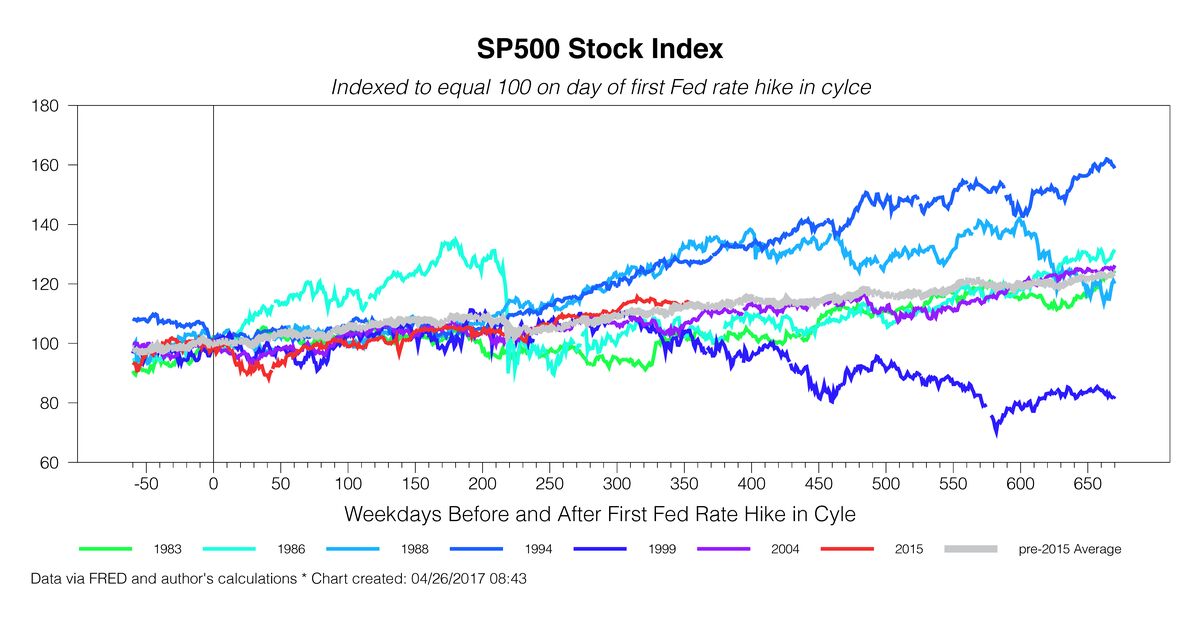

A chart from Tim Duy about rate tightening cycles. Money that cycles is bad money, off equilibrium. With these kind of money cycles we can be sure government will go broke.

The problem here is the government currency insurance guarantees, especially fixed prices in government programs. They always leak, mainly because they are hedged all the through the money cycle. Hence, government reaches a point where it cannot guarantee the currency and the economy collapses. Note, in the USA all these tightening cycles are most synchronous with government election cycle, and this is monopoly money. The two facts alone tell us we are crashing and no amount of central bank delusions can save a bankrupt government.

No comments:

Post a Comment