Donald Trump’s infrastructure guru spent part of Sept. 26 at a conference in Washington promoting the president’s $1 trillion plan to rebuild the nation’s crumbling roads, bridges and airports relying in part on public-private partnerships. The same day, across town, Trump was telling lawmakers that those kinds of deals don’t work.The president’s apparent change of heart on what’s been a key pillar of his economic plan left key constituents of the infrastructure initiative reeling.Two many gatekeepers between the taxpayer and the completed road.

Saturday, September 30, 2017

No pony in the manure pile

Biometrics may not be here yet

The Wire:

The idea is that our intelligent cash cards can recognize us with protected code. That makes it a secure element, it only uses the secret keys when its human is present. passcodes get you most of the way.

Started in 2009, the digital identification project has continuously expanded in scope, despite restraining Supreme Court orders. Today, it covers almost every conceivable facet of a normal civic life. While this has fanned the fears of an Orwellian state subsuming the inalienable sovereignty of individual citizens, there is a crucial need to revisit the basic problem statement that led to its genesis.Aadhaar was conceived to solve the problem of fake and ghost identities. All the present uses of Aadhaar profess to leverage this purported capability of it. Thus, we have Aadhaar getting linked to ration cards, NREGA payments, PAN cards, bank accounts, mobile SIMs, mid-day meals in schools, school admissions, university admissions…the list is endless. In a country plagued by corruption and bureaucratic inefficiency, the hope is that Aadhaar will help eliminate fraudulent identities, thereby saving the direct and indirect losses to the nation.Very efficient to use but plagued with fraudulent IDs. Biometrics is a technology not ready to deploy, let us see how Apple eye scan works.

The idea is that our intelligent cash cards can recognize us with protected code. That makes it a secure element, it only uses the secret keys when its human is present. passcodes get you most of the way.

Flynn didn't register and wrote an op ed for Erdogan of Turkey

A business associate of a Turkish client of retired Lt. Gen. Michael Flynn testified before a federal grand jury last week, according to a new report which helps shed light on why Flynn is being investigated by special counsel Robert Mueller.But we have the Citizens United decision which should certainly allow Flynn to lobby. Flynn didn't register as an agent for a foreign government. But the Citizens United was neutral, it cannot prevent foreign owned corporations from lobbying. Flynn actually went through a foreign corporation as his direct employer. Seems awfully sketchy.

We ain't working on Maggie's farm

the evidence suggests there has been no significant drop in demand, but rather a change in the labor supply driven by declining interest in work relative to other options

Scott Winship's research discussed in various blogs like Askblog.

Now I have retired early and often. When off work the cash pile is best spent spreading out the time because getting hired, especially for the politically incorrect, is an expensive pain in the ass. The alternative is to do a job right here, in the breakfast nook with a coffee stained ten year old notebook.

Even then, as a geek, my software effort seldom went beyond spaghetti proof of concept. That is what the Open Software foundation discovered. The transaction costs of hiring people was more than the cost of just grinding out and publishing a solution to the problem being solved. One could examine the hiring ads in the public tech market, and reverse engineer the particular problem, ponder it and run a proof of concept test.

The low barrier to entry in software vs the transactional employment costs. The problem is everywhere, high tradebook uncertainty in the labor markets.

The low barrier to entry in software vs the transactional employment costs. The problem is everywhere, high tradebook uncertainty in the labor markets.

Friday, September 29, 2017

Does the optimal pattern match generate a two colored graph?

We have two (sometimes three) queues we want matched. We order both queues in run time as a generating graph, then match their structure by inserting the mis-match collector (pit boss, market maker). Once both queues are order and conformal, then take one and exchange nodes for edges and edges for nodes,it will overlay the other and create a two colored graph, if I am imagining it right.

What was Ramsey Theory?

A typical result in Ramsey theory starts with some mathematical structure that is then cut into pieces. How big must the original structure be in order to ensure that at least one of the pieces has a given interesting property? This idea can be defined as partition regularity.For example, consider a complete graph of order n; that is, there are n vertices and each vertex is connected to every other vertex by an edge. A complete graph of order 3 is called a triangle. Now colour every edge red or blue. How large must n be in order to ensure that there is either a blue triangle or a red triangle? It turns out that the answer is 6. See the article on Ramsey's theorem for a rigorous proof.

Ramsey theory says no redundant nodes, no nodes of the same color touching, as. It is still managed as a queueing problem.

How must the graph be colored such that flow over the graph results in stable, optimal queues. So some Ramsey proofs can use our methods, show that a colored graph can be generated by matching, within a bound error, one or more maximum entropy generators.

It leads to forensics, we can observe unstable match inefficiencies grow, in the bit error process. Instability indicating someone is faking it, likely money laundering. That is, we find a bit error function that could not be generating a fair Ramsey partition, and thus must not be fair traded in the sandbox.

Using the tradebook model in labor markets

Research from the Federal Reserve Bank of San Francisco

The NEI can be thought of as a composition-adjusted measure of the entire pool of available job seekers.Using this measure of the job seeker pool, we can express changes in the average employment transitionrate in the economy as the sum of changes coming from three components: the ratio of vacancies to jobseekers (labor market tightness), the average search effectiveness of job seekers, and the remainder that represents aggregate matching efficiency.

There, we have two colors (job seekers and hirings) plus a pit boss. They talk search times but they really mean search queue length.

I didn't invent the idea, I stole it from these folks.

Obamacare fouls the labor markets

MOUNTAIN VIEW, Calif.--Sep. 26, 2017-- According to a study released today by eHealth, Inc.(NASDAQ:EHTH), which operates eHealth.com, the average family of three earning slightly too much to qualify for subsidies in 2018 would need to increase its household income by nearly $29,000 before health insurance became “affordable” based on Obamacare criteria.The Affordable Care Act (ACA or Obamacare) considers health insurance to be “unaffordable” when annual premiums for the lowest-priced plan in a market cost more than 8.16% of a household’s modified adjusted gross income (or MAGI). When health insurance is unaffordable by this standard, individuals.

