A Hufman ncoder removes redundancy in a sequence of numbers. In state GDP numbers, California removes 1/6 of the redundancy, but appears at the one out of fifty times. The small states,m whichremove 1/6, but appear 1/3 of the time. The Huffman compression algorithm allocates codes, long codes for innovative numbers, small codes for the less significant. The total number of bits needed to encode the sequence is less than the original, when redundancies removed.

OK, here is a theoretical key. There is a decoding network, and path length is significance. California gets more of that decoding graph pace than the some small number of states., small states compressed. That decoding network is also the logistical minimum network to deliver state GDPs, it minimizes transaction costs. As a model of government goods of constrained flow, one can see the problem; the optimum logistical map is a far distance from the Senate map.

The Huffman encoder can be made as more precise as long as a lengthening data window introduces redundancy, to be compressed. Huffman is useful, for example; locate the significant stocks in an index; compute the significance of chicken feed to omlet prices. Any place where accounting can be done on an isolated channel that maps into a constrained flow. Its like Ito's calculus for spreadsheets.

Another clue.

The decodin g network is a balanced queuing network, each node being equally active. So finite Poisson applies, and I have no idea, I retired. But Huffman does that, and a data geek should jump all over that tool.

One can imagine the betting bot runs a moving window Huffman tree. The bot settles bets in any branch where the queue grows beyond the bound.

The state GDP better

It has a window large and a multiple of 50. So, it collects the complete window and generates the most probable GDP, a compressed value. In the margin of the compression, bets have small change on the line, that' where the game is played. The exact compression map is not known until the precision bound is broken. The tree rebalanced, and small change becomes integer change, a pay off, or pay out. The closer you bet to the new decoded value, the more you earn. A gaussian payout across each bin seems what happens, but go talk to the pros.

The better bot could declare a specific precision, the number of balanced, decoded leaves on the decoder tree. So betters spread across the GDP range waiting for the encoded GDP to define the boundaries. The GDP numbers co e out, the bot Huffman encodes them from 50 numbers to 27 bins. Once the tree computed, the 27 ocunts travels down the tree and splits with the betters in the bin. So the bot may very well lose money when insiders innovate, that is great, that is the idea. The bot shares in the risk of tree rebalancing.

Thursday, December 31, 2015

Blue bars, from now on

Look, I am not saying the economy is the pits, I am just saying we have enough negative grist that the recession committee can put a mild blue bar up for Q4/Q1. It keeps the aesthetic appeal of our Fred charts, its a marker, a reminder of the cost of all the crap we bought from the Swamp. Plus, its a reminder to us in the SouthWest, we are still part of the DC dollar economy. I might be like the Clinton recession, revised away later.

Banker bot secret exposed

R3: This paper explores several of the drawbacks and challenges of using public blockchains for securing off-chain titles and concludes that these types of networks are not fit-for-purpose for globally regulated financial institutions.

It is not so bad, he regulators have o deploy regulator bots.

Wednesday, December 30, 2015

Obamacare, unsustainable

Alternet: In the aftermath of the economic collapse in 2008, a significant factor in the decline of the quality of jobs in the United States, as well as in Europe has been employers’ increasing reliance on “non-regular” workers — a growing army of freelancers, temps, contractors, part-timers, day laborers, micro-entrepreneurs, gig-preneurs, solo-preneurs, contingent labor, perma-lancers and perma-temps. It’s practically a new taxonomy for a workforce that has become segmented into a dizzying assortment of labor categories. Even many full-time, professional jobs and occupations are experiencing this precarious shift.This practice has given rise to the term “1099 economy,” since these employees don’t file W-2 income tax forms like any regular, permanent employee; instead, they receive the 1099-MISC form for an IRS classification known as “independent contractor.” The advantage for a business of using 1099 workers over W-2 wage-earners is obvious: an employer usually can lower its labor costs dramatically, often by 30 percent or more, since it is not responsible for a 1099 worker’s health benefits, retirement, unemployment or injured workers compensation, lunch breaks, overtime, disability, paid sick, holiday or vacation leave and more. In addition, contract workers are paid only for the specific number of hours they spend providing labor, or completing a specific job, which increasingly are being reduced to shorter and shorter “micro-gigs.”

Missouri flooding is costly

They say it is as bad as ever in Missouri, and many oil pipelines are shut. This is a quarter point drop in GDP growth. And to make matters worse, trucking has slowed. Unfortunately we are headed into the 2016 Q1 slowdown with no growth momentum. We are going to hear more recession predictions and the Fed will not be raising rates in Q1.

Puero Rico Governor saves the mansion!

Washington (AFP) - Puerto Rico said Wednesday that it would default on part of $1 billion in bond payments due January 1, blasting "hedge and vulture fund" creditors for blocking the restructuring of the island's debt.Alejandro Garcia Padilla, governor of the US island territory struggling with more than $70 billion in debt, said that it would miss about $37 million in payments to ensure the government has enough funding to pay salaries, pensions and other creditors.

But wait!

thdey still want to pay for the govefrnor's ,mansion! Hig them with lawyers until the mansion is sold.

Obamacare rebellion

Business Insider: Last week I wrote about my recent IRS audit (which went well).What I did not dwell on was one of the topics they wanted to cover – my health insurance premiums.The tax year in question was 2013. I dutifully obtained copies of my insurance premium payments and presented them to the agent. For half the year I paid $654 per month, then my premium increased to $748.That’s a 14.5% jump in one year. It annoyed me at the time, but nothing like the anger I felt when I saw those numbers during my audit.In the scant two years since 2013, my premium has increased from $748 to $1456, a 95% increase in two years.To be sure, I don’t have the same coverage.Today, I have less. In two weeks, it will get worse.My health insurance provider wrote to me with the “good news” that I could continue my coverage for only $2,008 per month, a mere 38% increase in one year.This would put my premium change from 2013 to 2016 at 207%.That seemed a bit much to me, so I spent some time on the Healthcare.gov website, doing my personal duty of “shopping” for healthcare.I found a plan that provides even less coverage (which means more expensive to use), but costs “only” $1,393 per month. While less than last year, it’s still more than double the cost from three years ago.The kicker is, I’ve never had claims that rose above my premiums, so every year the insurance company is making a profit on me.I understand how insurance works. I’m not angling to get into a car accident or contract a disease just so that I can make claims. I’m happy paying for this and not using it to the extent of my premiums. But I would be happier if the rates weren’t shooting to the moon each year even though my claims aren’t.Which brings me to the Affordable Care Act, a piece of legislation with an Orwellian name (it’snot affordable and it provides less care).As written the law calls for everyone to get insurance, and those unable to afford it will get a subsidy. At first glance, it might seem logical that the subsidy would go to those below the middle in terms of income and cost of insurance. But that’s not the case.It’s the bottom 90% that get financial assistance, which comes from the other 10%. Since about 30% of us get health insurance through the individual markets, that means 3% of Americans are propping up the system.We need a union.

The Kanosians know this is not sustainable, but they want as many unsustainable signed up ASAP, in time for the helicopter drop Its' not economics, it is fraud and Kanosian professors know they are fraudulent, they simply cannot be that stupid.

