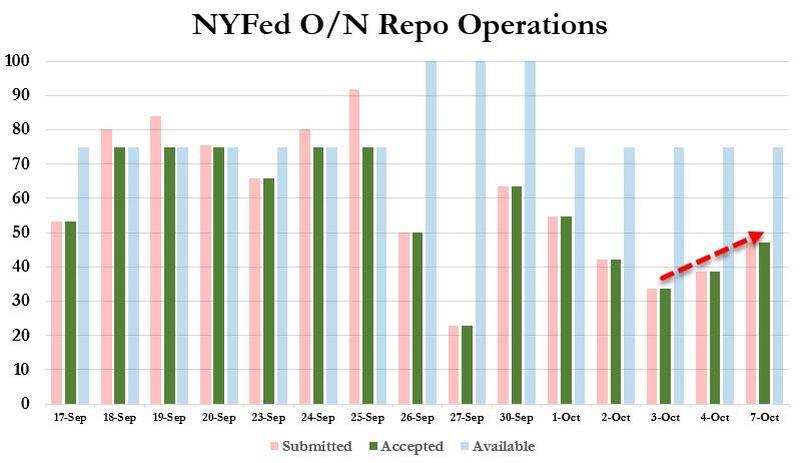

If this was the main job of the Fed, then these operations seem almost normal. The variation along the contracted target, in this case, looks like 40 billion. That is less than a half point bound on market risk. We would like to reduce that to a quarter point in the New Fed. It is a small goal, low bar,a 'This time is slightly better, by one Moore's upgrade, than last time'

But this is not a pure currency banker, but a central banker. It will not be at this equilibrium all the time, it has duties in the primary dealer system.

Uncertainty budget in the New Fed. Bit error is about a quarter point, then a rank four balanced rqueue epo channel supports a 4% price variation. That would be a 2.5% variation, matching the default trend, and the map. A 7% nominal change in NGDP is out of range, causes a non-adiabatic requant. Otherwise we can just sustain occasional bursts to 5%.

No comments:

Post a Comment