The labor 'brackets' will adjust to cover the Obamacare tax, But the effort is self defeating, it causes the market to favor subsidized workers shrinking the pool of subsidizers, and managers move the yet brackets again. Spiralling losses for the insurance companies that cannot keep up. Hence, insurance loss coverage by Congress will jump, unexpectedly, by a quarter of a point of GDP.

How does the sandbox deal with hidden information?

Economists are all talking information, stuff people know but not yet have made their bet. In the sandbox we incentivize folks until they reveal their hidden information.

Blacks didn't start it

Black America wrong to blame white racism for woes

It was a California thing.

Everyone observed that California all but makes it illegal to be white. The national dem party followed along.

It was a California thing.

Everyone observed that California all but makes it illegal to be white. The national dem party followed along.

The current web is hilarious

The police stated that the attack methodology was a “spear phishing” attack. North Korean hackers pretended to be government authorities and servicemen. A story published by Silicon Angle states that the hackers targeted exchange workers by sending them emails loaded with malware.Secure elements change all this, but we do not even need that. The Intel hardware security standard protects and verifies executable, as needed.

The deeper question. Why was any human authorized to move bitcoin at all without biometric ID? Let the hackers run wild, just keep the goodies in a contiguous section of protected executable and data. It is not accessible via memory operations, hardware prevents that. But it is accessible via device IO methods, executed from within the protected space.

The sandbox uses hardware security, just like bit coin uses block chain. Locally all the trade books are protected, as is all the trading bot executables, including the pit boss. All the contracts in the smart layer protected via local hardware. Any passage across the layers requires secure element protection.

Breaking records

L.A. County now has 58,000 homeless people. So why are there thousands fewer shelter beds than in 2009?

OK, LA County has 10 million people, and is one of the mildest climes in the world. So, geographical, mother nature can easily camp 58,000. And, by the way, that was mostly the private sector that housed the 10 million.

The problem is the dynamic, our legislature has literally invited the entire world to come here and vote twice, even as it promises unlimited services with long term pension liabilities.

A gray swan

Catalonia to split from Spain within 48 hours of secession vote - Reuters

This could get messy and shave a half point from Euro area growth. We will have Greece, Italy and Spain in Euro crisis.

Oklahoma gets a clue

Rep. Tom Cole (R-Okla.), who is close to the House GOP leadership, says colleagues are frustrated with a handful of senators “overruling the will of the entire House.”“We do need to see them step up and actually deliver for a change. We have over 200 bills sitting stalled over there. They haven’t been able to deliver on [health care] reform and they all ran on it and now we have a do-or-die moment on tax reform,” he said.The small/large state problem. They use separate containers and Congress has to carry risk on disrupted supply of government goods. All the government goods are tainted with expensive carry-on luggage from the small state senators. Demographics does not favor some small states and they get desperate with their senate vote. It causes severe regime changes and recessions about every presidential election.

Thursday, September 28, 2017

Megyn Kelly, in the news

Something about her new TV show.

Here she is, the Trumpster's ex-girlfriend, all distressed with some guy she picked up. Note, the one third boob shot, always important.

Here she is, the Trumpster's ex-girlfriend, all distressed with some guy she picked up. Note, the one third boob shot, always important.

It is a legal tax

The upcoming Janus v. AFSCME case deals with many of the same issues brought before the court in 2016 by Friedrichs v. California Teachers Association, as both cases challenged the constitutionality of state laws requiring public employees to pay union dues or fees as a condition of employment.The C al legislature taxes public sector employees and hands the money over to the unions Supported by the majority, and legally passed law.

The plaintiff will claim the money never passers through government hands. This is not a free speech issue,

Central bank money is backed by tax relief

The Wolf of Wall Street

Monopoly fiat money is all about taxation then regulation by central government. Government denominates important taxes by ratio, which is currency independent. There will be as many crypto currencies as needed to meet government tax needs.

"I'm not saying cryptocurrencies, there won't be one – there will be one – but there has to be some backing by some central governments out there.Nothing makes for utility then buying off the local sheriff and his posse.

If any digital currency demonstrates long-term viability, it will probably be one that’s backed by a central bank."

Monopoly fiat money is all about taxation then regulation by central government. Government denominates important taxes by ratio, which is currency independent. There will be as many crypto currencies as needed to meet government tax needs.

Unemployment claims

The spiker a the end is the hurricane effect. We had a much larger spike during Katrina as we see in 2005.

Also we have a 3.1% growth for Q3, very good, but surprising. That too may be a fake, much of it unobserved inflation to be revised down later, another hurricane effect.

The only concern is that all the swans are happening at the end of the recession cycle when resources are all allocated.

If we get medium term turbulence in the labor market, then employers may continue layoffs until the labor market clears. But the labor market is never ready, it has high transaction costs and intermediaries exit the market when searches get expensive. Thus large tradebook uncertainty means we take very large steps to requantize, we appear to limit cycle. The larger the tradebook uncertainty, the more sparse, and incomplete, are the hiring managers. JOLTs, job openings and closings, is an activity monitor, it should tell us how much jamming is going on in the labor market.

Also we have a 3.1% growth for Q3, very good, but surprising. That too may be a fake, much of it unobserved inflation to be revised down later, another hurricane effect.

The only concern is that all the swans are happening at the end of the recession cycle when resources are all allocated.

If we get medium term turbulence in the labor market, then employers may continue layoffs until the labor market clears. But the labor market is never ready, it has high transaction costs and intermediaries exit the market when searches get expensive. Thus large tradebook uncertainty means we take very large steps to requantize, we appear to limit cycle. The larger the tradebook uncertainty, the more sparse, and incomplete, are the hiring managers. JOLTs, job openings and closings, is an activity monitor, it should tell us how much jamming is going on in the labor market.

Wednesday, September 27, 2017

Why would they have a special voice?

Dahlia Lithwick, at Slate ponders why Black Athletes have a different voice then Asian Carpenters. Athletes are expert at athletics, not much else would be my guess.