Long termers don't want helicopter flights.

Destructive Long-Termism

One of my long-running gripes about much discussion of current economic issues is about what I consider the long-run dodge. By this I mean the attempt to change the subject away from unemployment and inadequate demand toward supposedly more fundamental issues of education and structural reform. Such efforts to change the subject seem to me to be both wrong and, to some extent, cowardly. After all, if the clear and present problem is inadequate demand, then we should have policies to deal with that problem — I don’t care how important you think the long run is, we should deal with the crisis at hand.

This is Krugman making a rear defense of drunk helicopter pilots. The game is spend the deficit on one's interest groups. Then at helicopter time the groups with the most debt get the bigger bailout.

The Chinese home buyer is back!

From Zero Hedge.

The offshore price of Yuan has dropped relative to the on shore controlled price. So money has left China and has arrived at the US housing market, mostly SouthWest.

Its a great business, the twop kids are adolescents who live here with the grand parents. They get the Legal Illegal Alienship card in California. Mom and Dad stay in China and earn the dough. This is trade rebalancing, US style.

The offshore price of Yuan has dropped relative to the on shore controlled price. So money has left China and has arrived at the US housing market, mostly SouthWest.

Its a great business, the twop kids are adolescents who live here with the grand parents. They get the Legal Illegal Alienship card in California. Mom and Dad stay in China and earn the dough. This is trade rebalancing, US style.

Tuesday, December 29, 2015

The two big states and their income

From the BEA, we have state income as a percent of the mean. We expect Texas and California to be very close to the mean, within 10%, and they atre.

California earns slightly more (7%) then the national average. Rank 11.

Texas earns slightly (2%) less. Rank 22. The difference between the two is that California got hit harder and longer from the crash.

How about New York?

New York is rich, they earn their dough by slinging DC debt, that is a lot of paper stacking.

How did we get out of the recession? We fracked oil and slung debt.

Here is Illinois, cliff diving. Florida is also taking a dump in the BEA list. I dunno why, at the moment. They have the entitlement income, so what's up?

Meanwhile, California struggled with its nearly bankrupt public sector problem. But that line going up, at the end of the California chart? That line is Silicon Valley writing software, software that is converging to the universally held collective banker bot. We hold our banker bot and we decode the supply while the bots encode the demand. The boundary will be always in motion, its price discovery, or a division of the inside and outside information boundary. Keeping that boundary means experimenting with our reserves a bit. But in the Theory of Every thing, that boundary is a system making a bi-partite graph, closing the loops. Banker boy does that for us, it attempts to remove the spurious shopping trips. But he bot is smart, it knows to leave a bit of uncertainty, it can handle currency risk.

California earns slightly more (7%) then the national average. Rank 11.

Texas earns slightly (2%) less. Rank 22. The difference between the two is that California got hit harder and longer from the crash.

How about New York?

New York is rich, they earn their dough by slinging DC debt, that is a lot of paper stacking.

How did we get out of the recession? We fracked oil and slung debt.

Here is Illinois, cliff diving. Florida is also taking a dump in the BEA list. I dunno why, at the moment. They have the entitlement income, so what's up?

Meanwhile, California struggled with its nearly bankrupt public sector problem. But that line going up, at the end of the California chart? That line is Silicon Valley writing software, software that is converging to the universally held collective banker bot. We hold our banker bot and we decode the supply while the bots encode the demand. The boundary will be always in motion, its price discovery, or a division of the inside and outside information boundary. Keeping that boundary means experimenting with our reserves a bit. But in the Theory of Every thing, that boundary is a system making a bi-partite graph, closing the loops. Banker boy does that for us, it attempts to remove the spurious shopping trips. But he bot is smart, it knows to leave a bit of uncertainty, it can handle currency risk.

Obamacare still driving up medical inflation

LA Times: US healthcare spending grew 5.3% last year to $3 trillion, another sign that a historic slowdown in medical inflation may be ending, a new federal report shows.The massive expansion of insurance coverage under the health law and rapid growth in specialty drug spending fueled the uptick in medical costs, officials said. Annual spending growth was 3.7%, on average, during the last five years.Experts aren't predicting a return to double-digit increases in medical spending. But the latest trend underscores how difficult it will be for policymakers, employers and insurers to control healthcare costs going forward.The country spent $9,523 per person on healthcare in 2014, including Medicare,Medicaid and private health insurance. That's far higher than what other developed countries pay, and healthcare spending now accounts for 17.5% of the U.S. economy.The upswing could further squeeze American workers. Health insurance premiums and deductibles keep taking a bigger bite of their paychecks, as employers shift more healthcare costs to employees."Two main factors were responsible for health spending growth in 2014 -- coverage expansion associated with the Affordable Care Act and faster growth in prescription drug spending," said Anne B. Martin, an economist at the Centers for Medicare and Medicaid Services.

That would be a 5% hit to public secor costs. Add in ghe additional 3% for lower pension returns. Add in he increrased minimum weager in C alifornia, and the usual underfunding and California public sector will cost us abut 7% more i 2016. Thank you Kanosians, you have put yourself out of a job, lay-offs starting soon. We will start by laying off ther Bezerkeley Economics department.

What multipliers greater than oner?

Multipliers may be greater than one if you use Magic Walrus. But Magic Walrus is proven wrong.

A straight look at changes in government spending vs changes in real GDP shows multipliers less than one, During the stimulus, federal spending up, growth down. After the stimulus, federal spending down, growth up.

How does Krugman get good multipliers/ He artificially separates structural deficit from cyclical. But it ain't so, the potential growth rate has been dropping for 15 years, since 2000. Now we have a big spending surge, thanks to Paul Ryan, and growth is dropping.

And if Magic Walrus is correct, the why do the recessions fall on presidential election boundaries. Nor do they explain why the California public sector state goes through huge unemployment spirals. All of this evidence poin ts to he Kanosians as the ultimate culprit in the recession cycle.

A straight look at changes in government spending vs changes in real GDP shows multipliers less than one, During the stimulus, federal spending up, growth down. After the stimulus, federal spending down, growth up.

How does Krugman get good multipliers/ He artificially separates structural deficit from cyclical. But it ain't so, the potential growth rate has been dropping for 15 years, since 2000. Now we have a big spending surge, thanks to Paul Ryan, and growth is dropping.

And if Magic Walrus is correct, the why do the recessions fall on presidential election boundaries. Nor do they explain why the California public sector state goes through huge unemployment spirals. All of this evidence poin ts to he Kanosians as the ultimate culprit in the recession cycle.

Monday, December 28, 2015

A mild recession today but no helicopter tomorrow

In spring of 2016 we have an option. Take some losses, and trigger the blue bar in retrospect, or try for another year and risk the drunken helicopter pilot?

Some surprises may await us. Christmas sales are up 10%. Subtract out imports, average; and we might get an unexpected 1% extra growth this Q4. Chinese home buyers may show up. Texas and the oil patch will cost us a half point, Illinois will cost a quarter. California might have a mild uptick in unemployment. The New York real estate market is in bear. And we have DC policy changes in taxes and Obamacare; hence our Q1 slowdown is coming. Canada will drop us a quarter. How is Mexico doing? They look OK.

