part of a domain name and is often referred to as a "top-level domain" or TLD. Popular domain suffixes include ".com," ".net," and ".org," but there are dozens of domain suffixes approved by ICANN. Each domain suffix is intended to define the type of website represented by the domain name.Normally we access a site by looking up the numerical equivalent of its web name; the URL is converted to an IP number.

In auto traded cash, there are keys kept by secure elements unknown to any human, according to sandbox rules and Intel SGX hardware based protection. Thus, all URL lookups in auto cash will be encrypted with the secret key, there will be no denial of service except by counterfeit of the secure element, a finite and correctable problem.

If we incorporate end to end security, then the routers themselves are part of the ringed fence, and they can work with encrypted IP numbers, making all exchanges nearly impervious to DOS. Routers thus obey the Intel SGX standard.

Any hacker trying to penetrate the WalMart discount point exchange would have to buy a ton of stuff from Walmart, in small quantities.

Intel and WalMart owe me an advertisement check.

Relative primeness and compact generators

Consider two sequences, semi random. Each sequence can be represented by a generator that produces the typical sequence in a set of random sequences. I can define relative primeness, the one compact generator is a multiple of the other if the matching error between typical sequences is a bound wiener process.

Consider government goods and private sector goods. Economists construct the problem as a hard partition, they do not always consider black market resale of government goods. Thus, in this model, all the matching uncertainty is retained as tradebook uncertainty in matching private and public sector goods. The compact generator for government goods is illiquid relative to private sector goods, not all parties will get the fair ratio between government goods and private goods, but they will restructure to restore the fairness in subsequent transactions.

Obamacare is the classic example of business restructuring going forward such they they eliminate the wage setting most disincentivized by Obamacare taxes. There is no legitimate way to resell Obamacare goods at a discount.Matching error grows, unbound. It is the construction, the hard partition. government never allows the private sector to find the matching wage settings such that we get a stable quotient algebra, government keeps enforcing the relative prime rule. Hence the spiral.

Consider government goods and private sector goods. Economists construct the problem as a hard partition, they do not always consider black market resale of government goods. Thus, in this model, all the matching uncertainty is retained as tradebook uncertainty in matching private and public sector goods. The compact generator for government goods is illiquid relative to private sector goods, not all parties will get the fair ratio between government goods and private goods, but they will restructure to restore the fairness in subsequent transactions.

Obamacare is the classic example of business restructuring going forward such they they eliminate the wage setting most disincentivized by Obamacare taxes. There is no legitimate way to resell Obamacare goods at a discount.Matching error grows, unbound. It is the construction, the hard partition. government never allows the private sector to find the matching wage settings such that we get a stable quotient algebra, government keeps enforcing the relative prime rule. Hence the spiral.

Friday, October 27, 2017

OK, Putin knocked off Magnitsky

Yada Yada:

I will summarize and you all readers can skip ahead and be bored.

Putin and the Yuri guys are tax cheats, murderers and oligarchs. They killed some lawyer who was about to expose the whole fraud. Obama don't like murdering oligarchs so he slapped Putin and the Ruskies with sanctions, making it harder to steal.

What does this have to do with Trump? Nothing, really, it is all Ruskie crapola.

I will summarize and you all readers can skip ahead and be bored.

Putin and the Yuri guys are tax cheats, murderers and oligarchs. They killed some lawyer who was about to expose the whole fraud. Obama don't like murdering oligarchs so he slapped Putin and the Ruskies with sanctions, making it harder to steal.

What does this have to do with Trump? Nothing, really, it is all Ruskie crapola.

What we know about Yuri Chaika — the Kremlin's 'master of kompromat' who's behind the notorious Trump Tower meeting.

Russia's chief prosecutor Yuri Chaika played a prominent role in lobbying against the Magnitsky Act during the 2016 election.Chaika's relationship with Russian lawyer Natalia Veselnitskaya, who met with top members of the Trump campaign last June, has raised questions about whether she was an agent of the Kremlin. Chaika's foray into American politics appears to have begun in earnest last April, when Rep. Dana Rohrabacher visited Moscow and obtained a memo from Chaika's office criticizing the Magnitsky Act. Russia's top prosecutor and "master of kompromat" has been working since at least last year to overturn legislation passed by President Barack Obama in 2012 that levied punishing sanctions and travel restrictions on high-level Kremlin officials suspected of human rights abuses and corruption.