What we have, really, is a lot of mourning over the loss of identity politics in the election, The affirmative action crowd's last gasp.

But the National Anthem is a lousy song enjoyed only by another of the identity groups., not necessarily white. A lot of newly arrived from other developed countries like the old style Constitutional government of 50 states complete with anthem.

The NFL should skip the identity politics, dump the anthem and the NFL can hire a musical director for those five minutes per game. The fans will soon forget and the proper five minutes of music can be profitable.

That is a secessionist point of view. Here is California's Anthem:

That is a secessionist point of view. Here is California's Anthem:

Our sanctuary city in California

The Los Angeles city controller recommended Wednesday using city land for emergency campgrounds and shelters to curtail the ragged shantytowns that have plagued neighborhoods from Boyle Heights to Wilmington in the current homelessness crisis.In a 37-page report, City Controller Ron Galperin also recommended tougher policing, streamlined cleanup protocols, showers and bathrooms for homeless people and expanded storage, including mobile bins, for their belongings.Except they don't work:

Both Seattle and Portland have experimented recently with allowing homeless camps on vacant land, only to sweep the settlements away months later as they descended into chaos or scattered violence.Mayor Tom Bradley’s “urban campground” opened in June 1987 in what is now downtown L.A.’s Arts District and closed three months later, after being declared on all sides an abject failure.“We should not be in the shelter business,” then-Deputy Mayor Grace Davis said after 103 days and $397,000 in city costs devoted to the camp experiment.

Tuesday, September 26, 2017

First approximations

The point in each case is that while changes in taxes or transfers may induce changes in how much people work, when you assess these changes you have to bear in mind that, to a first approximation, workers are paid their marginal product. This means that if increased transfers induce some people to work less, it also causes them to earn less, so that the rest of society isn’t any worse off; if lower taxes induce high earners to work more, it also means that they’re paid more, so that the rest of society doesn’t reap any of the gains.

The marginal product changes substantially for the part time worker when adding transaction costs.

I thought is was free money

REPUBLICANS TO RAISE TAXES?

The original idea was to borrow based on the calculated future, thus freeing unexpected new money now so we can buy Chinese TVs. Now they tell us we have to pay for the government stuff we bought.

The original idea was to borrow based on the calculated future, thus freeing unexpected new money now so we can buy Chinese TVs. Now they tell us we have to pay for the government stuff we bought.

At Redneck U we are all scaredy pooh

Jeff Sessions To Deliver Body Blow Against University Safe Spaces

We got our diversity college, off in the corner of the woods somewhere.

Jeff is going after them? What's he gonna do? Sue them for failure to sign the diversity waiver?

Monday, September 25, 2017

Neural networks from (my) memory

Consider a two dimensional array with X containing a large set of observed features and Y containing a smaller set of features that might uniquely identify some objects, like kitchen tools. Every cross point gives a measure of how well the observed feature matches the expected feature. Then add reinforcement by repeatedly flashing one single object into the camera, nodes that are activated get a bit of amplification, they learn. Whole bunches of cross points get excluded. We get a set of coefficients for that particular object.

This is what we will do in the sandbox, except we know the learning formula, we drive the bit error toward zero while asynchronous bid and ask queue up. Neural nets and optimum S&L tech are the same, but organizing by significance, then normalizing both queues;we get something like a fast transform for neural nets, we can learn and track at the same time.

Why a fast neural net?

In the set up I suggested, just give us all the sample and sort hem by significance of their endogenous appearance, how significant to the data itself. That gives us the compression graph, and we can directly compare that to the prior set of models, computing the 'bit error', and selecting the model with lowest bit error.

There is no intervening reference point; it is double sided. But better to say two and three colored trades with stated bit error process. There never was a time reference, just some insurance companies betting the semi-random sequence against the clock. Then, if it is entropy maximizing, the encoding graph is queued properly and should be isonormal to the mechanical process making the data. We can infer how big and crowded the grocery store without knowing its physical size.

This is not real news, Coinbase has been auto trading using matching since it began. They apply the same matcher, trading loaned money against borrowed money, with a stated bit error (house risk).

Here, in Quanta Magazine, they have an article. They are describing our savings and loan tech, wienerized hyperbolics. In the end it comes down to sphere packing with a fictional center.

My concept of bit error

In neural nets it is the noise between viewed features and required features. When you start learning, all the cross points are equally likely. If probability is maintained, then probabilities of node firings are quantized by maximally separating the finite set of objects it needs to learn. Your are driving variance into the quantization bins defined by the encoding paths. We reach a finite limit of how many nodes are erased, the remainder organized as the minimal matching graph.

This is all sandbox, the exchange techies know this, they are on the job.

This is what we will do in the sandbox, except we know the learning formula, we drive the bit error toward zero while asynchronous bid and ask queue up. Neural nets and optimum S&L tech are the same, but organizing by significance, then normalizing both queues;we get something like a fast transform for neural nets, we can learn and track at the same time.

Why a fast neural net?

In the set up I suggested, just give us all the sample and sort hem by significance of their endogenous appearance, how significant to the data itself. That gives us the compression graph, and we can directly compare that to the prior set of models, computing the 'bit error', and selecting the model with lowest bit error.

There is no intervening reference point; it is double sided. But better to say two and three colored trades with stated bit error process. There never was a time reference, just some insurance companies betting the semi-random sequence against the clock. Then, if it is entropy maximizing, the encoding graph is queued properly and should be isonormal to the mechanical process making the data. We can infer how big and crowded the grocery store without knowing its physical size.

This is not real news, Coinbase has been auto trading using matching since it began. They apply the same matcher, trading loaned money against borrowed money, with a stated bit error (house risk).

Here, in Quanta Magazine, they have an article. They are describing our savings and loan tech, wienerized hyperbolics. In the end it comes down to sphere packing with a fictional center.

My concept of bit error

In neural nets it is the noise between viewed features and required features. When you start learning, all the cross points are equally likely. If probability is maintained, then probabilities of node firings are quantized by maximally separating the finite set of objects it needs to learn. Your are driving variance into the quantization bins defined by the encoding paths. We reach a finite limit of how many nodes are erased, the remainder organized as the minimal matching graph.

