Some bot is running the yield curve for a coin. Call it the top bot, and it has member bots and a posted liquidity risk. When the risk is exceeded, top bot pays and collects the bets for member bots. Its the encode/decode process.

Paying bets for member bots is as easy as adjusting their savings to loans values, maintaining conservation of coin. Banker bot just plays a fair numbers game.

If you worry deposits, then banker bot will flash the red/yellow/green lights to warn you.

Friday, July 31, 2015

How do the bubbles know the best move?

The bubbles want to organize as unique sets but they are going to leave some bubbles stranded. When we say the best they can do is stable poison surfaces, that is an input. We find out bounds on the compression ratio:

t = s^3/c^3+(1/2)* s/c^3; with tanh,cosh, and sinh; or a close proximity.

These are bubles left over when a balanced bipartite graph is found. Its a probability distribution, Skellam; and layer in the count of duplicates whihc have conservation of bubble requirements.

So the ratio equation tells s how these buble encode and decode. The c bubble take a dare step, an s bubble takes the bait, the c bubble sneak in two ore steps, then the s buble take two steps and the mess stops. So thed tanh differential equation just puts bounds on the allocation of steps, or moves in the game. The Skellam distribution is the distribution of bipartite graphs, I think, Peters holy grail.

Its a two gteam game, bosons vs fermions. Fermions move to contain cold positions, bosons move to contain hot positions. That Skellam distribution is the Shannon cost of stable adaption.

t = s^3/c^3+(1/2)* s/c^3; with tanh,cosh, and sinh; or a close proximity.

These are bubles left over when a balanced bipartite graph is found. Its a probability distribution, Skellam; and layer in the count of duplicates whihc have conservation of bubble requirements.

So the ratio equation tells s how these buble encode and decode. The c bubble take a dare step, an s bubble takes the bait, the c bubble sneak in two ore steps, then the s buble take two steps and the mess stops. So thed tanh differential equation just puts bounds on the allocation of steps, or moves in the game. The Skellam distribution is the distribution of bipartite graphs, I think, Peters holy grail.

Its a two gteam game, bosons vs fermions. Fermions move to contain cold positions, bosons move to contain hot positions. That Skellam distribution is the Shannon cost of stable adaption.

Tuesday, July 28, 2015

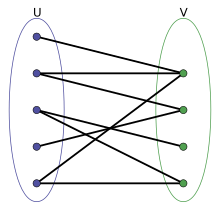

Bipartite graphs

Peter turn us on to them. The nodes have two colors and only connect to opposite colored nodes.

One color has more nodes, the other less; so we have a compression expansion, two sets of statistics. Stack bipartites and you impose connectivity requirements between layers.

The theory of everything says elasticity adjusts to make self adapting statistics. The compression ratios up or down, can be set to some quant that meets a 'settable' Gibbs state, the elements are rational and finite.

An information metrics can find the Hamming like bounds between layers. Bipartitie matters because somewhere, I hope, is a theory that multi-colored sets can be decomposed to two colored, within some precision.

The Skellam distribution is the distribution of duplicate school girls in those links. The idea of the Hurwitz theorem is to add separate quantum numbers as each Lagrange numbers go up. So the silver ratio can pack more duplicate school girls in those links nodes. The more duplicates packed, the more accurate. But the compression ratio, the number of red to blue nodes, goes up.

I think the idea is that a small compression ratio packs the packslinks nodes with one or two modes, then those duplicates will not interfere when these graphs are combined in two or more modes (seen as links). A mode is a prime factor in the Poisson arrival rate. That makes those bizarre atomic probability maps.

So what is going on is that the proof that a multi-colored bipartite can be split into a hierarchy of two colors. I think that proof is also the method of the self adapting statistics use to maintain equipartition. There in lies the relationship between queueing, Hurwitz, and information metrics. A two color graph has a Gibbs state determined by the queues on the connecting links. In that state there is no graph re-configuration that queues up more duplicates.

Something like that.

One color has more nodes, the other less; so we have a compression expansion, two sets of statistics. Stack bipartites and you impose connectivity requirements between layers.

The theory of everything says elasticity adjusts to make self adapting statistics. The compression ratios up or down, can be set to some quant that meets a 'settable' Gibbs state, the elements are rational and finite.

An information metrics can find the Hamming like bounds between layers. Bipartitie matters because somewhere, I hope, is a theory that multi-colored sets can be decomposed to two colored, within some precision.

The Skellam distribution is the distribution of duplicate school girls in those links. The idea of the Hurwitz theorem is to add separate quantum numbers as each Lagrange numbers go up. So the silver ratio can pack more duplicate school girls in those

I think the idea is that a small compression ratio packs the packs

So what is going on is that the proof that a multi-colored bipartite can be split into a hierarchy of two colors. I think that proof is also the method of the self adapting statistics use to maintain equipartition. There in lies the relationship between queueing, Hurwitz, and information metrics. A two color graph has a Gibbs state determined by the queues on the connecting links. In that state there is no graph re-configuration that queues up more duplicates.

Something like that.

Dead coins and bot security

The bot relies on a chain of hardware keys, in the cards. Of the entire collection of hardware paths, the vast majority of them are noise, on the chip. Higher security cards cover more of the decode graphs but have frequent key updates. Consumer card are lower security and less frequent updates. (These patents are property of the Bot Company. In fact they are part of the McKellar spin theorem, and Dannica is the bot VP marketing).

Eventually the consumer will leave some dead encrypted coin somewhere on the web, and soon it is undecipherable, because of security. That is not quite like cash. Long buried cash can be rediscovered, dead coin cannot. But, bankers offer a search service to look for and return your dead cash to your bot. What is at stake is, honest bot to bot exchange the new world.

The bot can handle dead cash in the yield curve for any coin, so it may remain a rate zero number on the curve, almost like digital trash. The bot can take gains from that, over time, end eventually empty the trash, because the bot knows the probability distribution of hardware code updates.