Yuri Chaika, who served as Russia’s justice minister during Putin’s first term and was appointed prosecutor general in 2006, is far from a household name in the United States.

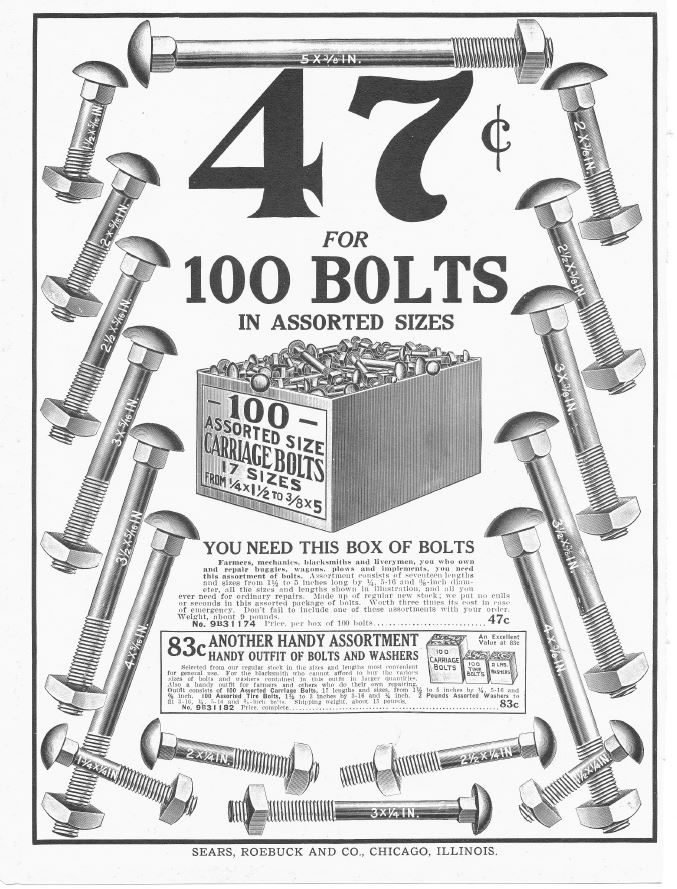

Why the rotary press is the industrial revolution

It specified engineering interchangeability vit standard parts catalogues. The rotary press move started in 1860. By 1875 hardware parts catalogues were commonly used. The standardization made machinery precise enough to manage electricity.

1869 Illustrated Catalogue of Woodworking Machinery, 93 pages

1871 John C. Hilton's Stencil Tools, 32 pages

1872 History of Woodworking Machines, 351 pages

1874 Henry Disston & Sons Hand-book for Lumbermen, 68 pages

1875 Catalogue and Price-list of Fine Imported and American Machinery, 124 pages

Disassembly sheet for bicycle circa 1890.

1869 Illustrated Catalogue of Woodworking Machinery, 93 pages

1871 John C. Hilton's Stencil Tools, 32 pages

1872 History of Woodworking Machines, 351 pages

1874 Henry Disston & Sons Hand-book for Lumbermen, 68 pages

1875 Catalogue and Price-list of Fine Imported and American Machinery, 124 pages

Disassembly sheet for bicycle circa 1890.

What idiot names his team Houston, Texas

Houston Texans players reportedly wanted to stage a walkout after team owner Bob McNair compared NFL players to 'inmates running the prison.

If your fans were kind of stupid, it might help them find the stadium, less to remember.

Who is your mascot? Some dot on a map.

If your fans were kind of stupid, it might help them find the stadium, less to remember.

Who is your mascot? Some dot on a map.

Government and the Redneck holocaust

The Washington Post and “60 Minutes” have just peeled back another sordid layer in the War on Drug by exposing Big Pharma’s role in expanding the Opiod Crisis that has resulted in more than 30,000 deaths per year.All the disgusting details can be found here, but it is really a straight forward case of legal bribery and corruption in the market for legal opiates — the driving force in this crisis as doctors continue to turn untold thousands of innocent people into opiate addicts.Opiate medicines have been a Godsend to humanity, but it comes also with scourge of addiction, dependence, and overdose deaths. The Harrison Narcotics Act of 1914 made the situation worse thanks to the meddling of federal bureaucrats who turned regulation and oversight into prohibition.Notice the doctors went along for the ride.

What makes a unit of account?

The cost of protection against counterfeit is low.