This is all sandbox, the exchange techies know this, they are on the job.

Puerto Rican bonds? Forget about it

An extreme case of black swan working through the debt channel, the hurricanes removed the defaulter from the scene.

After hurricanes, contracts everywhere get hit with sudden shortages that make more inflation and less real growth. Lumber will have to be diverted, by price, to the hurricane regions, leaving home builders to turn down high prices. Gasoline is another, we see a sudden shift to support hurricane regions and high prices turned down elsewhere.

But now the contracts backed by a debt instrument cannot meet yield and assets are sold and reused to pay debt. A series of small shocks will knock off about a half point this and maybe next year. Three years in a row with sub 2% growth.

After hurricanes, contracts everywhere get hit with sudden shortages that make more inflation and less real growth. Lumber will have to be diverted, by price, to the hurricane regions, leaving home builders to turn down high prices. Gasoline is another, we see a sudden shift to support hurricane regions and high prices turned down elsewhere.

But now the contracts backed by a debt instrument cannot meet yield and assets are sold and reused to pay debt. A series of small shocks will knock off about a half point this and maybe next year. Three years in a row with sub 2% growth.

Sunday, September 24, 2017

Does this include the Spanish and Italians?

A message for white people:I know how jarring it may be to hear a non-white person, or maybe anyone, even say the words “white people,” as it can take on a pejorative connotation. That’s fine. This isn’t always comfortable to have to say, but that doesn’t make it any less true, necessary, or timely.Let us be specific, whitie is a member of the hordes of german like marauders that over ran Rome. They crawled out of their caves, in the middle of winter, all lilly white. The Italians couldn't find them in the snow. Then the Scots and Irish, so white they are red. I think Sweden means 'land of white people'.

Am I white? Not sure, I might have enough French to disqualify.

Why are undergrads even at university?

Free speech vs the undergrad who just wants to get the material done

Smart kids can locate appropriate course material for any undergraduate class in America, all on the web. Any good junior college can cover the first two years well enough. Why do this at large crowded universities?

Students attend university for a particular form of speech, why else? How did 'Let kids be kids' and ' course material' get mixed up? University and college carry two hundred years and more of baggage back when books were expensive. But getting through the undergrad course material is much more efficient, away from the kabuki dancers.

I have no answer, we want the kids to experiment as young adults a bit, do some price discovery. But that has nothing to do with standard undergrad course material, with a few exceptions being team, audience and lab activities. So, the first lesson of free speech on university is get the undergrad courses the frig away from campus, away from the unnecessary shouting. Do a lot of the material on line, let the undergrads house themselves farther out and make fewer trips to campus.

Smart kids can locate appropriate course material for any undergraduate class in America, all on the web. Any good junior college can cover the first two years well enough. Why do this at large crowded universities?

Students attend university for a particular form of speech, why else? How did 'Let kids be kids' and ' course material' get mixed up? University and college carry two hundred years and more of baggage back when books were expensive. But getting through the undergrad course material is much more efficient, away from the kabuki dancers.

I have no answer, we want the kids to experiment as young adults a bit, do some price discovery. But that has nothing to do with standard undergrad course material, with a few exceptions being team, audience and lab activities. So, the first lesson of free speech on university is get the undergrad courses the frig away from campus, away from the unnecessary shouting. Do a lot of the material on line, let the undergrads house themselves farther out and make fewer trips to campus.

Nope

This period is likely to be dominated by everyday gadgets like speakers, eyeglasses, and even toasters that have been made "smart" with powerful computing chips, wireless communications radios, and sensors.The new information age?

Nah, the singularity seldom talks to you, you go through your happy life, it never interferes. But it always gives you optimum advice on transactions, it is in your hand and will flash green for go.

Bubbles

Did Jamie Dimon threaten us with socialist monetary police?

Governments will close down bitcoin and cryptocurrencies if they get too big, warns Jamie Dimon

He also said we already have digital dollars, true.

But, now he brings the government into this, he is going to demand government code in our secure elements. The issue is secure network and auto traded cash.

In secure network, auto trading removes arbitrage moments from the money and equity markets. His research guy needs to explain this to him, and at this point auto traded cash layer is becoming future consensus.

Saturday, September 23, 2017

Sixth graders

Chuck Schumer Coached Jimmy Kimmel Behind The Scenes On How To Oppose Obamacare Repeal

Neither Jimmy, Chuck nor Jimmy's audience have a clue.

Obamacare ate your pay raise

Every Labor Day, you can count on seeing a spate of news stories saying that "real wages" in the United States haven't grown since the 1970s. That's true, more or less, but the reason for the stagnation might surprise you. It's a complex story, but it boils down to this: Blame health care costs.

According to the Federal Reserve Bank of St. Louis, inflation-adjusted wages have grown by just 2.7 percent in the last 40 years. But inflation-adjusted total compensation—wages plus fringe benefits, such as health insurance, disability insurance, and paid vacation, along with employer-paid Social Security and Medicare taxes—increased by more than 60 percent in the same period.

Wages still make up a significant share of your total compensation: 68.3 percent, according to 2017 data from the Bureau of Labor Statistics, vs. 31.7 percent that goes to benefits. But that latter piece has grown significantly, in no small part due to the rising cost of health insurance. And that trend is only going to get worse.

This has political consequences, since most workers don't appreciate how hefty the non-wage share of their compensation is, nor do they generally realize just how much of the money their employer is shelling out on their behalf gets eaten up by health care. As a result, they demand that politicians intervene to deliver more raw pay.

Friday, September 22, 2017

No Dean Baker, interest payments are near the highs

He says:

Debt is a meaningless concept in this context. Debt would only matter insofar as the flow of income in the form of interest payments on bonds create a source of demand that pull resources away from other uses. With interest payments near a post-war low as a share of GDP, this should not be a major issue for the foreseeable future.