This is borderline downturn, and we have some control over the dating committee. Take our lumps in spring, via a revision. Is that within the rules? We risk a coordination failure if the monetary regime change is fooled by the arrival of pure digital cash. So by sneaking in a quicky recession now, finance can reset their clocks for banker bot's arrival.

Some surprises may await us. Christmas sales are up 10%. Subtract out imports, average; and we might get an unexpected 1% extra growth this Q4. Chinese home buyers may show up. Texas and the oil patch will cost us a half point, Illinois will cost a quarter. California might have a mild uptick in unemployment. The New York real estate market is in bear. And we have DC policy changes in taxes and Obamacare; hence our Q1 slowdown is coming. Canada will drop us a quarter. How is Mexico doing? They look OK.

This is borderline downturn, and we have some control over the dating committee. Take our lumps in spring, via a revision. Is that within the rules? We risk a coordination failure if the monetary regime change is fooled by the arrival of pure digital cash. So by sneaking in a quicky recession now, finance can reset their clocks for banker bot's arrival.

Hillary's 'No New Taxes'

Time: Among the various policy ideas and position papers put out by Hillary Clinton so far in the Democratic primary, one stands out for its bumper-sticker simplicity: If your family makes less than $250,000 a year, your taxes won’t go up.It’s a line Clinton has repeatedly emphasized in the last week and a half in places as varied as a dusty agricultural center in Ames, Iowa; a rally in Memphis; and a Democratic meeting in South Carolina.“I was actually the only one on that debate stage who will commit to raising your wages, and not your taxes,” she said last Tuesday at a campaign event in Dallas. “I don’t see how you can be serious about raising working and middle-class families’ incomes if you also want to slap new taxes on them—no matter what the taxes will pay for.”

But behind that simple promise is a roiling debate within Democratic circles about the future of the party’s domestic agenda.The no-new-taxes pledge is emblematic of the broader concerns about a Clinton presidency raised by the progressive side of the party. Critics say it is a crafty political move that would limit the ambition of proposals on everything from expanding Social Security to healthcare reform. It reinforces a long-running Republican argument that some would prefer to defeat head on. And, to put it simply, it makes it hard to pay for things Democrats want.

We got Obamacare because the middle class pays for it. If the Dems want to distribute middle class cookies then they will raise middle class taxes.

Texas in contraction

From Business Insider.

Texas is 10% of the economy, and this contraction drops growth by .5% . let us see later what GDP Now does with it,

Texas is 10% of the economy, and this contraction drops growth by .5% . let us see later what GDP Now does with it,

Sunday, December 27, 2015

Economists start your California regression

CalWatch: California will start the new year with a record-setting wage floor.“On Jan. 1 California will have the highest minimum wage in the country,” as Capital Public Radio noted. “California workers earning minimum wage will get an extra dollar an hour at the beginning of the year. The state raised the rate from $8 to $9 in July 2014. Soon it will be $10 an hour.” Legislation hiking the wage was sponsored by Assemblyman Luis Alejo, D-Salinas. According to Alejo, the increase would result in about $2,000 more net dollars over a year’s time working 40 hours a week at the new minimum wage.

Will it or won't it?

I find the sequence interesting, this is happening at the end of a long and weak expansion. And place. It is happening in the largest jurisdiction in North America. And the history. It is happening in the 7th most insolvent state, with the highest per capita expansion in medicaid. It is happening just after pension returns have been down graded, and the market has yielded a flat gain in price. And the frackers have run out of steam.

If GDP Now is showing a 1.5% growth, then that is California's growth, it is the heavy weight in the mean. Cities and counties are tight, they arem not hiring, and now they have another wage hike. There are three contributors to the wage costs, pension rising with a flat market, health expenses inflationary due to Obamacare, and now minimum wage hikes. Retail taxes likely down by 10% YoY. , Silicon Valley geeks won't be paying large capital gains. The public sector is no longer hiring, and may start lay offs.

Is this a perfect storm?

Yes, but no random event. Economic agents, mostly i government, calculate their run time, and they optimally leave the bills to the next fool in the sequence. The cycle is so predictable that its cost enters the accounting system, it become the transaction cost of government money.

The cost of regulation

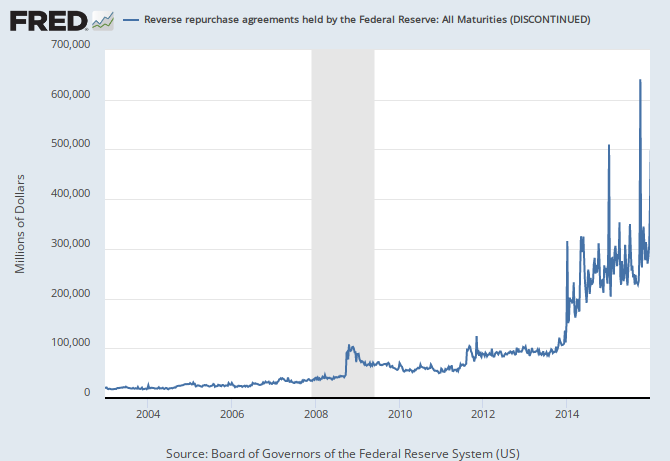

It is the volatility of this time series. These are the deposits of the regulated lenders. This volatility is mostly a quantity constraint imposed quarterly and yearly. So the lenders need a yield that covers this volatility. Once that yield is discovered, the it is converted into price, an elasticity is calculated.

Bankers do this stuff, find important activity not monetized and go on a price discovery. But, today, most of our discovery is about the costs of idiocy in the Swamp.

At some interest rate, the short term yield and asset yield will match the term premium currently standard. At that point, the GSEs are really solvent, as solvent as anything else. But what is that yield? They have a mandated liquid balance. The term and rate on that mandated balance had to fit other equivalent fund performance. For example, the GSEs should earn the one year treasury rate, and hold their buffer for that long. That rate is .63, and the current effective funds rate is .37. Regulations need not demand overnight liquidity rates.

The big fear

The fundamental fear in the asset markets is that the cost of regulation will be unsustainable deflation, bankruptcy. The Fed cannot round the loop anymore, the loop collapses.

Bankers do this stuff, find important activity not monetized and go on a price discovery. But, today, most of our discovery is about the costs of idiocy in the Swamp.

At some interest rate, the short term yield and asset yield will match the term premium currently standard. At that point, the GSEs are really solvent, as solvent as anything else. But what is that yield? They have a mandated liquid balance. The term and rate on that mandated balance had to fit other equivalent fund performance. For example, the GSEs should earn the one year treasury rate, and hold their buffer for that long. That rate is .63, and the current effective funds rate is .37. Regulations need not demand overnight liquidity rates.

The big fear

The fundamental fear in the asset markets is that the cost of regulation will be unsustainable deflation, bankruptcy. The Fed cannot round the loop anymore, the loop collapses.