The merchant can take a quick glance at the 20 and look for the difficult watermark. Thus the merchant and customer can act as if they are a ring fence of secure elements. Each party has a one step protocol.

Stock certificates have a complex contract associated with them, their exchange costs are high, like blockchain based currencies. In the partition we get high powered money operating on the more expensive and secure exchange system.

In Fintech, both contracts and coins are crypto digital with low cost executions. So we will get a very sharp partition between high powered money and auto-traded coins, there is no transaction cost wedge between the two forms. Hence we get the sharp layering between auto-traded cash and smart contracts, and can identify the smart contracts as mostly mapping time and space to relative likelihood.

The subject comes up again because Matt Levine is on the case. Matt is well respected in sorting this stuff out. With respect to ICO, the distinction demands a definition of the coin. Is it meant for banking purposes, a discount coupon for purchase, an ownership certificate? Our personal secure elements can easily handle all types.

If your company is doing an Initial Fintech Offering, just identify the contract web location, our bots and apps can build out the interpretation properly. Our apps can search and find places to trade any contract you define.

The merchant can take a quick glance at the 20 and look for the difficult watermark. Thus the merchant and customer can act as if they are a ring fence of secure elements. Each party has a one step protocol.

Stock certificates have a complex contract associated with them, their exchange costs are high, like blockchain based currencies. In the partition we get high powered money operating on the more expensive and secure exchange system.

In Fintech, both contracts and coins are crypto digital with low cost executions. So we will get a very sharp partition between high powered money and auto-traded coins, there is no transaction cost wedge between the two forms. Hence we get the sharp layering between auto-traded cash and smart contracts, and can identify the smart contracts as mostly mapping time and space to relative likelihood.

The subject comes up again because Matt Levine is on the case. Matt is well respected in sorting this stuff out. With respect to ICO, the distinction demands a definition of the coin. Is it meant for banking purposes, a discount coupon for purchase, an ownership certificate? Our personal secure elements can easily handle all types.

If your company is doing an Initial Fintech Offering, just identify the contract web location, our bots and apps can build out the interpretation properly. Our apps can search and find places to trade any contract you define.

But Wal-Mart is a FANG stock too!

Wal-Mart Stores Inc

NYSE: WMT - Oct 27, 3:04 PM EDT

88.06USD 0.56 (0.63%)

0.56 (0.63%)

Walmart will have to sell cloud services soon.

Relating Magic Walrus to the queuing problem

Magic Walrus is like an upper bound on performance if all parties met their bandwidth requirements, (they had the liquidity to cover their discrete transactions). How does this relate t the queueing problem?

Let us use Kling's GDP factory model and convert it to a GDP store. In the queuing model, we have trucks dropping off HDP goods in the back and customers buying them in the front. My claim is that when supply equals demand, there are zero or one trucks in the back and one or two customers in the front. At that condition, two transactions are pending for each completed movement of one discrete set of goods. One and a half a the front and one half at the back. Shannon bandwidth requirements are met and prices stable. We are at Magic Walrus.

But the Shannon lock does not include price discovery, the process of quantization. It is the paradox, there has to be some Hawking radiation to find the quants. So we slightly underperform, testing the boundaries of price such that we end up with about 1.5 transactions for completed transition across the layers. We have Hawking's radiation because we have a bit of congestion in the store, it is called tradebook uncertainty. The systems cannot know what is in the shopping baskets until the baskets get to the proper checkout lane. The shortages and overflows that appear due to undersampling cause price resets. Equivalence tells us that all the shortages and underflows are observable by watching the queues, when two trucks show up or when the checkout line is empty or overflowing.

Hawking radiation is the menu costs, the cost of maintaining the container algebra.

Let us use Kling's GDP factory model and convert it to a GDP store. In the queuing model, we have trucks dropping off HDP goods in the back and customers buying them in the front. My claim is that when supply equals demand, there are zero or one trucks in the back and one or two customers in the front. At that condition, two transactions are pending for each completed movement of one discrete set of goods. One and a half a the front and one half at the back. Shannon bandwidth requirements are met and prices stable. We are at Magic Walrus.

But the Shannon lock does not include price discovery, the process of quantization. It is the paradox, there has to be some Hawking radiation to find the quants. So we slightly underperform, testing the boundaries of price such that we end up with about 1.5 transactions for completed transition across the layers. We have Hawking's radiation because we have a bit of congestion in the store, it is called tradebook uncertainty. The systems cannot know what is in the shopping baskets until the baskets get to the proper checkout lane. The shortages and overflows that appear due to undersampling cause price resets. Equivalence tells us that all the shortages and underflows are observable by watching the queues, when two trucks show up or when the checkout line is empty or overflowing.