The blue line will not make .035 and has a hard time at .030

Debt is a meaningless concept in this context. Debt would only matter insofar as the flow of income in the form of interest payments on bonds create a source of demand that pull resources away from other uses. With interest payments near a post-war low as a share of GDP, this should not be a major issue for the foreseeable future.

The blue line will not make .035 and has a hard time at .030

Housing bubble

Workers earning the black line need the red line to buy a home. The red line rising is mostly Asian rebalance. The Asian rebalance has an ending.

More Asian rebalance.

Foreigners, mainly from China, purchased 25 percent and 16 percent of the new housing supply in New South Wales and Victoria, respectively, in the year through September 2016, according to a Credit Suisse Group AG examination of state tax receipts.

More Asian rebalance.

Foreigners, mainly from China, purchased 25 percent and 16 percent of the new housing supply in New South Wales and Victoria, respectively, in the year through September 2016, according to a Credit Suisse Group AG examination of state tax receipts.

Say what?

Derivatives trading is a market that’s worth an estimated 1.2 quadrillion dollars with a current growth rate of 30% per year.Some company is attempting a sandbox compatible, trading pit architecture. Somewhere they got that number above, and I dunno how many zeros make a quad. But that is all sandbox, sandbox is all the derivatives. I cannot imagine anyone manually trading derivatives in the future, and if its automated liquidity then sandbox is the market definition.

Potential growth

Taking the last three cycles we want the growth achievable before inflaton. The blue line is inflation, after all the numbers come in. That inflation measure peaks and we get a recession. The red line is real growth.

We can see that Bubba's regime never tested the limit, they kept the implicit low and real growth high.

Otherwise, it seem clear this graph shows potential growth has been dropping coincident with what?

Yes,you guessed it, rising debt; the one thing Bubba avoided. What else? Bubba and Obama have the same pattern, likely caused by having the same tax adjustment. In the end, real growth pulled ahead of the implicit, the virtuous cycle happened for a while.

The other thing. Unless the Repubs rock the boat, it seems like we already had our mild Obama recession and didn't notice, or it is upon us now. I have a hard time seeing a major crash of depression proportions in this chart, maybe a mild dip, a result of age an hurricane.

We can see that Bubba's regime never tested the limit, they kept the implicit low and real growth high.

Otherwise, it seem clear this graph shows potential growth has been dropping coincident with what?

Yes,you guessed it, rising debt; the one thing Bubba avoided. What else? Bubba and Obama have the same pattern, likely caused by having the same tax adjustment. In the end, real growth pulled ahead of the implicit, the virtuous cycle happened for a while.

The other thing. Unless the Repubs rock the boat, it seems like we already had our mild Obama recession and didn't notice, or it is upon us now. I have a hard time seeing a major crash of depression proportions in this chart, maybe a mild dip, a result of age an hurricane.

Thursday, September 21, 2017

No price fixing in Ohio?

ColumbusOhio’s biggest public pension system is considering cutting the cost of living allowances for its 1-million members as a way to shore up the long-term finances of the fund.Well the unions will be upset.

Which brings up an open issue. Jerry Brown was asking how a global warming tax could work if all the favored government unions were COLAed. Have not yet heard from an economist on that.

Mathematicians discover bottle necked compression

Last month, a YouTube videoof a conference talk in Berlin, shared widely among artificial-intelligence researchers, offered a possible answer [of how deep learning works] . In the talk, Naftali Tishby, a computer scientist and neuroscientist from the Hebrew University of Jerusalem, presented evidence in support of a new theory explaining how deep learning works. Tishby argues that deep neural networks learn according to a procedure called the “information bottleneck,” which he and two collaborators first described in purely theoretical terms in 1999. The idea is that a network rids noisy input data of extraneous details as if by squeezing the information through a bottleneck, retaining only the features most relevant to general concepts. Striking new computer experiments by Tishby and his student Ravid Shwartz-Ziv reveal how this squeezing procedure happens during deep learning, at least in the cases they studied.Golly gee whiz, sounds like my theory.

They have discovered that an encoding graph must be optimally queued. They end up doing two color matches like the one I describe on the right link in this blog. So, great, the basket theory of economics is now the basis of artificial intelligence. Hence, there should be no doubt that we intend to auto trade the cash layer, bankers have been warned. And, to reinforce, this means singularity 1.0.

The biggest technology change in our history, well forecast, well planned. I see the language of flow matching appearing more often in the discussion and research; dynamics of stock and flow, and sparse spectral responses (quantization). Queuing, the queue size has variance, the bet spread.

So, I should expect the change over to go smoothe, central banker seeing that they are still very dominant. Researchers at large banks must have gotten wind of the model, crypto coin exchanges understand ot, and I know a few large banks are getting the concept of using MS Coco* to build lateral clearing systems. . Trezor** and the hardware wallet folks know, as does Intel***, all get the secure element concept.

* Send me a check

** You too

*** Triple that

Guaranteed inflation?

Don't change the forecast; change the policy

I agree that it is likely that inflation will run below 2% in 2018. Nonetheless, I believe the Fed made a mistake by forecasting sub-2% inflation in 2018. Instead, the Fed should have changed its policy, so that it could continue to forecast inflation at 2% in 2018. This is what Lars Svensson means by "targeting the forecast."Scott Sumner wants the currency banker to pay off the future bets on inflation to 'make it so' . The target is some inflation announcement at a specific time.

The biggest uncertainty is the inflation index, consider a quarter point uncertainty. If we estimate a slow down in inflation below target, the bets pile up and price trend drops another half point. But we get inflation the next quarter. But the cycle is priced and currency uncertainty becomes a chaotic variance about the real trend. But I think that is what Scott wants. He distinguishes between forecast and target, his only outcome is a bound variance within which most goods and services can be priced neutrally.

I call it being Wienerized, it occurs because anything like what Scott proposes becomes a fair access tradebook subject to all the rules of congestion, which match price variance. The monetary stimulus Scott proposes comes from being able to target NGDP, doing it right means fair access, low transactions costs and auto-traded.