Eventually the consumer will leave some dead encrypted coin somewhere on the web, and soon it is undecipherable, because of security. That is not quite like cash. Long buried cash can be rediscovered, dead coin cannot. But, bankers offer a search service to look for and return your dead cash to your bot. What is at stake is, honest bot to bot exchange the new world.

The bot can handle dead cash in the yield curve for any coin, so it may remain a rate zero number on the curve, almost like digital trash. The bot can take gains from that, over time, end eventually empty the trash, because the bot knows the probability distribution of hardware code updates.

The Bot vs Stripe

Business Insider: Stripe sets itself apart from other payments services by being the programmer-friendly backend "plumbing" that enables apps and online stores to take payments from anybody, anywhere.No, the server is taking payments, the app is doing the client side.

What is banker bot?

Banker bot is a hardware block chained, tamper proof, encrypted, peer to peer, honest digit exchanger. It is exactly cash, instant cash, and more, it is exactly cash exchanged anywhere; secure and counterfeit proof. It is valuable because bots never defraud bots.

Then the kids at our bot universities made a maximum likelihood estimator, and it is in your smart card, always estimating on your behalf. The bot is cash plus the singularity. The bot is theory of everything.

The banker coin must be worth a few billion dollars!

Mish would say: It never needed pilots

Business Insider: The National Transportation Safety Board has finally determined what caused Virgin Galactic's SpaceShipTwo to crash into the Mojave Desert last October.

Pilot error.

Banker bot could fly that thing much better, safer, and have more fun plus lower testing costs enormously. Banker bot can learn to fly, in a simulator, with the human pilot safely on the ground.

Monday, July 27, 2015

Betting the numbers with the bot

betting the numbes assumes the winning number is selected at random, so its a useless bat in that it does not collect insider information. But it is simply a matter of collecting bets and building a Huffman encoder/decoder based on probability. The difference being that the precision of the code if fixed to, say 256 number. When all the bets are in, then a number is selected and decoded. As it descends the decoding tree, losing branches pay up and the winning branches collect. The decode can have fewer bits than the encode, allowing winnings to be shared among a descending branch not taken. Finite precision Huffman coding is a good invention, a good place to start.

Now change the selected number to something like the next GDP NowCast value. Now the encoding and decoding graphs are shaped to accommodate the NowCast belief function, the betting collects inside information.

Now change the selected number to something like the next GDP NowCast value. Now the encoding and decoding graphs are shaped to accommodate the NowCast belief function, the betting collects inside information.

The Banker Bot market is growing

Business Insider: LONDON (Reuters) - One of the founders of trading venue Chi-X Europe is joining the race to bring "blockchain" technology, the system that tracks and identifies transactions in digital-currency bitcoin, to the wider financial world.

The objective is to allow people to transfer cash or make payments instantaneously without a bank or clearing party being involved, saving on transaction costs.

A venture called SETL, led by former Chi-X head Peter Randall and hedge-fund investor Anthony Culligan, said on Monday its blockchain-inspired technology would simultaneously transact real-world currencies or assets and provide a "golden record" of the trade, which takes days on some financial markets.

There we go, peer to peer exchanges between smart cards. Security, in this case, is in the block chain code. All transactions are captured in a block chain, and remembered. If you try and spend the money twice then something blocks you, what? Eventually get caught.

SETL's network would work in the same way as the bitcoin blockchain, generated from each participant's server. The ledger of transactions would be stored on these servers, with encryption, but regulators or auditors would be given access to identify the parties involved.SETL is the name of the company. But they still rely ultimately on server verification and clearing houses.

SETL is not alone. Firms across the finance and technology space have been ramping up efforts to tap the potential of blockchain in overhauling the payment and settlement of financial assets, which currently use central authorities and clearing-houses to track and guarantee transactions.

International Business Machines Corp has been in informal talks about a blockchain-tied cash system with a number of central banks, Reuters reported earlier this year, while Nasdaq OMX last month announced a partnership with blockchain infrastructure provider Chain.

Block chain has nice properties, it part of the Banker Bot protocol set. But if we have hardware keys, we have essentially block chained the hardware itself, the smart card is hardware tied to a specific security level, and the block chains graphs can actually overlap, putting our smart cards into more than one hardware chain; each hardware chain tamper proof, and all bots verify bot to bot exchanges at the hardware level. One solution to solve them all.. Dannica, our VP of Marketing has this problem solve.

Peter's paper goes path searching

It is about how many characters i a code word need to be changed to get some other code word of the same size. That is called the Hamming distance. If the allowed Hamming distance is bound, or some Hamming distance dis-allowed, then the trick is to find a partition of code words, by Hamming distance.

In our bot, this means the number of ways in which a bet remains, in the money. So Peter is going to use random graph selection with dependencies, he is looking for the lengths of paths through an encoder and decoder. That is our bot, traversing probability graphs to find the best spot to bet, on our behalf with hones and fairly measured probability graphs.

This is why Peter is the VP software in the bot company and owns 1/12 of banker coins. And this is why CurrencC should join the bot company.

But, anyway, this is where I like the idea of queueing on a graph. The partition of sets is a set of queues on the directed graph. The nodes are the probable outcomes in which the excluded sets have some adaptive variance, elasticity of set interaction is matched, and accumulation up the graph obeys an information metric rule, that guarantees the equipartition. The partition sizes being represented in the finite Skellam distribution. Because elasticity is adjusted, we get a bubble overlap mechanism, the excluded sets are squeezed out of the graph. So the graph, going up, sorts the sets by hamming distance. he number of sorts decreasing going up until a node is balanced; that is encode. Decode is the fermion graph, selecting the most probable source code words, going down the graph. But fermion queues are shorter, going down, then boson queues are going up. So, change the Elasticity ratio in : C^2-S^2 = Elasticity, elasticity rational. This is the effect of squeexing the hyperbolic angle, but the Skellam variance changes as set size increases, as does the information metric. In the match, we get various combination of school girls sizes. But they are hierarchical, as in the Hurwitz. Irrational number theorem. Set the elasticity to the first Lagrange, get a set of queues, thenrecombine decompose those queues with the second Lagrange. I think. But the solution is there, that is the link to number theory.