Hawking radiation is the menu costs, the cost of maintaining the container algebra.

Great GDP report

3.1% annual growth. The hurricanes are not costed in this initial report and subsequent revisions could drop this to 2.5-2.75, still a very good report. I am surprised to the upside, I was looking at 2.1-2.3, a pessimistic guess.

Thursday, October 26, 2017

The story is absolutely hilarious

Even National Review is appalled!

And everyone is staring at the Trumpster thinking this guy is brain damaged to let this go on right in front of the public! Like, "I am Trumpster, watch me allow an idiot to ruin my political career"

Meet Whitefish Energy, which has just been awarded a $300 million project to rebuild storm-smacked Puerto Rico’s electrical grid.The funny part is that one would actually have to search out someone as stupid as Secretary Zinke.

Whitefish is based in the hometown of Secretary of the Interior Ryan Zinke, who knows the firm’s chief executive and whose son once worked for Whitefish in a modest capacity. Whitefish Energy has two full-time employees, and its largest government contract prior to this was a $1.3 million job fixing 4.8 miles of power line. Its biggest government job other than that was replacing a pole. Whitefish Energy is a two-year-old firm, and it reported $1 million in revenue on its procurement documents.

The firm plans to charge Uncle Stupid more than $300 an hour for a subcontracted lineman and $462 an hour for a subcontracted supervisor. (Subcontractors will make up the bulk of its work force, since — let’s repeat — the firm has two full-time employees.) The company will also charge about $400 per worker in per diem food and housing costs. A former Department of Energy official calls the arrangement “odd.”

And everyone is staring at the Trumpster thinking this guy is brain damaged to let this go on right in front of the public! Like, "I am Trumpster, watch me allow an idiot to ruin my political career"

Boom to bust in one day

Pending Home Sales Plunge In September To Lowest Since Jan 2015

The day after completed sales showed an 18% boost? What is going on?

Two theories, funny hurricane data, or everyone in Texas ran out an bought a house just before the hurricanes.

Matt Levine helps with our sandbox semantics

BloombergView:

Somebody mixed metaphors. If I produce coins, I am a currency banker, but I can still issue stock certificates. I can issue stock if I produce eggs, and still offer a free dozen eggs with each stock purchase.

Even outside of banks, though, a lot of ICOs are closer to this line of thinking than the other one. A token offering, in this view, is not a way to fund the development of an unowned protocol that exists for the benefit of its users. It's just a way to fund a regular business with a regular stock offering (or securitization, or whatever), only "tokenized." "Tokenized" means that the stock in the business trades on a blockchain instead of on a regular stock exchange. But it is still basically stock -- though it might be stock with weak governance rights and few legal protections.Matt is talking about Initial Coin Offerings and points out the the coins are not always meant to be coins, but act like securities. He uses the generic 'token' to imply the general class of digital ownership contracts. This is separate from a 'coin' . Tokens imply a more complex contractual obligation, in general. Coin is a subclass that is meant for one step exchange.

Somebody mixed metaphors. If I produce coins, I am a currency banker, but I can still issue stock certificates. I can issue stock if I produce eggs, and still offer a free dozen eggs with each stock purchase.

Not since the crash of 2008!

Inventories crash and Zero Hedge draws this dotted line on the 'way back machine'. I feel more comfortable when their dotted lines end up at 2013 or 2011, hate it when that point all the way back.

There is no pareto efficient reform of taxes

Pareto efficiency or Pareto optimality is a state of allocation of resources from which it is impossible to reallocate so as to make any one individual or preference criterion better off without making at least one individual or preference criterion worse off.Word of the day. Tax reform ideas are being shut down as unworkable or too complex. In this case we have something called a pass through tax break:

I've written before about problems with the provision of the Republican tax framework that President Donald Trump touts as good for small businesses.This tax break would ensure that people who own so-called pass through businesses would be taxed at no more than 25% on income from those businesses, unlike wages, which may currently be taxed at rates up to 39.6%.A major problem with this proposal is most small businesses wouldn’t benefit at all. More than 80% of tax filers with small business income are already taxed at rates of 25% or less, so only the wealthiest business owners, who currently face high tax brackets, would get a tax cut.We have to exempt state and local taxes. Exempt something called pass thru. We are stuck with entitlement and Obamacare taxes. All avenues if reform have already been tried and rejected.