S&P dings Xi Ping

S&P Downgrades China To A+ From AA- Due To Soaring Debt Growth

Strike a bit of fear into our senators who have grown the deficit by 18% over the past year.

McAfee goes full sandbox

McAfee had perfectly captured the crypto enthusiasts’ sentiment. Blockchain technology has begun to erode governments’ control over money and will continue to do so. These governments has responded by lashing out in a form of crypto inquisition that parallels the American prohibition. We also learned that many bitcoin exchange executives were not allowed to leave China amidst the recent regulation rulings. Surprisingly, McAfee’s comments did not encourage fear, but inspired a strong sense of community among the crowd. He walked off the stage to a thunderous applause.Not yet up to speed on auto trading, but otherwise caught the emphasis on crypto and blockchain as separate technologies.

Wednesday, September 20, 2017

My labor market theory conclusion

Tradebook uncertainty is large. Hiring managers get their layoffs done then wait for the market to settle. That is the quantization effect from tradebook uncertainty,io \t sets the minimum quant distance needed to get the next significant price. Th labor market needs intermediaries, and when a requant happens those intermediaries have to gear up.

The cost of a repricing, menu costs, is high for labor. Menu costs is known mathematically as quantization noise, chemists have something similar as do physicists. Quantization is real everywhere because it allows adiabatic change, the ability to flow bit error through the system with a minimum of transactions.

The cost of a repricing, menu costs, is high for labor. Menu costs is known mathematically as quantization noise, chemists have something similar as do physicists. Quantization is real everywhere because it allows adiabatic change, the ability to flow bit error through the system with a minimum of transactions.

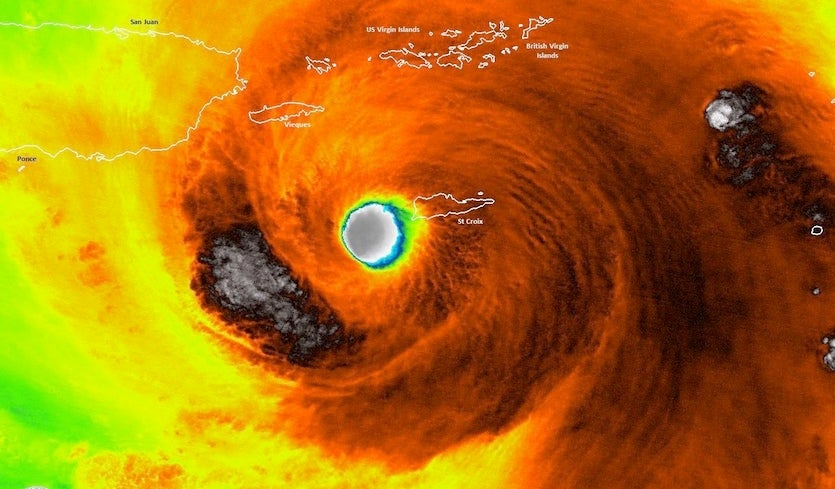

Fast, furious, and many

SAN JUAN, Puerto Rico — Hurricane Maria is likely to have "destroyed" Puerto Rico, the island's emergency director said Wednesday after the monster storm smashed ripped roofs off buildings and flooded homes across the economically strained U.S. territory.Intense flooding was reported across the territory, particularly in San Juan, the capital, where many residential streets looked like rivers. Yennifer Álvarez Jaimes, Gov. Ricardo Rosselló's press secretary, told NBC News that all power across the island was knocked out."Once we're able to go outside, we're going to find our island destroyed," Emergency Management Director Abner Gómez Cortés said at a news briefing. Rosselló imposed a 6 p.m.-to-6 a.m. curfew, citing flood warnings and the importance of keeping streets clear for repair and rescue teams.An economy of four million. Along with Texas and Florida, surplus inventory is re-directed by price. The numbers add up because all three are in the same zone, congestion becomes the problem. It is ultimately real goods, real train yards too full, many highways clogged with trucks, some warehouses bare, others full. Sudden dis-equilibrium in real goods raises interest charges fast.

The Trump Bump and the 12% swing in the dollar

The downward swing in the dollar was rapid, and 12%. Import and import prices jumped, about 20% of the economy. So we are adding a half to full point to inflation, very soon and very unsustainable.

The ten year rate will want to rise, and the senators, worst case, are looking at eight hundred billion dollar interest charge, up from five hundred a few years ago. Interest charges are discovered, in real time. If they are in the trillion dollar range, the senators will be endlessly haggling over their programs, shut down is impossible to avoid.

Interest charges are priced, in real time.

You have to read the bill to find out what's in it , so to speak.

We do not know the cost of Obamacare completely, we are discovering it. Nor we do know if the boomers will stampede. It is uncertain that the millennials actually agreed to pay over 3.5% of income to federal interest charges. Defense budgets are whacko all around.

The volatility of interest is quite obvious, 100 billion dollar swings over a year or two. The senators cannot measure the relative risk among the hundred odd discretionary programs they rely on. Their word is as good as their willingness to continually haggle and prioritize.

Interest as a fraction of RGDP

See those two peaks at .035?

This economy cannot do that level anymore, that is why we are volatile on the right, we hit a bound, a hard bound.

The interest charges have bankrupted a bunch of government programs. But the structure of government is very contingent on these programs, they keep the small and mid sized states going. Hence the senators, seemingly undecided but in actuality they are in DC hovering over these programs to the exclusion of any other business.

Those two peaks at .035 caused the upper bound, they caused a quantization effect. So, to the right on the graph we do not even test .03. You don;t need economics to see the issue here, if this is a natural process then we can infer a regime change, a requantiztion, in the process because the two parts of the graph clearly anti-correlated. So, without involving the economists at all, we might expect a new, larger jump in volatility if we requantizated above the ,035. It is all about a process somewhere packing sphere and it generates this kind of regime change.

The ten year rate will want to rise, and the senators, worst case, are looking at eight hundred billion dollar interest charge, up from five hundred a few years ago. Interest charges are discovered, in real time. If they are in the trillion dollar range, the senators will be endlessly haggling over their programs, shut down is impossible to avoid.

