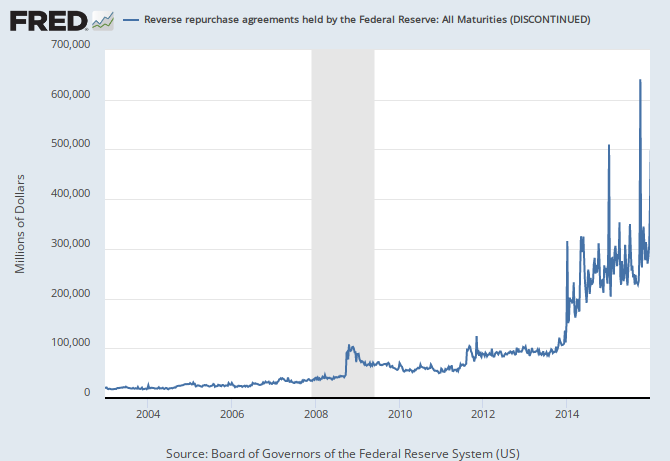

It is the volatility of this time series. These are the deposits of the regulated lenders. This volatility is mostly a quantity constraint imposed quarterly and yearly. So the lenders need a yield that covers this volatility. Once that yield is discovered, the it is converted into price, an elasticity is calculated.

Bankers do this stuff, find important activity not monetized and go on a price discovery. But, today, most of our discovery is about the costs of idiocy in the Swamp.

At some interest rate, the short term yield and asset yield will match the term premium currently standard. At that point, the GSEs are really solvent, as solvent as anything else. But what is that yield? They have a mandated liquid balance. The term and rate on that mandated balance had to fit other equivalent fund performance. For example, the GSEs should earn the one year treasury rate, and hold their buffer for that long. That rate is .63, and the current effective funds rate is .37. Regulations need not demand overnight liquidity rates.

The big fear

The fundamental fear in the asset markets is that the cost of regulation will be unsustainable deflation, bankruptcy. The Fed cannot round the loop anymore, the loop collapses.

No comments:

Post a Comment