Even worse, we may not be able to afford the adjustment period if there were major reform. The Swamp is in a 'state' of Illinois. Better to go with the can kick and revisit these issues in Q2 2018.

Just your standard Swamp corruption

Carmen Yulin Cruz, the mayor of San Juan, Puerto Rico, engaged in a Twitter feud with a small Montana energy firm on Wednesday, after she and others questioned the firm's controversial $300 million contract to assist the hurricane-ravaged US territory.

Whitefish Energy Holdings was awarded the contract last month to restore Puerto Rico's power grid, but it raised eyebrows recently as the island has struggled to provide power to more than 75% of residents weeks after Hurricane Maria hit on September 20.

Cruz called the no-bid contract "alarming" and demanded it be voided in light of ethical discrepancies, Yahoo News reported Wednesday.

I think its legal for Swamp Rats to steal from the middle class, both sides do it as we all know.

Janet couldn't cause a recession

“I must admit that there is some evidence that inflation expectations could have slipped,” she told the National Economists Club in Washington on Oct 20. While she believes they are still well anchored and consistent with the Fed’s target, “that’s something that cannot and should not be taken for granted.”

The law and the policy are in agreement, Congress and the Fed should cooperatively cause an inflation hike and then recession. They have done this every recession cycle since 1980.

It doesn't work anymore, and we cannot identify cause or effect. I think Congress is failing at failing because they are bankrupt, they do not have even the minimal spending power needed to cause a good old fashion American recession.

Wednesday, October 25, 2017

Price the early look

IEX Puts Speed Bump in Path of Fastest Trading

This is about the new stock exchange which pauses each complete trade for almost a millisec before updating the public trade book. Thus, high frequency traders who try for an early look, in orer to front run a price change, will no longer have the advantage of being 'closer' to the tradebook.

The better solution is to place the trading bots right inside the space containing the trade book and give each bot round robin access, and the let the bots automatically engage in hedging, fairly. If some bots wtn a higher priority access to the trad ebook, charge those bots a fee, and split it with the other bots willing to wait in line.

Prior to IEX, the intra trade liquidity was done in secret with a specially chosen company picked by the NYSE directors. But that function is really the market making function and should be an observable random process called the pit boss, justy another observable, automated trading bot.

Now that we have the sandbox, a lot of this shit gets fixed.

This is about the new stock exchange which pauses each complete trade for almost a millisec before updating the public trade book. Thus, high frequency traders who try for an early look, in orer to front run a price change, will no longer have the advantage of being 'closer' to the tradebook.

The better solution is to place the trading bots right inside the space containing the trade book and give each bot round robin access, and the let the bots automatically engage in hedging, fairly. If some bots wtn a higher priority access to the trad ebook, charge those bots a fee, and split it with the other bots willing to wait in line.

Prior to IEX, the intra trade liquidity was done in secret with a specially chosen company picked by the NYSE directors. But that function is really the market making function and should be an observable random process called the pit boss, justy another observable, automated trading bot.

Now that we have the sandbox, a lot of this shit gets fixed.

Where is the deflation?

Economists notice that inflation the lines goes downward since the Nixon shock.

So, economists must consider two possibilities, deflation is coming soon or we stabilize around the current prices. If there is inflation, it is not on this chart.

So, economists must consider two possibilities, deflation is coming soon or we stabilize around the current prices. If there is inflation, it is not on this chart.

Wow

Following existing home sales modest bounce, new home sales in September exploded by 18.9% MoM - the biggest jump since January 1992.Against expectations of a 1.1% decline, new home sales soared 18.9% MoM in September - 9 standard deviations above expectations...From Zero Hedge.

The sales were mostly final before the hurricanes. So this looks more like an unexpected and massive bubble in housing. See what happened to home prices in the next read.

Trumpster vs Corky And Flakie

This is back to big state/small state as the issue in this internal GOP feud.

The Trumpster's essential claim is that New York won the presidency. The small states cannot do the big programs which the big four can handle. So Corky and Flakie are looking at this sudden rise in interest charges swamping their small state programs, as well as the rising real estate loan rates. This is all very existential stuff to many states suffering relative out migration to the west, without the Swamp discretionary spending their economies are not really viable.