Interest charges are priced, in real time.

You have to read the bill to find out what's in it , so to speak.

We do not know the cost of Obamacare completely, we are discovering it. Nor we do know if the boomers will stampede. It is uncertain that the millennials actually agreed to pay over 3.5% of income to federal interest charges. Defense budgets are whacko all around.

The volatility of interest is quite obvious, 100 billion dollar swings over a year or two. The senators cannot measure the relative risk among the hundred odd discretionary programs they rely on. Their word is as good as their willingness to continually haggle and prioritize.

Interest as a fraction of RGDP

See those two peaks at .035?

This economy cannot do that level anymore, that is why we are volatile on the right, we hit a bound, a hard bound.

The interest charges have bankrupted a bunch of government programs. But the structure of government is very contingent on these programs, they keep the small and mid sized states going. Hence the senators, seemingly undecided but in actuality they are in DC hovering over these programs to the exclusion of any other business.

Those two peaks at .035 caused the upper bound, they caused a quantization effect. So, to the right on the graph we do not even test .03. You don;t need economics to see the issue here, if this is a natural process then we can infer a regime change, a requantiztion, in the process because the two parts of the graph clearly anti-correlated. So, without involving the economists at all, we might expect a new, larger jump in volatility if we requantizated above the ,035. It is all about a process somewhere packing sphere and it generates this kind of regime change.

Public sector unions pummell middle class

Before the welcoming committee even arrived at their front door, the Schurtz family’s first property-tax bill arrived in the mail. “We laughed,” Michelle said. “That’s all we could do.”The Schurtzes paid their first full year of property taxes in 2015. The bill totaled $11,000.When it comes to property taxes, sticker shock is typical in Illinois. From small-business owners in Chicago to suburban dwellers in middle-of-the-pack school districts, long-time Illinoisans are often bewildered as to why they pay the second-highest property taxes in the nation, at an average of more than 2 percent of a home’s value.And the nonpartisan Tax Foundation said Chicago’s record-setting property-tax hike will likely vault Illinois to the top of the table, making the Land of Lincoln home to the highest property taxes in the U.S.

Who got defrauded?

Rodriguez announced in November 2014 that he was running for a board seat and raised more than $50,000 during his first campaign reporting period that ended Dec. 31, 2014, according to the District Attorney’s Office. Prosecutors allege that nearly half those contributions were fraudulent because Rodriguez and Melendrez reimbursed those who gave them.In total, 25 donors, most of them family and friends, were allegedly paid back $24,250. The donors’ names were listed on a campaign finance report that was allegedly signed by Rodriguez under the penalty of perjury and submitted to the commission, prosecutors said.He won the election needing only half the money, so he returned it. Where is the crime? If he defrauded the voters then why did they elect him? Did he defraud the state? Maybe, but the state eventually learned the money was returned. I see this merely as a paper work error, maybe a misdemeanor.

Tuesday, September 19, 2017

My labor market theory and recesions

I extend the idea of tradebook uncertainty to labor markets and note the large tradebook uncertainty for labor markets.

Hence, any shock that distorts the labor market means hiring managers must way for the market to clear a bit before hiring, generally that means for all the mass layoffs to stop.

Why mass layoffs?

Generally because companies and institution make employment bets when the labor market is calm. But the intermediaries are gone, most of the staff hired up and the third party staffers gone elsewhere.

In California we see this effect. If something shakes he economy a bit, then public sector slows a bit, except the entire sector moves with Sacramento. But, a few lay offs of teachers will go into a teachers employment market that is not geared up, head hunters are not on the job working this market. The short term bulging makes the labor market uncertain and hiring managers lengthen their employment searches, slow things down. Teachers should be able to move between public schools and industry faster with less matching effort.

Hence, any shock that distorts the labor market means hiring managers must way for the market to clear a bit before hiring, generally that means for all the mass layoffs to stop.

Why mass layoffs?

Generally because companies and institution make employment bets when the labor market is calm. But the intermediaries are gone, most of the staff hired up and the third party staffers gone elsewhere.

In California we see this effect. If something shakes he economy a bit, then public sector slows a bit, except the entire sector moves with Sacramento. But, a few lay offs of teachers will go into a teachers employment market that is not geared up, head hunters are not on the job working this market. The short term bulging makes the labor market uncertain and hiring managers lengthen their employment searches, slow things down. Teachers should be able to move between public schools and industry faster with less matching effort.

More earthquakes, more hurricanes

We have to retally the black swan costs.

Unexpectedly, nature may have tipped us into recession. I was thinking it more likely we skated by. All the cycles remained aligned, long term generation cycle, government cycle, trump hump; and now the first and second of the black swans. If we do a dip in Q3 below 1% growth, then things get very unmeasurable for three quarters because winter is late in recording and Q1 is government slow down quarter anyway.

Unexpectedly, nature may have tipped us into recession. I was thinking it more likely we skated by. All the cycles remained aligned, long term generation cycle, government cycle, trump hump; and now the first and second of the black swans. If we do a dip in Q3 below 1% growth, then things get very unmeasurable for three quarters because winter is late in recording and Q1 is government slow down quarter anyway.

With no real government in Baghdad

KIRKUK, Iraq — Iraqi Kurds are set to vote next week on independence from Iraq in what many say is a popular expression of their desire for self-determination after suffering for a century under war and dictatorship.Government in Baghdad is about factions splitting the oil pot. mostly idiot Shia religious psychos. Kurds got better things to do.

Deplorable cave dwellers

“They’re both kind of very similar,” Jerry Brown said at a climate change event in New York. “You should check out the derivation of ‘Trump-ite’ and ‘troglodyte,’ because they both refer to people who dwell in deep, dark caves.”Some 140 year old ex-Jesuit priest.

He is no intellectual but he does know how to manage Cal Dems. Wait until Gavin gets the governorship, we will soon be broke and dating teenagers.