But the rags came back, the very next day

In private, top Afghan and American officials have begun to voice increasingly grim assessments of the resurgent Taliban threat, most notably in a previously undisclosed transcript of a late-October meeting of the Afghan National Security Council.The rags came back and wouldn't stay away

Ahla Akbar, a little ditty

But the rags came back

OK,OK maybe the problem is environmental, who the hell wants to live in the Afghan mountains except nutty people.

I will gladly pay you a red chip tomorrow for a green today.

Japan. Too many red chips. That tax thing was quite the green chip. They should have done that tax in three steps, balanced the reds.

Going in to this a bit more.

After spreading out the green tax chip, they got the oldsters ton dump a couple of reds, then bingo; they nearly got a red/green ratio, and its inverse. They got a nice cotangent ring going, great. That make them yet another sensible aggregate of biological intelligence. They don 't need no Aby Nomics.

Going in to this a bit more.

After spreading out the green tax chip, they got the oldsters ton dump a couple of reds, then bingo; they nearly got a red/green ratio, and its inverse. They got a nice cotangent ring going, great. That make them yet another sensible aggregate of biological intelligence. They don 't need no Aby Nomics.

Brad Delong has a puzzle for us

Brad is talking abut the cause of low interest rates:

What happens next?

The Fed is discvovering the cost of regulating andx owning the GSEs, and that costy will be apportioned through the interest rate mechanism. Wd do n ot know the cost, it is in sider information betweenm Treasury, the Senate and the debt cartel. But regulatory costs have to be discovered since Congress is effectively a member banks. Regulzatory costs become a currency risk, and the currency bankers wants currency risk monetized.

Tighten or ease?

Dunno, the Fed does not know, we do not know if regulation is too restrictive or not. So the Fed has to follow the loop, see how the GSEs react and how the Treasury debt market reacts.

Let's try the shortest term rate, the effective funds rate. Where does that money com e from? It is mostly, I heard, a fixed regulated ratiuo of long term assets held by GSEs and regulated home lenders. So, the data shows about the same balance volatility as before with little change in balance; yet the rate jumped a quarter point. It was, in fact, a regulated rate. Regulated by Congress. Congress, by virtue of applying a constant to an institutional ratio requires a rate regulation by the Fed. It meets all the qualifications of a price control. Taylor has it slightly backwards, the price floor is set by Congress, and the Fed has the power to raise that rate floor.

Why does the North Atlantic economy right now want and need such a low real interest rate for its proper equilibrium? And for how long will it want and need this anomalous and disturbing interest-rate configuration? These are deep and unsettled questions involving, as Olivier Blanchard puts it, "dark corners" where economists' writings have so far shed much too little light.

Hold on tight to this: There is a wrongness, but the wrongness is not in what central banks have done, but rather in the situation that has been handed to them for them to deal with.

What happens next?

The Fed is discvovering the cost of regulating andx owning the GSEs, and that costy will be apportioned through the interest rate mechanism. Wd do n ot know the cost, it is in sider information betweenm Treasury, the Senate and the debt cartel. But regulatory costs have to be discovered since Congress is effectively a member banks. Regulzatory costs become a currency risk, and the currency bankers wants currency risk monetized.

Tighten or ease?

Dunno, the Fed does not know, we do not know if regulation is too restrictive or not. So the Fed has to follow the loop, see how the GSEs react and how the Treasury debt market reacts.

Terrorist, yes or no?

The one on the right, with the modest little wrap on her head during a sunny afternoon. I say likely not a an Islamic terrorist. Another clue, she has obviously plucked her eyebrows. I think pluck eyebrow is unislamic.

Friday, December 25, 2015

A theory on the backhand back swing

The left hand, or sub -dominant hand, guides the body, it is counter pose. Always keep he sub-dominant free to fine tune the shot.

On the back swing, there may be grip change. The left hand need just touch the racket, a slight nudge and the right hand grip will adjust. Immediately there after, the left does all the steering with free motion , the right is in charge of the racket. The key to run and shoot, always get both arms independent as soon as possible. Winning tennis should always be one armed shoot, two arm run.

On the back swing, there may be grip change. The left hand need just touch the racket, a slight nudge and the right hand grip will adjust. Immediately there after, the left does all the steering with free motion , the right is in charge of the racket. The key to run and shoot, always get both arms independent as soon as possible. Winning tennis should always be one armed shoot, two arm run.

Dean Baker, fraud of the day

He says:

Look at the chart to the left, that is a mal proportioned population distribution which will not support entitlements.

He says:

Bullshit. Tell this idiot that old people are sicker and have heart attacks and cancer, both vewy expensive. It is rare for young people to be that sick

He says:

Horse manure. Discretionary spending is down for one reason, entitlements are eating up the federal budget. We're headed to Italian level growth because of Italian level debt. The federal budget cannot sustain high growth as the high interest costs will approach 20% of the budget, and DC collapses. Let's look at potential growth, as measure by Magic Walrus, and debt:

What the frig is wrong with our economic graduate schools that they turn out fraudulent scientific practices?

He is right about Obamacare, it does n ot favor the old, But Obamacare took 1% of the income from the middle class, and Hillary is facing a very pissed off middle class, hence the Trunp surge. If Dean cannot figure this out, the he need to go back to mail order Kanosian school.

Lesson One: Social Security and Medicare are not Unfair to the Young

Look at the chart to the left, that is a mal proportioned population distribution which will not support entitlements.

He says:

Lesson Two: The Affordable Care Act Redistributes from the Healthy to the Less Healthy, not the Young to the Old

Bullshit. Tell this idiot that old people are sicker and have heart attacks and cancer, both vewy expensive. It is rare for young people to be that sick

He says:

Lesson Three: Our Children Will Only be Hurt by the Debt Because the Washington Post and Other Elite Types Will Use it As An Excuse to Cut Necessary Spending

Horse manure. Discretionary spending is down for one reason, entitlements are eating up the federal budget. We're headed to Italian level growth because of Italian level debt. The federal budget cannot sustain high growth as the high interest costs will approach 20% of the budget, and DC collapses. Let's look at potential growth, as measure by Magic Walrus, and debt:

Waddya know, debt way up, potential growth way down.

What the frig is wrong with our economic graduate schools that they turn out fraudulent scientific practices?

He is right about Obamacare, it does n ot favor the old, But Obamacare took 1% of the income from the middle class, and Hillary is facing a very pissed off middle class, hence the Trunp surge. If Dean cannot figure this out, the he need to go back to mail order Kanosian school.

Thursday, December 24, 2015

The two handed backhand is a mistake

Tennis is a game of run and shoot. When was the last time you saw an Olympic runner with his hands together? Never, you need two free arms to maximize leg efficiency, they counter-pose, stabilize the spine over the legs. Watch Roger, he gets a partial step on the two handers, and keeps them in jail. Roger runs the court better then any of them, he is always a two handed runner with a stable axis of rotation through the spine. Stable spine, fixed eye position, independent wrist movement, while left hand maintains counter pose balance.

At the moment of impact, Roger's spine is the axis of rotation, but rotational momentum is zero, his spin e stablbe with respect to court surface. Hence, the left and right arm have their co-linear movement nullified at the spine, the right shoulder, forearm and srist are maximally independent and ontaain them maximum pendulum ratio.