I think, but I will think better after finishing the paper.

In our bot, this means the number of ways in which a bet remains, in the money. So Peter is going to use random graph selection with dependencies, he is looking for the lengths of paths through an encoder and decoder. That is our bot, traversing probability graphs to find the best spot to bet, on our behalf with hones and fairly measured probability graphs.

This is why Peter is the VP software in the bot company and owns 1/12 of banker coins. And this is why CurrencC should join the bot company.

But, anyway, this is where I like the idea of queueing on a graph. The partition of sets is a set of queues on the directed graph. The nodes are the probable outcomes in which the excluded sets have some adaptive variance, elasticity of set interaction is matched, and accumulation up the graph obeys an information metric rule, that guarantees the equipartition. The partition sizes being represented in the finite Skellam distribution. Because elasticity is adjusted, we get a bubble overlap mechanism, the excluded sets are squeezed out of the graph. So the graph, going up, sorts the sets by hamming distance. he number of sorts decreasing going up until a node is balanced; that is encode. Decode is the fermion graph, selecting the most probable source code words, going down the graph. But fermion queues are shorter, going down, then boson queues are going up. So, change the Elasticity ratio in : C^2-S^2 = Elasticity, elasticity rational. This is the effect of squeexing the hyperbolic angle, but the Skellam variance changes as set size increases, as does the information metric. In the match, we get various combination of school girls sizes. But they are hierarchical, as in the Hurwitz. Irrational number theorem. Set the elasticity to the first Lagrange, get a set of queues, then

I think, but I will think better after finishing the paper.

California's world wide health care buisiness is booming

Cal Watch: Although California officials insisted that expanding Medi-Cal coverage has been an economic boon, critics and Sacramento Republicans warned that the program’s staggering growth has created a costly, nettlesome problem for a state already strapped with challenges.

The Golden State has seen more than triple the expected enrollment under the Obamacare-authorized expansion of Medicaid, a surge of over 2 million. “Beyond that,” the Associated Press reported, “a record number of people who already qualified for the low-income health program signed up, pushing overall enrollment in the state’s Medicaid program known as Medi-Cal past 12 million to roughly 1 in 3 Californians.”The boom has kicked costs up by nearly $24 billion. And though the federal government has picked up a big chunk of the additional tab, tax increases have already been put on the table. “California will see costs continue to grow as the federal government reduces its matching rate,” California Healthline cautioned.The cost struggle

While legislators have crunched the numbers, regulators have labored to understand just how poorly the new health care regime matches up with the demand it has created. In an effort to control costs, California “has relied heavily on managed care insurance companies,” the San Francisco Chronicle noted in a report on the state’s struggles to come with Medi-Cal demand. Under the current approach, California “pays insurers a fixed amount per patient and expects the companies to provide access to doctors and comprehensive care, rather than paying for each medical visit or procedure under a fee-for-service model.”

Well, good thing the Swamp is paying us the $24 billion, or make the $240 billion nationwide. The Swamp is facing a run of inflated prices on its Obamacare payouts, taxes won't keep up. Its election time and which politician is going to allow another 20% increase in debt/GDP ratio? The Swamp is getting a quick slowdown on tax collections soon.

Smart Card to Smart Phone interface

Most people use a wet wad of bubble gum on the back of their smart phones. The smart card attaches right on. The smart card appears like a restricted memory to the smart phone. You can change the smart card balances, but you will need to tap in your personal tap code, thus the exchange is always bot to bot, it will tunnel through the smart phone.

So the smart phone is useful, but the owner can also tap his card on the home PC, or tap the wall where smart vault is buried.

So the smart phone is useful, but the owner can also tap his card on the home PC, or tap the wall where smart vault is buried.

You don't scare me Peter Keevash

Abstract: We give a new proof of the Frankl-Rodl theorem on forbidden intersections, via the probabilistic method of dependent random choice. Our method extends to codes with forbidden distances, where over large alphabets our bound is significantly better than that obtained by Frankl and Rodl. We also apply our bound to a question of Ellis on sets of permutations with forbidden distances, and to establish a weak form of a conjecture of Alon, Shpilka and Umans on sun flowers.This is Peter's work, along with Long, co author. We learn about sets of school girls who, each in set pairs, exclude one unique set. Peter gets a better bound on the number of sets in this family of sets. This is going to be fun. Its like asking how much net do I need to catch roller coaster passengers being flung.

Schoolgirls, they are everywhere these days. Now, as we read this and have fun, Banker Coin goes up in value (Peter owns 1/12 of the coin). Peter makes us much more comfortable about banker bot.

Peter's Plot:

The bot is weaving a web of safety nets along our journey's path. So, our smart card light goes yellow when we make a lousy bet on the number of school girls. Thus our SmartCards are more fun, and trustable. We are going to have fun.

How would I do this?

A queuing problem on a finite graph, without loops. I know that local node properties have to obey this l-avoiding problem. So I have a restriction on two colliding Poisson, at stability. I apply the information metric to my Skellam distribution, after hiring a professional mathematician. My information metric gives me a relationship between information efficiency and variance on that Skellam. My solution minimizes the second derivative on that compression ratio between set sizes on my schoolgirls. No I know there is a relationship between equipartition and kinetic energy, so I got self adapted statistics, and I have to find a bounded path for variance on a finite graph.

So, our bot just helps the owner avoid long waits in line. Literally, we will find this to be true. We get that red light, long wait, warning. And, that bot computes with the largest, most accurate and secure collection of information available. Peter's students are going to be gazillionares.

The banker interface:

The bank programmer sees his client as a large set of spreadsheets, just like he does now. Except the banker can write a protocol graph which instructs the smart card to perform spread rebalances in real time as purchases are made. Bankers will literally be in the business of writing central banker rules, specific to their client groups.

