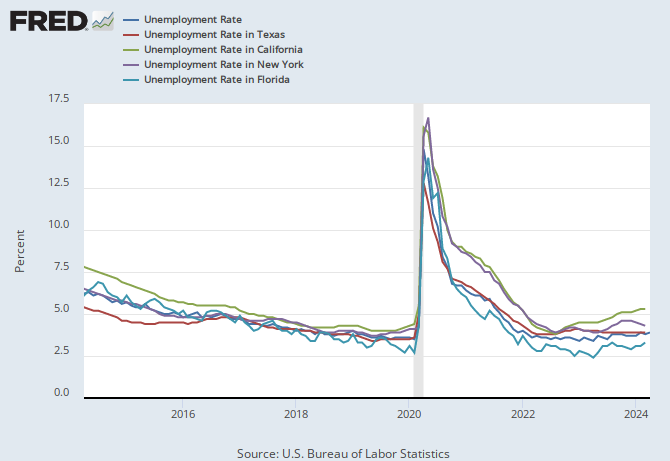

The Texas jump is significant, the smaller California jump not. Mostly Texas signals the recession, but, this time around, oil is a bit unique.

Convergence in rates is significant, happens at recession time, mostly, but not uniformly. But the economy does not stay converged for long, the large economies assert their differences.

So, interesting but hard to specify a prediction.

Let's add some things. Texas and California, one and two in size, make the difference. Texas way outperformed the large states over the cycle, and their 4.2% GDP growth is gone. Texas and California have been getting the young STEM workers, so look to the SouthWest to lead any prediction. There is nothing in the NorthEast or Great Lakes that is going to maintain the cycle.

So, by elimination, the whole US economy rests on California leading the way. California institutions are managed by the unions, its legislature racist and delusional, and Brown the Elder trapped by Brown the Younger. Our population growth is nearly zero, the gains all in Texas and Washington State. We are slightly less insolvent than New York. This economy depends on a bunch of software geeks in the bay area, and the only thing selling are digital ads. A lunatic asylum is a better term for the US economy.

No comments:

Post a Comment