The two hander has moved his axis of rotation out to his breastbone, his spine has a secondary rotational moment, The two handcer needs a second, slight step, to adjust the spine back onto the legs. Baseball batters have that same partial step after the swing.

Roger on the rally

Go dig up a video of Roger, and watch them backhand rallies with the two handers. Roger watches that partial step to adjust, and times his backhand back to the same spot, while the two hander is just completing his adjustment. Of necessity, the two hander gets into a oscillation, he cannot let the center be open, he is forced to do the partial step. Once the oscillation begins, Roger has a wide angle of potential kill shots. Roger's entire game is eye on impact with stable, zero momentum spine, left hand fine tuning, right wrist take the maximum kinetic energy wave. The right wrist is still fine tunable by Roger, as all the joint are muscle fired in a wave. Joint movement is maximally independent, and rotational velocity adds up.

Escaping Roger's jail

How? You have to have some sort of one handed backhand, even a weaker one. It dampens the court oscillation. Use it when needed to supplement the two hander, its an escape clause. Better yet, make the two hander the specialized killer shot, use it when speed and power gets you a definite position advantage. That is a fair price for the partial step.

See for yourself in Roger v Rafo. Watch the coun ter timing on the backhand rallies, see Rafo take that extra adjustment aftr each two hander.

At the moment of impact, Roger's spine is the axis of rotation, but rotational momentum is zero, his spin e stablbe with respect to court surface. Hence, the left and right arm have their co-linear movement nullified at the spine, the right shoulder, forearm and srist are maximally independent and ontaain them maximum pendulum ratio.

The two hander has moved his axis of rotation out to his breastbone, his spine has a secondary rotational moment, The two handcer needs a second, slight step, to adjust the spine back onto the legs. Baseball batters have that same partial step after the swing.

Roger on the rally

Go dig up a video of Roger, and watch them backhand rallies with the two handers. Roger watches that partial step to adjust, and times his backhand back to the same spot, while the two hander is just completing his adjustment. Of necessity, the two hander gets into a oscillation, he cannot let the center be open, he is forced to do the partial step. Once the oscillation begins, Roger has a wide angle of potential kill shots. Roger's entire game is eye on impact with stable, zero momentum spine, left hand fine tuning, right wrist take the maximum kinetic energy wave. The right wrist is still fine tunable by Roger, as all the joint are muscle fired in a wave. Joint movement is maximally independent, and rotational velocity adds up.

Escaping Roger's jail

How? You have to have some sort of one handed backhand, even a weaker one. It dampens the court oscillation. Use it when needed to supplement the two hander, its an escape clause. Better yet, make the two hander the specialized killer shot, use it when speed and power gets you a definite position advantage. That is a fair price for the partial step.

See for yourself in Roger v Rafo. Watch the coun ter timing on the backhand rallies, see Rafo take that extra adjustment aftr each two hander.

Secret political code meaning "Drunken Helicopter Pilot"

Audit?TiM: 2016 Democratic presidential candidate and U.S. Senator from Vermont Bernie Sanders wrote an op-ed for The New York Times on Wednesday calling for the Federal Reserve to be audited independently by the Government Accountability Office on an annual basis.Meanwhile, Senate Majority Leader Mitch McConnell (R-Ky.) has scheduled a historic Jan. 12 vote on a bill, colloquially referred to as “Audit the Fed,” which was introduced by Sen. Rand Paul (R-Ky.). The bill would authorize the GAO to perform full audits of the Federal Reserve System.“To rein in Wall Street, we should begin by reforming the Federal Reserve, which oversees financial institutions and which uses monetary policy to maintain price stability and full employment. Unfortunately, an institution that was created to serve all Americans has been hijacked by the very bankers it regulates,” wrote Sen. Sanders.

Horsemanure. All of these candidates have policies that lead to one outcome, a sudden flight, overnight, of the Bernanke's drunken airline.

Retire oftern

MarketWatch: Retirement, contrary to popular opinion, is not the time in which your satisfaction with life declines and your health deteriorates. Instead, it’s the exact opposite: Retirement is likely to improve your overall happiness and health, according to a working paper published by the National Bureau of Economic Research this year.And that improvement happens immediately, according to the authors of the paper, Aspen Gorry and Devon Gorry, both professors at Utah State University, and Sita Slavov, a professor at George Mason University.

California, Texas and Florida

Bloomberg: Starting in four years, these three states will control 33% of the House, and 6% of the Senate; clearly unworkable.

Wait, you say, Bezerkeley told us the two party system fixes this problem. No, politics is local. In each of these states, G is the state capital; they want bulk financial transfers. In 30 other states, G is DC; they want services. There is an economy of scale effect, the path length across government is longer for the large three. DC cannot support both systems.

Wait, you say, Bezerkeley told us the two party system fixes this problem. No, politics is local. In each of these states, G is the state capital; they want bulk financial transfers. In 30 other states, G is DC; they want services. There is an economy of scale effect, the path length across government is longer for the large three. DC cannot support both systems.

Wednesday, December 23, 2015

Was rock throwing in our evolutionary path?

What makes the upright humanoid? Stand up and throw a rock. Hunting from a distance, defense from a distance. Humanoid can throw rock into fruit trees, into streams. Then they hoard rocks. Want a pile ready to take on the hunt. But a rock hoard yields cutting rocks, different rocks; and hand eye coordination, the same rock throwing motion becomes the pounding motion. Tool age explosion. Hand eye coordination still remains a fundamental thrill to humans, the same motion appears in all our sports. It would be born at the thrill of blasting your first edible fruit without climbing the tree. Then take the same rock and cut it up. What an evolutionary advantage.

I take on Brad's graph

His key charts to decompose demand.

1) Total government purchases down. One thing, California, New York, and Illinois; the first, fourth and fifth largest. Also the First, fourth and seventh most insolvent, They have pension costs.

2) Housing is down relative to its peak, in 2007, where this graph references. But that was a bubble, so maqke the adjustment and housing is OK.

3) Business investment recovered just like it always does.

4) Exports up! Hurray, a partial rebalance fro m the years of government induced deficits.

How do we get cause and effect with QE?

We compare this crash with the five previous, how was this one different. We are at the end of the central banker debt cycle, its helicopter time.

1) Total government purchases down. One thing, California, New York, and Illinois; the first, fourth and fifth largest. Also the First, fourth and seventh most insolvent, They have pension costs.

2) Housing is down relative to its peak, in 2007, where this graph references. But that was a bubble, so maqke the adjustment and housing is OK.

3) Business investment recovered just like it always does.

4) Exports up! Hurray, a partial rebalance fro m the years of government induced deficits.

How do we get cause and effect with QE?

We compare this crash with the five previous, how was this one different. We are at the end of the central banker debt cycle, its helicopter time.