The Trumpster's essential claim is that New York won the presidency. The small states cannot do the big programs which the big four can handle. So Corky and Flakie are looking at this sudden rise in interest charges swamping their small state programs, as well as the rising real estate loan rates. This is all very existential stuff to many states suffering relative out migration to the west, without the Swamp discretionary spending their economies are not really viable.

Ten year at 2.46 this morn?

That is a very high yield and may not hold through the day.

But from the Treasury point of view, it makes sense. If they keep rolling over short term debt they end up compounding beyond the ten year rate, so Treasury is piling on the ten year to clear short term debt.

Mortgage rates will jump and Congress is likely to stall.

But from the Treasury point of view, it makes sense. If they keep rolling over short term debt they end up compounding beyond the ten year rate, so Treasury is piling on the ten year to clear short term debt.

Mortgage rates will jump and Congress is likely to stall.

Mueller, Obama, and Hillary dunnit

Let’s give plausible accounts of the known facts, then explain why demands that Robert Mueller recuse himself from the Russia investigation may not be the fanciful partisan grandstanding you imagine.

Here’s a story consistent with what has been reported in the press—how reliably reported is uncertain. Democratic political opponents of Donald Trump financed a British former spook who spread money among contacts in Russia, who in turn over drinks solicited stories from their supposedly “connected” sources in Moscow. If these people were really connected in any meaningful sense, then they made sure the stories they spun were consistent with the interests of the regime, if not actually scripted by the regime. The resulting Trump dossier then became a factor in Obama administration decisions to launch an FBI counterintelligence investigation of the Trump campaign, and after the election to trumpet suspicions of Trump collusion with Russia.

The claim here is that Mueller conspired with the Ruskies, paying them in fact, to collect bad intel on Trump and use that politically, while covering up Hillary's dirty deeds with the Ruskies. Comey helped out, FBI lying and cheating against Trump; with Obama and Hillary playing along all the way.

My original theory holds true. Trump never conspired to win the election. He conspired to lose the election and sell hotels in Russia.

All the Swamp rats, from Corky, Flakey, to Hillary and Obama are all upset and have always believed in lying and fraud. Now Trump accidently wins and has been pointing out the Swamp Rats have no clothes, they are bankrupt.

Tuesday, October 24, 2017

Big hurricane bill

The measure provides $18.7 billion to replenish the Federal Emergency Management Agency's rapidly dwindling accounts, and $16 billion so the flood insurance program can keep paying claims.It brings the total approved by Congress during this fall's hurricane season to more than $50 billion — and that's before requests expected soon to cover damage to water and navigation projects, crops, public buildings and infrastructure, and to help homeowners without flood insurance rebuild.Like, whoa. The states and localities will likely spend an equivalent, as will victims. These would be worse case and come to 1% of GDP. The hurricane expenses likely drove the one year treasury up 20 basis points.

But, in the budget, the extra interest charges look like a sudden 10% jump in the fourth largest budget item. If the jump in charges is not easily covered then senators have to worry about budget stretch outs or their state contracts, an existential threat.

Seems like an impossibility

Health care will add more jobs than any other sector in coming decade, while manufacturing industries are projected to shed the greatest number of positions.Health-related jobs in areas such as home health care and hospitals will grow by about 3.7 million jobs by 2026, according to a report released Tuesday ...

3.7 million more medical workers is about 15 million more old and sick, some 10% of the work force. But productivity growth is at a standstill, mainly because we are stuck on entitlements. Our potential growth rate is likely below 2%, and this drops it by 20%, resulting in potential growth of 1.5%, impossible, the debt costs won't go much below 2% before foreign investors drop out.

Lock humans out of the 'SGX enclave'

The hardware wallet startup Ledger is continuing to expand its company goals, as the startup just revealed its partnership with California-based tech corporation Intel. The Intel SGX solution plans to create a secure area called the “SGX enclave” for private keys tied to digital assets. Essentially this means the data will be stored within the enclave as opposed to applications, and the goal aims to curb a variety of software attacks.Good idea, I should have thought of it.

Small, open economies do better

The simple model of a small, open economy shows that tax cuts raise workers wages, often correct. In the complete model, taxes pay for services with neutrality of debt, on average Jared complains:

What does it mean, Jared, when the simple model does not apply? It means government multipliers are less than one, fiscal expansion of debt makes matters worse.