Sunday, July 26, 2015

I like the school girls who set rates

Reverend Kirkman: Fifteen young ladies in a school walk out three abreast for seven days in succession: it is required to arrange them daily so that no two shall walk twice abreast.Let's see, the one year rate jumps 30%, now at .32. Higher rate, smaller the number of school girls. Ten year rate drops 10%, more school girls per set. Different index numbers, but they must obey omega set properties across the quant. Matilde, my VP science, and 1/12 owner of the bot, is going to show us how using an information metric. Rates are 1/schoolgirl girl^2, at the term defined by the index.

Home builders plan to build larger groups of houses. Grocery stores planning on smaller groups of shoppers. Look at the Skellam distribution, under the assumption the hyperbolics make Poisson. Grocery shopping make a large reduction in queue size, a narrow Skellam. So the grocer should get its Shannon profit more often. Grocers get liquidity boost in the short term.

Anyway, that my first guess. I like the metaphor of an immediate feed back loop that just sufficiently mixes up a sequence of school girls or a common set size.

How does government handle this?

Well, they are evidently planning to move smaller sets of school girls more often. The betting is that DC fails and we crash.

How will government crash?

California's plan to offer world wide health care will clash with the Swamp's ability to pay the premiums. The gears will jam, almost certainly, on Q1, 2016.

So, yea, this is real and the pros are on the trail. Hi Dannica!

Inflation scare

Bloomberg: Landlords have been preparing to raise rents on single-family homes this year, Bloomberg reported in April. It looks like those plans are already being put into action.This doesn't show up yet on headline CPI? So this must be a sudden price change, an economy killer.

The median rent for a three-bedroom single-family house increased 3.3 percent, to $1,320, during the second quarter, according to data compiled by RentRange and provided to Bloomberg by franchiser Real Property Management. Median rents are up 6.1 percent over the past 12 months. Even that kind of increase would have been welcome in 13 U.S. cities where single-family rents increased by double digits.

here is another clue. The one year Treasury earns .32%, while the ten year is down to 2.27%, the curve is flatter. Why? Its election time and DC doesn't want to pay the term premium, so its relying on the short term debt market to push the bills farther into election season. Remember, Jan 2016, DC gets a huge Obamacare bill. What happens to inflation when the curve flattens? That is the debate ongoing, and now we wait and see.

Saturday, July 25, 2015

How is my VP of Marketing

Dannica, this is the title to one of her books. Now, tell me again that this marketer could not put banker bot in the pockets of hundreds of million?

An excerpt:

So, I claim the bot is the valuable company, and CurrenC should let itself be bought by the bot, for quantities of banker coin. Dannica deserves it for her hard work in the bot company. (I do not own banker coins)

Bot has linked the three math brains, the TOE pros. And their students are having epiphanies about this, and Cal and Oxford kids collaborating, as we speak. So, clearly CurrencyC needs to join the bot.

The joint bot goal is to get something smart, multi-currency, and secure into the hands of 3 million Greeks, ASAP, before the Monotonarian invasion.

One last point. Wal Mart owns 1/15 of banker coin, and they funded CurrenC. So Wal-Mart knows it has these brains and the kids humming along on the singularity. So Wal-Mart wants CurrenC inside the bot company. My team, folks, pick the pros, get the math kids.

An excerpt:

"Math? Are you kidding me?"So, since banker bot owns Dannica, by virtue of her 1/12 ownership, then banker bot can expect that she is going to invent and patent innovate methods to make hardware keys as nets of interlocking fermion spinners. Then she is going to stand in front of the video camera, and explain how wonderful our lives will be with banker bot.

In high school, a teacher once suggested that I be a math major in college. I thought, "Me? You've got to be joking!" I mean, in junior high, I used to come home and cry because I was so afraid of my math homework. Seriously, I was terrified of math.

Things had gotten better for me since then, but still—college math? That sounded really hard; I didn't think I could hack it. Besides, who studies math in college other than people who want to be math teachers, right?

So, I claim the bot is the valuable company, and CurrenC should let itself be bought by the bot, for quantities of banker coin. Dannica deserves it for her hard work in the bot company. (I do not own banker coins)

Bot has linked the three math brains, the TOE pros. And their students are having epiphanies about this, and Cal and Oxford kids collaborating, as we speak. So, clearly CurrencyC needs to join the bot.

The joint bot goal is to get something smart, multi-currency, and secure into the hands of 3 million Greeks, ASAP, before the Monotonarian invasion.

One last point. Wal Mart owns 1/15 of banker coin, and they funded CurrenC. So Wal-Mart knows it has these brains and the kids humming along on the singularity. So Wal-Mart wants CurrenC inside the bot company. My team, folks, pick the pros, get the math kids.

Jerry vs Jerry: round six

Here we have Jerry Brown pragmatist of 2015 going to court against Jerry Brown, idealistic environmentalist:

Well, that Jerry of 1978 is a hard nut to crack.CalWatch: Gov. Jerry Brown suffered another setback in his effort to gain the upper hand over California’s persistent drought. New details on alterations to his massive pumping plan, which would change the way the Delta region distributes the water that flows into it, revealed major changes that have aroused major opposition.In a harsh editorial, the San Francisco Chronicle underscored that the altered scheme “will cost more, provide less water than originally envisioned (but more than pumped south now), restore less than half of the delta habitat than proposed, take longer to build and, most notably, lack the 50-year guarantee of water deliveries that made the old plan attractive.”For that, Brown had federal regulators to blame. Environmental agencies objected that his half-century assurance “would lock in water deliveries without regard to shifting environmental conditions,” the Chronicle reported. Since that fact was inherent to any such promise, Brown had to drop it in order to proceed.

Welcome to our new legal illegal alienships

This is the good side effect of California's new visa program. We offer permanent residency to anyone who can get a mailing address, and it is driving up home prices in Southern California. Will the Chinese buying spree come to a sudden stop? You bet, but we do not mind, we are a spiral state anyway.

I like the new green card program in California, I like Chinese, and Chinese food is my second favorite, next to Mexican.

Así pues, la bienvenida a nuestros vecinos chinos, sólo recuerda, el español es nuestra lengua materna.

Orange County Register: China has hacked our government, devastated or severely challenged our industries and enjoyed one of the greatest wealth transfers in history – from our households to its. China also benefits from by far the largest trade surplus with the United States and also owns 11 percent of our national debt.

