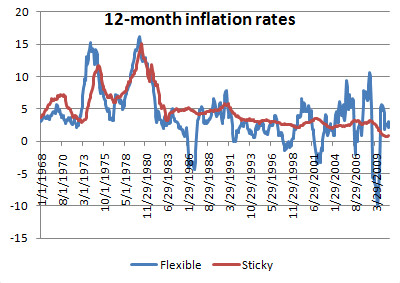

I stole Krugman's chart.

He connects wages and inflation via the Phelps relationship.

The Phillips curve is a historical inverse relationship between the rate of unemployment and the rate of inflation in an economy. WikiKrugman explains that wages were less volatile because the cost of living adjustment (COLA) was destroyed in wage deals, decoupling the Phelps relation. Hence, absent the COLA's, volatile commodities do not couple back into stable prices. And Lawrence Lux's responds, saying tax cuts and consumer debt insulated wages from inflation volatility and decoupled the Phelps relation.

My view, as my hoards of readers know, is that business shifted wage expenses onto government via the entitlement system and Reagan tax cuts; government covering present payments to future retirement costs. The time line is too long to explain the problem from consumer debt. The Phelps conclusion that wages and inflation should match shuld include quantization effect, the loss of precision when large government programs cover much of wages, indirectly. The wage settings dropped rank, as I say, and wages still follow inflation, but with a much longer adaptation time. Unfotrunately, the downward adaption in wage subsidies by government happens under the threat of default..

2 comments:

i have his book.

Good day time. Is fantastic article. All of it looks fantasticBuy D3 Gold

Cheap RS Gold

Post a Comment