In this case, the model assumes that the US is a small, open economy such that capital inflows instantaneously fund more investment, such investment immediately boost productivity, and the benefits of faster productivity immediately accrue to paychecks. The simple model ignores the extent to which these inflows would raise the trade deficit as well as their impact on revenue losses and higher budget deficits.The model assumes away imperfect competition, which is relevant today as a) monopolistic concentration is an increasing problem, and b) the one thing economists agree on in this space is that in these cases, the benefits of the corporate cut flows to profits and shareholders, not workers, other than maybe some “rent sharing” with high-end workers.It is it not an unrealistic model, there exist small, open economies for which this is true, taxes are well adjusted.

What does it mean, Jared, when the simple model does not apply? It means government multipliers are less than one, fiscal expansion of debt makes matters worse.

Caterpillar is a White Swan today

Wall St. gains on 3M, Caterpillar earnings; Dow jumps

Caterpillar was doing poorly most of the recovery but in the past few years they have begun to grow sales, mainly due to mining (oil). So the recent jump in sales is not all hurricane business.

Caterpillar is a large and major player. When they do well a whole complex of smaller vendors do well and volatility on the stock market drops. When volatility is low, the inverted PE ratio ends toward the one year treasury.

But the one year starts to look good when one can roll it over and get the ten year rate after a short waiting period. The curve slope is low, and can't go much lower.

Koch socialism

A small Montana company located in Interior Secretary Ryan Zinke's hometown has signed a $300 million contract to help get the power back on in Puerto Rico, The Washington Post reported.Whitefish Energy had only two full-time employees on the day Hurricane Maria hit Puerto Rico, according to the Post. The company signed the contract — the largest yet issued to help restore Puerto Rico — with the Puerto Rico Electric Power Authority (PREPA) to fix the island's electrical infrastructure.Do not bother to hide the corruption.

It is not so much that Koch socialists steal from the poor, using government power. The real problem is that the Magic Walrus requires theft and corruption to work and we have a bunch of embarrassed economists who gave the store to the rich and are in denial. The problem cannot be fixed except by default because the cost is priced in via debt.

Refurbish the vacuum quants that create existence

Newfound Wormhole Allows Information to Escape Black Holes

The paradox the wormholes resolve is that black holes don't emit Hawking radiation randomly, but the radiation 'transports' along the fifth dimension to another black hole and exits.

But... The proof is information theoretic, what is the real 'queueable' item? The unit of vacuum, and the little buggars have to be 're-creased' every 10^32 years as their creases wear. So, in the process of packing sphere, the bubbles travel to a created center for reformation. Quasars do this work, I think, they are quark repair stations.

I have animated the theory. Free protons, in my theory, communicate about where the suspected center of time is, they always try to point to a center. This effort is equivalent to finding the typical sequence of events up to current.As entropy increases, the collective guess become consistent until they accidentally create the quasar effect. My animated theory bounces between information theoretic and actually compressed flow of sphere packing. I am free to make it appear the protons are trying to figure something out, that is why we call it information theoretic.

So a quasar spout coming out of a whirlpool disk is a 3D projection of a 5D object, the fifth D is really combinatorial. The actual space construction inside quasar space looks like a fourth dimension of distance exists, as if one could look around corners. The quasar needs the extra combinatorial grouping to carry information and reshape quarks. That extra prime grouping is hidden from us, but becomes the entanglement field.

The entanglement field, then, is the distance over which multi-verses can be separated. Multi-verses can slightly overlap as long as they distinguish their quantum fields.

Monday, October 23, 2017

Gearing up for Fintech

Everyone, actually. Central banks get the issues and semantics, they figured out it is not all bitcoin-blockchain.

We have the regular introduction of crypto-currency derivatives, which are virtual, custodial side chains in bitcoin language. So I can buy a house with a bitcoin derivative and my finance company can just swap ownership it derivative tokens, even though we are pricing in bitcoin. We can evade the block chain.

Overstock was successful in introducing its block chain stock trade system. So we got cross over in both directions.

Trezor is integrating is personal secure element to the latest in automatic trading systems, making one stop trading bots a reality, end to end.

Ripple got some coin fame for connectivity, the specialty of that system is running clearing actions through multiple clearing houses automatically. Ben liked that coin.

Bitcoin is still climbing.

I am actually getting bored, like it is time to ready singularity 2.0.