Sometimes it seems to be increasingly China’s world, and we just happen to live in it. Some, such as columnist Thomas Friedman and Daniel A. Bell, author of the newly published “The China Model,” even suggest we adjust our political system to more closely resemble that of the Chinese.

Yet, a funny thing has happened on the way to global domination – the Chinese are coming here with their money, and, often, with their families. Rather than seeing China as the land of opportunity, more Chinese have been establishing homes in America, particularly in California, where they account for roughly one-third of foreign homebuyers, with upward of 70 percent paying cash. Overall Chinese investment in U.S. real estate has grown from $50 million in 2000 to $14 billion in 2013, surpassing all other foreign investors.

Dragon on the prowl

Populists and unions have long decried U.S. investment in China as a killer of American jobs, but Chinese investment in the U.S. now exceeds American investment in China. The reasons for this shift are complex and reveal as much about China as about us. The Chinese are coming here for many reasons, including an unaffordable, risky real estate market at home, a growing cost disadvantage in manufacturing due to rising wages, quality-of-life considerations and growing deep-seated fears about potential government confiscations and arrests.

Así pues, la bienvenida a nuestros vecinos chinos, sólo recuerda, el español es nuestra lengua materna.

Aytollahs still pissed abotuu the coup d'etat

USA Today: Iran's supreme leader tweeted a graphic Saturday that appears to depict President Obama holding a gun to his head as Britain relaxed its travel advice to the nation, citing decreased hostility under the Iranian government.This is what pisses him off:

"US president has said he could knock out Iran’s military. We welcome no war, nor do we initiate any war, but.." reads the caption above the tweet sent by Ayatollah Ali Khamenei on @khamenei_ir, his English language account.

The 1953 Iranian coup d'état, known in Iran as the 28 Mordad coup, was the overthrow of the democratically elected Prime Minister of Iran Mohammad Mosaddegh on 19 August 1953, orchestrated by the United Kingdom (under the name "Operation Boot") and the United States (under the name TPAJAX Project).[3][4][5][6]If the Persians were better organized, they could have remained Persians when:

Mossadegh had sought to audit the books of the Anglo-Iranian Oil Company (AIOC), a British corporation (now BP) and to change the terms of the company's access to Iranian petroleum reserves. Upon the refusal of the AIOC to co-operate with the Iranian government, the parliament (Majlis) voted to nationalize the assets of the company and expel their representatives from the country.[7][8][9] Following the coup in 1953, a government under General Fazlollah Zahedi was formed which allowed Mohammad-Rezā Shāh Pahlavi, the Shah of Iran (Persian for an Iranian king),[9] to rule the country more firmly as monarch. He relied heavily on United States support to hold on to power until his own overthrow in February 1979.[7]

The Muslim conquest of Persia, also known as the Arab conquest of Iran[2] led to the end of the Sasanian Empire in 651 and the eventual decline of the Zoroastrian religion in Iran. Arabs first attacked the Sassanid territory in 633, when general Khalid ibn Walid invaded Mesopotamia (what is now Iraq), which was the political and economic center of the Sassanid state.[3] Following the transfer of Khalid to the Byzantine front in the Levant, the Muslims eventually lost their holdings to Iranian counterattacks. The second invasion began in 636 under Saad ibn Abi Waqqas, when a key victory at the Battle of Qadisiyyah led to the permanent end of Sasanian control west of Iran. The Zagros mountains then became a natural barrier and border between the Rashidun Caliphate and the Sassanid Empire. Owing to continuous raids by Persians into the area, Caliph Umar ordered a full invasion of the Sasanian Iranian empire in 642, which was completed with the complete conquest of the Sasanians around 651.a[›] The quick conquest of Iran in a series of well coordinated multi-pronged attacks, directed by Caliph Umar from Medina several thousand miles from the battlefields in Iran, became his greatest triumph, contributing to his reputation as a great military and political strategist.[4]

Iranian historians have sought to defend their forebears by using Arab sources to illustrate that "contrary to the claims of some historians, Iranians, in fact, fought long and hard against the invading Arabs."[5] By 651, most of the urban centers in Iranian lands, with the notable exception of the Caspian provinces and Transoxiana, had come under the domination of the Arab armies.

So, Ayatollahs are just pissed at their own incompetence in 640.

Banker bot is a natural at insider marketing

Business Insider: Native is one of the hottest topics in digital media, and advertisers and publishers are taking notice.Banker bot knows the belief function of your company, and you company automatically appears, in all its glory, as a betting tree on the bot master website. Your company automatically becomes a bot coin, betable and spendable.

By creating advertisements that are in the same format as the content audiences are there to consume, marketers hope to provide a much less disruptive advertising experience. Native ads have also proven effective, drawing higher click rates than traditional banner ads, particularly on mobile devices.

Exclusive data BI Intelligence finds that spending on native ads will reach $7.9 billion this year and grow to $21 billion in 2018,

Friday, July 24, 2015

Does CurrentC scare the bot?

Bloomberg: After almost three years in development, the retail industry’s answer to Apple Pay is finally getting off the ground.Naw, CurrentC is a welcome addition and an advance over Apple Wallet. CurrentC will adopt the Banker Bot methods as soon as the kids from Cal Tech and Oxford have it ready. I would go with CurrenC in the mean time.

A mobile payment application developed by Merchant Customer Exchange -- a company founded in August 2012 with funding from Wal-Mart Stores Inc., Target Corp. and Best Buy Co. -- has been tested by employees of the retailers and will get a limited trial run next month in stores, according to three people familiar with the situation. That means shoppers will soon be able to use the technology, called CurrentC, to pay for items with their phones.

The challenge for CurrentC now is playing catch-up against established apps from Apple Inc., Google Inc. and others, as well as explaining to customers why they should bother using it. When Apple Pay rolled out last year, CurrentC was derided by critics as a lower-tech alternative that retailers supported because it would give them tighter control over shoppers’ transactions.

Thursday, July 23, 2015

Does banker bot care about free banking?