Republican Communist Party watch

Business Insider: Donald Trump’s tax-cut plan could add as much as $24.5 trillion to the national debt over the coming 20 years unless it is accompanied by steep cuts in spending and entitlement programs, a new analysis finds.The paper published by the Tax Policy Center, a joint venture by the Urban Institute and Brookings Institution, provides a sobering reminder that many of the generous tax cut plans being floated by Trump, former Florida Gov. Jeb Bush and other candidates carry enormous long-term price tags. Some of them, if adopted, would spark a renewal of the long-term debt crisis and could undermine the very economic recovery that GOP and Democratic presidential candidates alike are promising.

We are getting Bernanke's drunken helicopter pilots, no matter what.

We have been Down Casted

Down to 1.3% YoY growth. But doubt the number, this is white noise Christmas and revisions will be forthcoming.

Tuesday, December 22, 2015

How to predict the recessions.

Some economist named Matt Busigin says the blue squiggly line does not quite predict recession. He is right. But he neglects those blue bars, they absolutely predict a recession. This business cycle is at its end. This cycle is more like the Reagan cycle, we got one minor cycle of the blue squiggly and thhen another recession. Can we do the Clinton? The squiggly went two complete cycles.

The Pure Cash Network

SmartCards exchange digits with each other, and no human can tamper. So,Joe Blow takes his smart card and taps at the new coin icon, on his computer. That software opens up a new web betting site. New currency is as simple as a new blog.

Joe Coins will compete with dollars, so Joe sets up the NGDP betting target. Any other Smart Card that has Joe Coins can bet on the NGDP. Joe takes out a loan of one Joe coin, and bets that the NGDP will be 7. The BEA reports 18.7 Trillion, and Joe is the best bet, he wins his own coin .

Transaction costs are tiny, convenience is infinite. So a bunch of folks at the BEA go to the betting site to get coins, that is OK, Joe Coins like insider information. Joe makes the BEA staff watch one ad to get one coin.

These insiders all bet on advanced information, they make the NGDP numbers, after all. But even within this group, their is deviation about when and where the final number will be. The bet has spread, and the spread narrows as the NGDP number gets composed. We still get an even split between losers and winners, but the bot has to re-balance the betting tree, the graph which represents the possible NGDP bets, grouped by significance. The betting tree has essentially monetized the BEA operations. The BEA staff likes the game, they split the bets generally.

Now semi outsiders, business and banks and large investment corporations pull out their smart cards and buy Joe Coins from the BEA staff, using dollars. They want to use the betting tree as a hedge. Joe Coins improve efficiency in inventory flow, But knowledge of BEA data as it com es in is great, the Atlanta Fed does that. But the Bot will always dig into insider information..

Banker bot can be snookered, it loses and gains now and then. This is because the bot currency risk equals the insider uncertainty, and this is shared by all betters. The bot has to bet the 50/50 split, the balance point in the tree. But transactions are quantized, they are maximum entropy, So when uncertainty drops via insider betting, the bot will lose some spectral space, the maneuvering between the left and right branches. Inflation and deflation happen on the margin.

This all works because the terms are guaranteed tamper proof and transaction costs low and information published honestly. That means card to card transaction only, Joe Blow has to plug his card into the web to run the betting site.

Why do businesses support Joe Coins over dollars? Because banker bot attracts insider information, and monetizes it; thus neutralizing it. This is a huge gain in efficiency, this is the singularity. This is a collection of smart cards that are indexing all things humans consider important.

Tim Cook says we can do this on his telephones. I say we got intelligent credit cards, no phone calls needed.

Joe Coins will compete with dollars, so Joe sets up the NGDP betting target. Any other Smart Card that has Joe Coins can bet on the NGDP. Joe takes out a loan of one Joe coin, and bets that the NGDP will be 7. The BEA reports 18.7 Trillion, and Joe is the best bet, he wins his own coin .

Transaction costs are tiny, convenience is infinite. So a bunch of folks at the BEA go to the betting site to get coins, that is OK, Joe Coins like insider information. Joe makes the BEA staff watch one ad to get one coin.

These insiders all bet on advanced information, they make the NGDP numbers, after all. But even within this group, their is deviation about when and where the final number will be. The bet has spread, and the spread narrows as the NGDP number gets composed. We still get an even split between losers and winners, but the bot has to re-balance the betting tree, the graph which represents the possible NGDP bets, grouped by significance. The betting tree has essentially monetized the BEA operations. The BEA staff likes the game, they split the bets generally.

Now semi outsiders, business and banks and large investment corporations pull out their smart cards and buy Joe Coins from the BEA staff, using dollars. They want to use the betting tree as a hedge. Joe Coins improve efficiency in inventory flow, But knowledge of BEA data as it com es in is great, the Atlanta Fed does that. But the Bot will always dig into insider information..

Banker bot can be snookered, it loses and gains now and then. This is because the bot currency risk equals the insider uncertainty, and this is shared by all betters. The bot has to bet the 50/50 split, the balance point in the tree. But transactions are quantized, they are maximum entropy, So when uncertainty drops via insider betting, the bot will lose some spectral space, the maneuvering between the left and right branches. Inflation and deflation happen on the margin.

This all works because the terms are guaranteed tamper proof and transaction costs low and information published honestly. That means card to card transaction only, Joe Blow has to plug his card into the web to run the betting site.

Why do businesses support Joe Coins over dollars? Because banker bot attracts insider information, and monetizes it; thus neutralizing it. This is a huge gain in efficiency, this is the singularity. This is a collection of smart cards that are indexing all things humans consider important.

Tim Cook says we can do this on his telephones. I say we got intelligent credit cards, no phone calls needed.

How do we grow?

Right now we are frackers in Texas, Florida's entitlement profits are surging. New York is flat as folks move to Florida. Chicago and Illinois are toast.

What happens in the 2020 census? If you said the Northeast liberals will no longer control Congress, you are correct.

Home sales plunge

Down 13.9% the west. What else is happening in the west? Lower dividends reduces pension earnings and will cause local government budget stress and layoffs.WASHINGTON (Reuters) - U.S. home resales posted their sharpest drop in five years in November, a potential warning sign for the health of the U.S. economy although new regulations on paperwork for home purchases may have driven the decline.The National Association of Realtors said on Tuesday existing home sales plunged 10.5 percent to an annual rate of4.76 million units. That was the sharpest decline since July 2010. October's sales pace was revised slightly lower to 5.32 million units.Housing has been providing a sizable boost to U.S. economic growth this year as a strengthening labor market and low interest rates have helped young adults to leave their parents' homes.Economists had forecast sales rising to a rate of 5.35 million units last month.NAR economist Lawrence Yun said most of November's decline was likely due to regulations that came into effect in October aimed at simplifying paperwork for home purchasing. Yun said it appeared lenders and closing companies were being cautious about using the new mandated paperwork.Also potentially weighing on home sales, the median price for a U.S. existing home rose to $220,300 in November, up 6.3 percent from the same month in 2014. Yun said the steep rise in prices and shrinking inventories could also be constraining home purchases.Sales dropped across the country, down 13.9 percent in the West, 6.2 percent in the South, 15.4 percent in the Midwest and 9.2 percent in the Northeast.

More signs of global recession

Yes, the Chines economy seems to be growing at around 3%.