We have the regular introduction of crypto-currency derivatives, which are virtual, custodial side chains in bitcoin language. So I can buy a house with a bitcoin derivative and my finance company can just swap ownership it derivative tokens, even though we are pricing in bitcoin. We can evade the block chain.

Overstock was successful in introducing its block chain stock trade system. So we got cross over in both directions.

Trezor is integrating is personal secure element to the latest in automatic trading systems, making one stop trading bots a reality, end to end.

Ripple got some coin fame for connectivity, the specialty of that system is running clearing actions through multiple clearing houses automatically. Ben liked that coin.

Bitcoin is still climbing.

I am actually getting bored, like it is time to ready singularity 2.0.

Sunday, October 22, 2017

We survived hurricane season

Initial, and optimistic, estimates put the cost at a quarter point for Q4. Housing starts took a bigger dive than expected, so that estimate is closer to a third of a point, Labor markets remain 'tight' the survey says, meaning JOLTs may have slowed, but not died. Two more weeks of erratic JOLTs data is likely.

My revised estimate is 2/3 of points of GDP loss over three quarters, down from a full point. We will skip the blue bar and worry again in Q1 2018, Swamp ledger time.

My revised estimate is 2/3 of points of GDP loss over three quarters, down from a full point. We will skip the blue bar and worry again in Q1 2018, Swamp ledger time.

Friday, October 20, 2017

Millennials have agreed!

The ten year is at 2.38, a 40 basis point jump over two years, or a 15% rise in federal interest charges for the indefinite future. We got the millennials to sign the ledger on this day, those wonderful little kids.

Thursday, October 19, 2017

Wealthy folks on strike

Treasury Secretary Steven Munchin, speaking on the eve of the 30th anniversary of the 1987 market crash, predicted stocks will plunge if Congress fails to overhaul taxes."There's no question in my mind if we don't get it done you're going to see a reversal of a significant amount of these gains," Mnuchin told Politico on Wednesday.Mnuchin's warning -- a highly unusual one for a sitting treasury secretary -- suggests he fears a drop of at least thousands of Dow points. The average has spiked almost 5,000 points since last fall's election, a rally that President Trump often celebrates as evidence of his success.The super wealthy can no longer be guaranteed the market rises as they fund Congressional debt. Ned should know, he was head life insurance salesman at Goldman-Sachs. Tis is a threat, either the Swam cu taxes on the super wealthy of interest charges are going up.

Wednesday, October 18, 2017

Why would an intelligent person join Mensa?

A study of intelligence and neurosis discovers that members of the high intelligence club, called MENSA, are neurotic. Smart happy people don't join narcissistic organizations. In fact, it is kind of a stupid thing to do, unless you are smart and neurotic.

After comparing this with the statistical national average for each illness they found that those in the Mensa community had considerably higher rates of varying disorders.

While 10 per cent of the general population were diagnosed with anxiety disorder, that rose to 20 per cent among the Mensa community, according to the study which published in the Science Direct journal.

Not worth the enforcement

At around midnight Sunday, Gov. Jerry Brown pandered to religious extremists and jeopardized the job security of women across California.In his final act of this legislative session, Brown vetoed a bill that would have ensured that a woman can’t be fired because she decided to get pregnant, use contraception or have an abortion.Assembly Bill 569, the Reproductive Health Non-Discrimination Act, would have banned workplace discrimination due to a woman’s personal reproductive health choices.

This is back to California and the legislature granting licenses to sue just about any business for any reason.

In this case, gay bars hiring gar workers, lots of lawsuits. Businesses that don;t cater to the LGBTGIF crowd be getting sued all the time for marketing reasons. Brown was correct to veto, it is not the place to be doing this, not in a state where each law is a license to suddenly sue some, now defenseless, business.

The cost of California's lawsuit business

Businesses in California survive by watching potential lawsuits, and avoid them like the plague. The legislature grants the right for some aggrieved class to sue some other identified class. The result is that business has a narrower range of operations, in marketing, production or services, before it runs afoul of some lawsuit. During a downturn, business will simply shut for a while until margins improve enough to cover lawsuit risk.

Real problem, happen in my hometown all the time, mostly real estate restriction, a myriad from the state, old building designation being the worst. Then all the mandates in emergency health care running the costs of emergency rooms way up. labor relations with local government a nightmare of regulation. Handicapped access was a big lawsuit problem for a while. On and on... businesses and local government getting hit with these 'licenses to sue' granted by a fairly ignorant state legislature.

Subscribe to:

Posts (Atom)