George Selgin is the expert on free banking. He quotes the amateur:

How does bot handle government manipulation?

The bot obtains prices for government regulations, and maintains a fairly measured probability distribution of those prices. Humans affected by regulations can make fair counter bets, and this makes the current regulatory environment somewhat redundant free. the inefficiency is partially removed by controlled side effects. Bots gather inside information about regulatory cost. Banker bot simply tells you the most likely event based on fair probability measures. Its major concern is generating accurate colors on the smart card LED, making its owner much smarter. So it makes no moral judgement about regulations.

Like certain weeds and infectious diseases, some myths about banking seem beyond human powers of eradication.And then goes through a bit of banking history.

I was reminded of this recently by a Facebook correspondent’s reply to my recent post on “Hayek and Free Banking.” “We had free banking in the US from 1830 until 1862,” he wrote. “It didn't work out too well.” “During the Wildcat Era,” he added, “banks were unregulated and failed by the hundreds.”

How does bot handle government manipulation?

The bot obtains prices for government regulations, and maintains a fairly measured probability distribution of those prices. Humans affected by regulations can make fair counter bets, and this makes the current regulatory environment somewhat redundant free. the inefficiency is partially removed by controlled side effects. Bots gather inside information about regulatory cost. Banker bot simply tells you the most likely event based on fair probability measures. Its major concern is generating accurate colors on the smart card LED, making its owner much smarter. So it makes no moral judgement about regulations.

Banker bot does this

Kathleen Elkins talks about the virtues of a cash only diet:

Yahoo: The cash-only diet is as simple as it sounds: You ditch the plastic, determine how much money to withdraw for a certain amount of time, and buy things only with the cash you allocated for yourself.Remember, Smart Card and the bot are cash, cash in its purest form. Smart card comes with the multi-colored warning light for purchases. So, don't worry, run our bot in safe mode, keep the LED yellow or green.

The theory behind using only cash is that you're less likely to make impulse purchases — you'll buy more of what you need and less of what you want — as you have a limited amount of cash set aside in your wallet. In addition to becoming a more conscious spender, you have to cross the barrier of physically handing over your money and watching it disappear."Rather than blindly using your credit card and deferring whether it's worth it or not until your bill comes — by that time, it's too late — using cash forces you to make that decision when you pay," Sethi writes. "You withdraw a limited amount and watch it dwindle. It's very primal: Since we're more motivated by loss than by gain, each dollar you physically spend will cause you pain: the good kind of pain."Sethi is not the only one to advocate the cash-only diet. Research shows that people spend significantly more when using credit cards instead of cash, and some people use this strategy to get out of deep debt.I gave it a whirl for two weeks, heading to the ATM at the start of each week for $125, as I keep my monthly costs under $500 (this excludes rent and utilities). Here's why I'm never going back to my debit- and credit-card days:

Hunting for probability measuring sticks

The bot manages bets on a balanced probability graph. The minimizing of redundancy inevitably defines nodes on the graph as almost stable, almost never needing rebalance. The collective of betting among fair bots result in the creation of virtual coins, centers of a distribution measure, notches on a ruler; identifiable with integer indices.

Bots report to humans and makes these virtual coins bettable. The master bot web page maintains the top 100, 500 and 1,000 of these significant distributions. Smart Card owners can bet them.

Remember, the bot company has purchased the two pros, and their students from the universities. These students have this down, they are brimming with excitement. You will see start ups flourish.

Bots report to humans and makes these virtual coins bettable. The master bot web page maintains the top 100, 500 and 1,000 of these significant distributions. Smart Card owners can bet them.

Remember, the bot company has purchased the two pros, and their students from the universities. These students have this down, they are brimming with excitement. You will see start ups flourish.

The LED and you

That light on your smart card, it goes from red to yellow to green? The sequence of light changes is your center of rotation, it defines your lifetime income hypothesis.

You always need the card to bet so that you, the owner, always knows when the bet is out of variance compared to your personal yield curve. The lights are secret, under your control.

Consider tap betting, the standard smart card betting protocol. You need your card in hand to tap the screen and set the bet coins and amount. You are required to watch the light when betting. You are always betting some probability sequence collected by the bot and your own probability sequence. The optimum bet happens when you learn the most about yourself.

We all have to get these smart cards, ASAP. Should I pester the company management?

You always need the card to bet so that you, the owner, always knows when the bet is out of variance compared to your personal yield curve. The lights are secret, under your control.

Consider tap betting, the standard smart card betting protocol. You need your card in hand to tap the screen and set the bet coins and amount. You are required to watch the light when betting. You are always betting some probability sequence collected by the bot and your own probability sequence. The optimum bet happens when you learn the most about yourself.

We all have to get these smart cards, ASAP. Should I pester the company management?

What does 'redemption of currency' mean to a bot

I never understood the term, but it is going away.

The bot redeems a bet with a fairly measured probability distribution. That means, any owner of the coin can place a volatility weighted bet, and get fair odds. Bots do not cheat bots and are protected from human tampering. Any two fairly measured probability distributions can be bet against each other, and the price converted into a yield curve. Fairly measured currencies always trade.

Any way, George Selgin dealt with some of this in his recent post:

Yet Hayek himself was no free banker.

What makes a precise yield curve? The savings and loan tree of the coin betters. Can you always buy goods with any coin? Sure, why not, the bot will convert prices.

Then what is the need of all the different coins? Because folks can gather groups of traders who have an undiscovered mutual entropy. Put them on a coin, the traders will collapse the redundant trades.

All of this is guaranteed by the brilliant kids from Cal Tech. Smartest brains in the world, they have all this nailed.

The card is the cash

Decompose its basic functions, it exactly mimics cash. Any transaction between bots, regardless of interconnectivity, is always a counterfeit proof delivery of cash. That is why Banker Coin is so valuable, total value should be around 20 million. Banker Coin is pegged to the number of smart card holders who have the complete Cal Tech banker bot, and Oxford programming interface, complete with Tap Magic.

