The House is a binomial diistribution. The most common number of voters per rep is about 800 plus or minus 100. In the senate, 10 senators represent 50 percent of the voters.

What do the other 90 senators and their 45 states do about federal government programs. They accept cash or earmarks. The Constituion is built to be as inefficient as the states are skewed in population. A hard boundary. Distributing cash on House boundaries is very fair, but loses economies of scale.

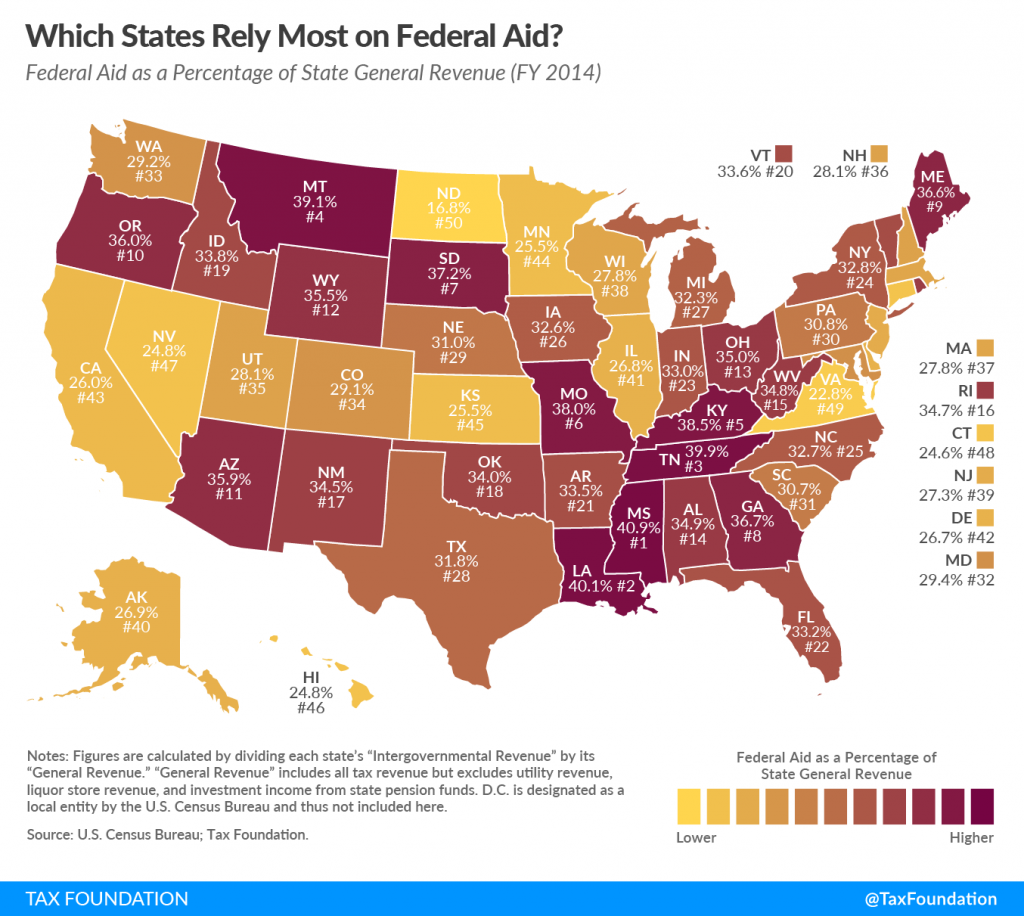

State governments also receive a significant amount of assistance from the federal government in the form of federal grants-in-aid. Federal aid is given to states for Medicaid, transportation, education, and other means-tested entitlement programs administered by the states.

The interesting part of the graph is the variation, about 10 percent. Some 65% of federal taxes never return, except by earmarks and federal purchase. Some 15% is used to pay debt charges, some 15% or so goes over seas in freign policy. And about 15% in entilements. So there is a 20% residual subject to earmarks special interests and the like.

So take 20% of Federal spending is endogenous to the needs of federal government but subject to inefficieny of the senate/house. How inefficient? Well how inefficient is the map above? There is about a 30% variation, and I doubt earmarks are less variant. So the residual federal spending is likely to suffer a 30% inefficiency due to earmarks, about 6% total losses in government endogenous purchase.

6% of the federal budget is wasted due to earmark, so how about just give 5% of the federal budget to states capitals, maybe 3-5 billion per state capital, subject to better efficiency? Giving money to state capitals means some of the payment swapping can be reduced, and the map above becomes more efficient, a multiplier effect.

No comments:

Post a Comment