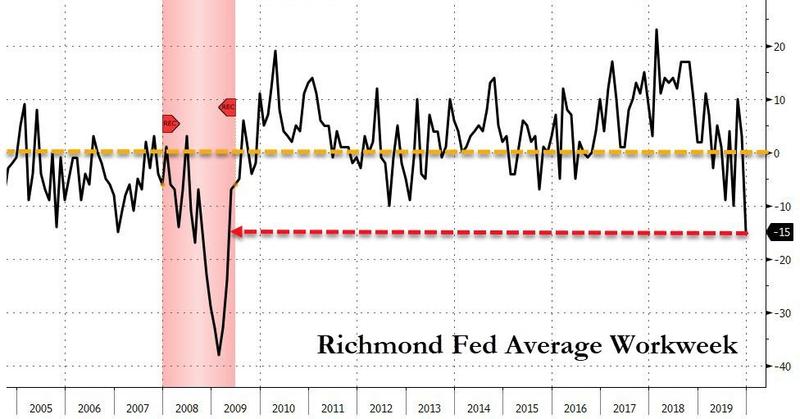

Note the red dotted line, it seems to identify a negative peak. This is a Richmond Fed economic survey result. Zero hedge is the Baumol process in action, finding the complete sequence, then take advantage of the new commutative property. It is about sorting and grouping the evens in between, resetting the portfolio for the next repeat. In sandbox terms that is encoding, and is seen as a distribution of investment cash through an optimally matching generator, a structured queue for investment flows.

Zero Hedge is in the deja vu business, always teasing us with the old 'I told you so'. Hence the sarcastic humor when they miss. Great fun and informative, they are a forensic accounting blog.

No comments:

Post a Comment