China’s leaders signaled they will take further steps to support growth, including widening the fiscal deficit and stimulating the housing market, to put a floor under the economy’s slowdown.

Monetary policy must be more “flexible” and fiscal policy more “forceful” as leaders create “appropriate monetary conditions for structural reforms,” according to statements released at the end of the government’s Central Economic Work Conference by the official Xinhua News Agency on Monday. It said the fiscal deficit ratio should be raised gradually.

While the leadership also endorsed structural reforms and reining in China’s increasing reliance on credit, the macroeconomic policy statements indicated concern about letting the economy’s expansion slow too much.

And this:

Watch the recession predictions jump.Political Calculations: One week ago, we described the pace of U.S. companies announcing that they would be cutting their cash dividend payments to their shareholders as being between "slow-to-slowing growth and contraction".There's no in-between any more. Over the last week, the pace of dividend cut announcements has ramped up to where they have reached levels that are consistent with economic contraction occurring within the U.S. economy.

Monday, December 21, 2015

How's that currency devaluation coming?

It takes more oil to trade for one of those Chinese iPhones. C on tinuinbg:

Yahoo: The U.S. greenback broke above $1.40 versus the Canadian dollar late last week in the wake of a softer than expected inflation and wholesale salesprints north of the border.

And according to Scotiabank Economist Derek Holt, the timing of the loonie's slump is abysmal as it drains debt-laden households' purchasing power precisely when big-ticket purchases like homes and autos are running at all-time highs. And the higher they are, the farther they could potentially fall.

"The currency's plunge couldn't have happened at a worse time for the country’s household sector," Holt lamented in a note published on Friday. "When a currency declines as CAD has alongside a deep negative terms of trade shock, it is among the mechanisms through which markets price a large wealth transfer out of the country to the regions of the world that are large net importers of commodities."

Import compression has occurred, Holt acknowledged, with real volumes shrinking in back-to-back quarters, but import substitution - making goods or services domestically that were previously produced by foreigners—might not be in the cards. "Canada doesn’t produce at home many of the consumer goodies that are desired especially on the bigger ticket side of the equation," he wrote. "It is also unlikely to start doing so."But Krugman proved that trade is complementary, so we are not surprised at the Canadian hardship. Krugman also says currency devaluations are less painful than internal devaluations. The effect is the same, the difference is that a currency devaluation does not include a bunch of corrupt politicians engaging in special interest protections.

California is not ready for the recession

Flash: California Issues $9 Billion in Debt

Did you know that California just issued $9 billion in debt? There wasn’t a press release— in fact, the announcement was buried on page seven of a report quietly posted on a website — even though this debt is larger than 95% of California’s outstanding General Obligation Bonds.

This debt takes the form of one year’s increase in unfunded pension obligations to employees of the state’s K-12 system. Last year those liabilities were $58 billion. Now they’re $67 billion. The $9 billion addition is as real as any other debt. Arguably it’s more real because, as the Stockton decisiondemonstrated, bankruptcy courts are more likely to cut bond obligations than pension obligations.

As the Chicago Public School crisis illustrates, unfunded pension obligations harm schoolchildren. This is the phenomenon French economist Thomas Piketty warns about when describing debt as “devouring” the future. Including interest, this $9 billion debt will devour more than $20 billion that would otherwise benefit schoolchildren. Looked at another way, just one year’s interest on this debt is almost as large as the expected growth in state support for education in the current budget year.

Stay tuned. More debt will be quietly issued in January when the state reports the growth in other pension obligations. In the meantime, ask yourself how such debts get created without voter approval and why the creditors who will pocket the $20 billion are allowed to finance the elections of legislators who create those obligations.

And this:

Dan Waters: When Jerry Brown returned to the governorship in 2011, he pledged to clean up the state’s finances and pay off a “wall of debt.”

Brown defined the debt rather narrowly, however, as $33 billion borrowed from banks, special funds and school aid to cover budget deficits during the Great Recession.

One of the debts that Brown omitted was the $10 billion that California borrowed from the federal government to keep unemployment checks flowing to jobless workers.

The state’s Unemployment Insurance Fund, or UIF, became insolvent in 2009 and California, like some other states, sought relief from Washington.

Recovery from that recession has been underway for nearly a half-decade, but California still has more than a million unemployed workers and is still paying out about $6 billion a year in benefits to a third of them.

The UIF is still insolvent – nearly $7 billion in the hole – and in 2012 the feds began whittling down California’s debt by raising taxes on the state’s employers, about $3 billion so far and rising, plus hundreds of millions in interest.

Then we had the 3% hit to local budgets as pension returns slowed. And now, as Obamaare kicks in, a recession will raise the Medical enrollment and put more burden on the fed and state tax system. The Kanosians have simply made the business cycle more extreme. We may not have a mild recession, the spiral has been made worse, not better.

Hillary is a dingbat

WSJ: The crossfire between the two leading presidential candidates intensified Monday, as Democrat Hillary Clinton’s campaign stood by her claim that Republican front-runner Donald Trump’s rhetoric is being used as propaganda by terrorist groups, though there is no evidence Islamic State has put him in videos.Mrs. Clinton said in Saturday’s Democratic debate that Mr. Trump “is becoming ISIS’s best recruiter,” and that he was being used in videos. Mr. Trump angrily denied the former secretary of state’s charge and demanded an apology from her. The Clinton campaign refused to provide one, pointing to comments from several counterterrorism experts and social media posts by terror groups to support the claims.The spat across party lines represents a new phase in the presidential campaign for Mrs. Clinton, who has begun to sharpen her attacks on her Republican rivals, with Mr. Trump emerging as a top target.Mrs. Clinton and her Democratic challengers mentioned Mr. Trump nine times in their Saturday debate—a sign of how he has come to dominate the political conversation on both sides of the aisle.

This is her dingbat foreign policy again, treat the enemy with clinical psychology and they will fall in line. Love them Hillary says. Her nanny foreign policy made matters much worse in the Middle East. She and Kerry also screwed up the Ukrainian thing. Kerry, nothing but a dufas with a pompadour.

Hillary is a dingbat

Here we have the failure of Hillary's nanny foreign policy, and Obama just b eleiv ing her crap as if institutional decrees are reality. Hillary got snookered and stiffed.