Banker Coin:

So, by all means, for buy banker coin then buy smart card. The coins are split, 1/3 founders of the bot company, 1/5 for partner companies, and 1/7 to buy the Cal Tech and Oxford kids. I do not own banker coin.

Pre-order:

Fell free to pre-order from CardLogix, initial price, $60. No delivery date yet.

How is the security?

Last I heard, our VP Marketing, had it rigged, no human will ever actually see and of the security graphs. And nested, unconnected disguise graphs will be semi random. Security levels aggregate up as the card holder runs every larger transaction rates. Those high level keys use less semi-random and more connected subgroups. They are under lock and key and full security. The banker company owns all property rights to partially partitioned security codes, as used by banker bot.

Spoofs and floods?

The bot don't care, it takes bets in order of arrival and rebalances adiabaticly with the posted liquidity risk.

Can I bet via robo bot?

Bots are tied to smart cards, and smart cards come with a variety of forms, SmartVault for your home, and SmartUnits for running web sites. So, your robo bot must be in the card and plugged into the betting network. Hence your robo bot can take bets on rapid change. But, have no fear, you can buy as many smart cards as you like, they even make one that plugs into the PC, pre-order this, I will try to get the manufacturer's name.

I hear nothing but good reports, I might bump my estimate of Banker Coin value.

The bot redeems a bet with a fairly measured probability distribution. That means, any owner of the coin can place a volatility weighted bet, and get fair odds. Bots do not cheat bots and are protected from human tampering. Any two fairly measured probability distributions can be bet against each other, and the price converted into a yield curve. Fairly measured currencies always trade.

Any way, George Selgin dealt with some of this in his recent post:

Yet Hayek himself was no free banker.

What makes a precise yield curve? The savings and loan tree of the coin betters. Can you always buy goods with any coin? Sure, why not, the bot will convert prices.

Then what is the need of all the different coins? Because folks can gather groups of traders who have an undiscovered mutual entropy. Put them on a coin, the traders will collapse the redundant trades.

All of this is guaranteed by the brilliant kids from Cal Tech. Smartest brains in the world, they have all this nailed.

The card is the cash

Decompose its basic functions, it exactly mimics cash. Any transaction between bots, regardless of interconnectivity, is always a counterfeit proof delivery of cash. That is why Banker Coin is so valuable, total value should be around 20 million. Banker Coin is pegged to the number of smart card holders who have the complete Cal Tech banker bot, and Oxford programming interface, complete with Tap Magic.

Banker Coin:

So, by all means, for buy banker coin then buy smart card. The coins are split, 1/3 founders of the bot company, 1/5 for partner companies, and 1/7 to buy the Cal Tech and Oxford kids. I do not own banker coin.

Pre-order:

Fell free to pre-order from CardLogix, initial price, $60. No delivery date yet.

How is the security?

Last I heard, our VP Marketing, had it rigged, no human will ever actually see and of the security graphs. And nested, unconnected disguise graphs will be semi random. Security levels aggregate up as the card holder runs every larger transaction rates. Those high level keys use less semi-random and more connected subgroups. They are under lock and key and full security. The banker company owns all property rights to partially partitioned security codes, as used by banker bot.

Spoofs and floods?

The bot don't care, it takes bets in order of arrival and rebalances adiabaticly with the posted liquidity risk.

Can I bet via robo bot?

Bots are tied to smart cards, and smart cards come with a variety of forms, SmartVault for your home, and SmartUnits for running web sites. So, your robo bot must be in the card and plugged into the betting network. Hence your robo bot can take bets on rapid change. But, have no fear, you can buy as many smart cards as you like, they even make one that plugs into the PC, pre-order this, I will try to get the manufacturer's name.

I hear nothing but good reports, I might bump my estimate of Banker Coin value.

Wednesday, July 22, 2015

Bill de Blasio: Think first, speak second

RT: Mayor de Blasio made the remarks while speaking on the sidelines of a two-day Vatican conference on climate change and human trafficking. He said the EU must come up with a Europe-wide immigration policy or stop pretending it’s a union.Bill would be less troubled if he would have thought about Texas, then modified his speech to do a better shift and dodge. Now Bill just got Republicans and half of Democrats discovering, again, what hypocrisy sound like.

"As a proud Italian-American, I am deeply troubled by the lack of action by the European Union and the way that Italy has been left to fend for itself very unfairly," said De Blasio in a statement, whose grandparents emigrated from Italy to New York.

For years, Italy has been demanding for the European Union to do more to help with the waves of migrants who board Europe-bound smugglers’ boats from Libya and elsewhere in northern Africa. Italy, along with Greece and Malta, are on the frontlines for new arrivals of peoples from African countries, which puts a huge strain on the three nations’ resources.

The EU has beefed up its Mediterranean rescue operations, but Italian demands that EU nations take in would-be refugees have stalled.

Encoding and decoding of the lifetime income function

Roger Farmer and his self fulfilling hypothesis says our life time function and current exchanges are always reconciled. Self adapted statistics. Our VP of science, Marcolli, says this is the adjustment to the boson probability graph and the fermion probability graphs, tanh and coth in hyperbolic terms. When are spending pattern changes, it is encoded until a node rebalance is needed, then it is decoded. The fermion graph decodes our planned budget.

So should Roger Farmer sit on the board of the banker bot company? Sure, but I have no vote, I do not own Banker Coins. But Roger has a bunch of kids in UCLA who like financial calculus, that is an asset.

So should Roger Farmer sit on the board of the banker bot company? Sure, but I have no vote, I do not own Banker Coins. But Roger has a bunch of kids in UCLA who like financial calculus, that is an asset.

Peter Schiff sells horse manure

PETER SCHIFF: Gold is the only form of money whose value does not require a leap of faith

Banker bot is proven technology and its value requires no leap of faith. It is worth its weight in gold. The Smart Card is harder to counterfeit then a gold bar can be filled with lead. The Smart Card holds value as long as the Smart Card has value, just like gold. My advice is to find those Banker Coins, who has them? These coins are actively invested in secure smart cards with a fully functional banker bot. Find those coins, who has them? buy them their value will grow in value faster than gold.