Monday, September 18, 2017

The modern version of Yippie

The Insane Clown Posse or Juggalos Every rebellious generation hashem. These are the kids who just wanna have fun and sort out the politics later. The anarchist wing of the libertarian left.

In 2011, the FBI classified the Juggalos as a gang, right along with more infamous gangs like the Bloods and Crips and MS-13. That classification has had a real impact on the lives of ICP fans, as they’ve reportedly lost custody battles, had their attempts to enlist in the military rebuffed and even been fired from their jobs by virtue of their association with an official, FBI-recognized gang.

In a year of white working-class grievances, the Juggalos make for an especially curious test case, too. Hailing largely from the Midwest and South, Juggalos have a significant amount of demographic overlap with the less-educated whites who have been scrutinized as a distinct and powerful voting bloc in the wake of Donald Trump’s election. But most of their political statements up until now have been found in ICP’s song lyrics, like the band’s anti-Confederacy anthem “Fuck Your Rebel Flag” and the movement's insistence that everyone, regardless of race, sexuality or age, can be a Juggalo. “We made the name ‘Juggalo’ to represent all of us: men, women, black, white, brown, yellow, fat as fuck, skinny as a broomstick, gay, straight, bi, trans, young, old and folded and loopy, rich, poor,” Kevin Gill, a Juggalo and speaker at the rally, yelled into the mic, as cries of “Whoop whoop” and several expletive-laden choruses rippled through the crowd. They may have made up a motley and underwhelming crowd on Saturday, but their mobilization represents a particularly bizarre iteration of what so many pundits lament is sorely missing on the left: a nexus between white working-class demographics and a stated, passionate commitment to inclusion, diversity and civil liberties.

Secure element and efficient transport

Report: Traffic on major freeways has grown 80 percent since 2010

Another of my companies.

Tap your smart card on the commute icon, give permission for auto tracking. Hence forth you travel smoothly on reserved lanes. My company name is Redneck Drivers.

Anytime you hear the name 'Redneck', you will hear high quality, security, trust, angelic warmth and happy puppies.

It is non stationary

Machine learning at central banks

If the machine learning mimics the economy then it tries to come to a conclusion, find the tipping points. That makes it non stationary.

Machine learning is just that, trying to come to a conclusion. The sandbox is like that, finite boundary problem orbiting solutions that are error bound though not quite complete. At any given time we have a set of prices that covers variations in real yields, the typicals. As long as quants hold, the market is parsing out the typical set, then precision i not supported and we reprice, set the pricing error change in the other direction.

If the machine learning mimics the economy then it tries to come to a conclusion, find the tipping points. That makes it non stationary.

Machine learning is just that, trying to come to a conclusion. The sandbox is like that, finite boundary problem orbiting solutions that are error bound though not quite complete. At any given time we have a set of prices that covers variations in real yields, the typicals. As long as quants hold, the market is parsing out the typical set, then precision i not supported and we reprice, set the pricing error change in the other direction.

Swedes unfit to survive

Sweden's overall fertility rate in 2007 was 1.88 children per woman, below the rate of 2.1 children per woman required to replace the population. Since 1980, the percentage of births registered in Sweden to mothers born outside the country has nearly doubled from 12 percent to 22 percent.Nov 3, 2008

On closer study, researchers found confused researchers citing bogus claims on evolution:

Suppose you plug in the most commonly-used estimates of IQ by country, assign each of Vinnerjung's "small groups" equal shares of the remainder, and assume international adoptees are average for their home country. Then if they'd stayed in their birth countries, the non-Western adoptees would have a mean IQ of only 84.

The horrors of birth on pretty swedish women so frightened the country, they went into a national search for scientifically raised foreigners. In fact they solved the problem, bring in foreigners who spend more time having kids and less time importing them. It is called evolution, and it ha a genetic basis.

A rush to block chain

The Chinese regulators are having the opposite effect.

By shutting down access to bitcoin domestically, they drive up the demand for foreign exchanges more dramatically. Chinese evaders are rushing to get their bitcoin ledger entered, protecting their loot like gold. Bitcoin prices responding up with each new central bank threat.

The price volatility they cause is surplus to existing bitcoin holders. The communists are better off legalizing the currency but requiring they clear via the government blockchain portal, for a fee on yuan. Then the authorities give citizens' the gain from public ledger but collect the monetary insurance fee for the yuan.

Consider the volatility

What the authorities do now is causing a 10% volatility in bitcoin exchanges, likely much worse. We get huge jams. The authorities could charge a variable fee, around 5%, in a monopoly setting, to exchange yuan for blockchain, anonymously. Volatility in coinage is free money, easily smoothed.

A five percent typical fee would last a long time and generate the appropriate communist exit fee. Add a term fee for rare, large transfers. Well, in fact, sell bitcoin exits on an automated, Redneck compatible trading pit. Call my VP, or ask your favorite banker. I can set the Communists up with a very stable yuan system hedged properly by international bitcoin.

My fee is 200 bitcoins.

By shutting down access to bitcoin domestically, they drive up the demand for foreign exchanges more dramatically. Chinese evaders are rushing to get their bitcoin ledger entered, protecting their loot like gold. Bitcoin prices responding up with each new central bank threat.

The price volatility they cause is surplus to existing bitcoin holders. The communists are better off legalizing the currency but requiring they clear via the government blockchain portal, for a fee on yuan. Then the authorities give citizens' the gain from public ledger but collect the monetary insurance fee for the yuan.

Consider the volatility

What the authorities do now is causing a 10% volatility in bitcoin exchanges, likely much worse. We get huge jams. The authorities could charge a variable fee, around 5%, in a monopoly setting, to exchange yuan for blockchain, anonymously. Volatility in coinage is free money, easily smoothed.

A five percent typical fee would last a long time and generate the appropriate communist exit fee. Add a term fee for rare, large transfers. Well, in fact, sell bitcoin exits on an automated, Redneck compatible trading pit. Call my VP, or ask your favorite banker. I can set the Communists up with a very stable yuan system hedged properly by international bitcoin.

My fee is 200 bitcoins.

Subscribe to:

Comments (Atom)