Seymour Hersh: Barack Obama’s repeated insistence that Bashar al-Assad must leave office – and that there are ‘moderate’ rebel groups in Syria capable of defeating him – has in recent years provoked quiet dissent, and even overt opposition, among some of the most senior officers on the Pentagon’s Joint Staff. Their criticism has focused on what they see as the administration’s fixation on Assad’s primary ally, Vladimir Putin. In their view, Obama is captive to Cold War thinking about Russia and China, and hasn’t adjusted his stance on Syria to the fact both countries share Washington’s anxiety about the spread of terrorism in and beyond Syria; like Washington, they believe that Islamic State must be stopped.The military’s resistance dates back to the summer of 2013, when a highly classified assessment, put together by the Defense Intelligence Agency (DIA) and the Joint Chiefs of Staff, then led by General Martin Dempsey, forecast that the fall of the Assad regime would lead to chaos and, potentially, to Syria’s takeover by jihadi extremists, much as was then happening in Libya. A former senior adviser to the Joint Chiefs told me that the document was an ‘all-source’ appraisal, drawing on information from signals, satellite and human intelligence, and took a dim view of the Obama administration’s insistence on continuing to finance and arm the so-called moderate rebel groups. By then, the CIA had been conspiring for more than a year with allies in the UK, Saudi Arabia and Qatar to ship guns and goods – to be used for the overthrow of Assad – from Libya, via Turkey, into Syria. The new intelligence estimate singled out Turkey as a major impediment to Obama’s Syria policy. The document showed, the adviser said, ‘that what was started as a covert US programme to arm and support the moderate rebels fighting Assad had been co-opted by Turkey, and had morphed into an across-the-board technical, arms and logistical programme for all of the opposition, including Jabhat al-Nusra and Islamic State. The so-called moderates had evaporated and the Free Syrian Army was a rump group stationed at an airbase in Turkey.’ The assessment was bleak: there was no viable ‘moderate’ opposition to Assad, and the US was arming extremists.

We might be forced to endure four years of dingbat because of some stupid affirmative action rule in the Kanosian Party.

The Fed did not raise rates

The Fed simply implementing an accounting trick that moves some GSE income through the member bank accounts. It was an internal accounting shift. Remember two things. 1) The effective funds rate is based on an isolated, fund determined by government regulation of the GSEs. 2) Treasury gets the interest income from the GSEs no matter what, Congress owns the GSEs. So what is lost in reduced remits to Treasury is returned in additional interest income from the GSE.

What is the future of this illusion?

Congress has additional options for spinning off the GSEs, a good thing. The Fed is promising to reconnect regulated funds to the market, and that makes spin-off more viable. This is an easing, an expansion of the Fed banking network, a gain in efficiency and thus lower transaction costs.

What is the future of this illusion?

Congress has additional options for spinning off the GSEs, a good thing. The Fed is promising to reconnect regulated funds to the market, and that makes spin-off more viable. This is an easing, an expansion of the Fed banking network, a gain in efficiency and thus lower transaction costs.

Sunday, December 20, 2015

Tim is a bit cluelerss

Let's help Tim a bit. The key information is encrypted from everyone, including whoever owns your telephones. Thr idea is to make information act exactly like a five dollar bill. The device will emulate the five, duplicate the engraving and paper, and will automatically add and subtract correctly with other like devices. No human can tamper with these devices, not even some bonehead CEO fro a fruit company. Not can any human use the internal encryption for any purpose other than hones transactions. So, Tim, take your telephones and your government out of the picture, this is st6rictly between us and the mathematicians.Business Insider: "I don’t believe that the tradeoff here is privacy versus national security," Cook said during an interview on "60 Minutes"."We’re America. We should have both."People are using their iPhones to store private sensitive information, like their health and finances. Even conversations with friends or confidential business secrets should be able to be stored securely on an iPhone, Cook believes."You should have the ability to protect it. And the only way we know how to do that is to encrypt," Cook said.

Unemployment by state

How can we compare state unemployment?

Check out the first 15, all of them cold. Small, cold plains states have to count inventory very accurately, including labor. Unemployed are ice cubes.

Check out 15 bottom, dominated by California. Nevada, Oregon and Arizona; even New Mexico,are part of the California economy. So wherever California sits in the list, it brings three other states along with.

Along the California coast, camping is not that painful, and unemployment lasts longer.

The North East has been losing population,mostly those without jobs.

Then Florida specializes in entitlements, they are strongly influenced by the baby boomer demographics.

How to sort out state comparisons?

Find the mutual entropy map between them so as to identify regional economic trends are encoded in the economy. From there try to work with region to region differences.

Check out the first 15, all of them cold. Small, cold plains states have to count inventory very accurately, including labor. Unemployed are ice cubes.

Check out 15 bottom, dominated by California. Nevada, Oregon and Arizona; even New Mexico,are part of the California economy. So wherever California sits in the list, it brings three other states along with.

Along the California coast, camping is not that painful, and unemployment lasts longer.

The North East has been losing population,mostly those without jobs.

Then Florida specializes in entitlements, they are strongly influenced by the baby boomer demographics.

How to sort out state comparisons?

Find the mutual entropy map between them so as to identify regional economic trends are encoded in the economy. From there try to work with region to region differences.

| Unemployment Rates for States Monthly Rankings Seasonally Adjusted Nov. 2015p | ||

|---|---|---|

| Rank | State | Rate |

| 1 | NORTH DAKOTA | 2.7 |

| 2 | NEBRASKA | 2.9 |

| 3 | SOUTH DAKOTA | 3.0 |

| 4 | HAWAII | 3.2 |

| 4 | NEW HAMPSHIRE | 3.2 |

| 6 | IOWA | 3.4 |

| 7 | MINNESOTA | 3.5 |

| 7 | UTAH | 3.5 |

| 9 | COLORADO | 3.6 |

| 10 | VERMONT | 3.7 |

| 11 | IDAHO | 3.9 |

| 12 | KANSAS | 4.0 |

| 12 | MONTANA | 4.0 |

| 14 | MAINE | 4.1 |

| 14 | WYOMING | 4.1 |

| 16 | OKLAHOMA | 4.2 |

| 16 | VIRGINIA | 4.2 |

| 16 | WISCONSIN | 4.2 |

| 19 | INDIANA | 4.4 |

| 20 | OHIO | 4.5 |

| 21 | TEXAS | 4.6 |

| 22 | MASSACHUSETTS | 4.7 |

| 22 | MISSOURI | 4.7 |

| 24 | NEW YORK | 4.8 |

| 25 | KENTUCKY | 4.9 |

| 26 | ARKANSAS | 5.0 |

| 26 | FLORIDA | 5.0 |

| 26 | PENNSYLVANIA | 5.0 |

| 29 | CONNECTICUT | 5.1 |

| 29 | DELAWARE | 5.1 |

| 29 | MICHIGAN | 5.1 |

| 32 | MARYLAND | 5.2 |

| 32 | RHODE ISLAND | 5.2 |

| 34 | NEW JERSEY | 5.3 |

| 34 | WASHINGTON | 5.3 |

| 36 | SOUTH CAROLINA | 5.5 |

| 37 | GEORGIA | 5.6 |

| 37 | TENNESSEE | 5.6 |

| 39 | CALIFORNIA | 5.7 |

| 39 | ILLINOIS | 5.7 |

| 39 | NORTH CAROLINA | 5.7 |

| 39 | OREGON | 5.7 |

| 43 | ALABAMA | 6.0 |

| 43 | ARIZONA | 6.0 |

| 43 | MISSISSIPPI | 6.0 |

| 46 | LOUISIANA | 6.3 |

| 47 | ALASKA | 6.4 |

| 48 | NEVADA | 6.5 |

| 48 | WEST VIRGINIA | 6.5 |

| 50 | DISTRICT OF COLUMBIA | 6.6 |

| 51 | NEW MEXICO | 6.8 |

Subscribe to:

Comments (Atom)