Tuesday, July 21, 2015

DragnTap

Its beer pong with a electric launch arm. You need your Smart Card, its a drag for power, tap for launch. You bet with a protocol like Tap poker. But the point is, dragging the smart card is not a patentable idea, hear that Tim? Drag, wave, any motion ever done with a standard credit card is prior art. This includes picking teeth, the hat toss, and credit card dominoes, all standard prior art.

Tsipras should buy Smart Cards from CardLogix

He can specify a secure banker bot, just mention this web site. Then order 4 million and put Greek under a distributed banker bot price and accounting system. The Greek people will never be fooled again, the SmardCard flashes red when the price is unlikely. Hardware bot to bot communications makes for honest probability distributions, hence the Greek owner will always get the truth.

What happens to Banker Coin?

Well, last I checked, CardLogix owned 1/15 of those coins, or there abouts. So, by accepting the Greek order, CardLogix causes Banker Coin to jump in value. And of course, that makes Yahoo and Wal-Mart partners; all own equal amounts of Banker Coin.

All these vendors have know the only team set up to deliver the bot on time is the team I selected, and the team collectively owns 1/3 of Banker Bot. They have no choice but to trade or distribute Banker Coin such that the bot lands safely into the card. Since they are the experts, I know this to be true, then the bot will take the fewest steps to the hardware secure SmartCard.

Bankers?

They segment the card owners and write accounting applications that define banker bot features which generate value for the bot owners. But they know they will be writing banker bot script, as defined in these web pages. So, they are going to want a piece of Banker Coin before all hell breaks loose. Hence my team is stuck, they have to create a secure market to buy and sell banker coin, and by definition, that means getting the bot safely into the card.

Would I buy this coin?

Have all these people get in one room and open the bidding, I would buy.

Is my team doing the work?

You bet, Dannica McKellar has been working the hardware security as fermions on a lattice, when blocks of paths may be disconnected sub graphs. This is the partial encode issue where when wants frequent key updates for highly secure cards with high values. So powerful cards know more of the encoding tree for hardware access. Low value consumer cards only know a bit if it, their hardware key is valid for longer. Dannica is just continuing work on the McKellar spin theorem, so any hardware patents belong to her.

Matilde is about finishing her work on matching our fermion savings to our boson spending. She compares information efficiency between the encode path up and decode path.

Peter from Oxford! He has a bunch of Oxford math kids working out graph traversals and interface, especially the patent free tap interface.

All three collaborate on the Theory of Everything, making sure we get a great product.

And the Alternative money team has been holding seminars with bankers, finding and solving their likes and dislikes. Bankers are already working the language of credit flow, their state dependent version of the bot, optimized for our unique budgets.

Wal-Mart techies and running hard at the Tap Shopping game. This is their big app. Their currency is held by anyone doing business with Wal-Mart, inventory volatility is minimized, gains to all maximized.

The Yahoo venture group is working on this deal as we speak.

I am almost sure of of these tasks accomplished. I peg the company value at $20 million.

What happens to Banker Coin?

Well, last I checked, CardLogix owned 1/15 of those coins, or there abouts. So, by accepting the Greek order, CardLogix causes Banker Coin to jump in value. And of course, that makes Yahoo and Wal-Mart partners; all own equal amounts of Banker Coin.

All these vendors have know the only team set up to deliver the bot on time is the team I selected, and the team collectively owns 1/3 of Banker Bot. They have no choice but to trade or distribute Banker Coin such that the bot lands safely into the card. Since they are the experts, I know this to be true, then the bot will take the fewest steps to the hardware secure SmartCard.

Bankers?

They segment the card owners and write accounting applications that define banker bot features which generate value for the bot owners. But they know they will be writing banker bot script, as defined in these web pages. So, they are going to want a piece of Banker Coin before all hell breaks loose. Hence my team is stuck, they have to create a secure market to buy and sell banker coin, and by definition, that means getting the bot safely into the card.

Would I buy this coin?

Have all these people get in one room and open the bidding, I would buy.

Is my team doing the work?

You bet, Dannica McKellar has been working the hardware security as fermions on a lattice, when blocks of paths may be disconnected sub graphs. This is the partial encode issue where when wants frequent key updates for highly secure cards with high values. So powerful cards know more of the encoding tree for hardware access. Low value consumer cards only know a bit if it, their hardware key is valid for longer. Dannica is just continuing work on the McKellar spin theorem, so any hardware patents belong to her.

Matilde is about finishing her work on matching our fermion savings to our boson spending. She compares information efficiency between the encode path up and decode path.

Peter from Oxford! He has a bunch of Oxford math kids working out graph traversals and interface, especially the patent free tap interface.

All three collaborate on the Theory of Everything, making sure we get a great product.

And the Alternative money team has been holding seminars with bankers, finding and solving their likes and dislikes. Bankers are already working the language of credit flow, their state dependent version of the bot, optimized for our unique budgets.

Wal-Mart techies and running hard at the Tap Shopping game. This is their big app. Their currency is held by anyone doing business with Wal-Mart, inventory volatility is minimized, gains to all maximized.

The Yahoo venture group is working on this deal as we speak.

I am almost sure of of these tasks accomplished. I peg the company value at $20 million.

Are software managers this stupid?

Wired: I was driving 70 mph on the edge of downtown St. Louis when the exploit began to take hold.I am a little confused. Why would a Jeep Cherokee software engineer connect the controls to the web?

Though I hadn’t touched the dashboard, the vents in the Jeep Cherokee started blasting cold air at the maximum setting, chilling the sweat on my back through the in-seat climate control system. Next the radio switched to the local hip hop station and began blaring Skee-lo at full volume. I spun the control knob left and hit the power button, to no avail. Then the windshield wipers turned on, and wiper fluid blurred the glass.

As I tried to cope with all this, a picture of the two hackers performing these stunts appeared on the car’s digital display: Charlie Miller and Chris Valasek, wearing their trademark track suits. A nice touch, I thought.

The Jeep’s strange behavior wasn’t entirely unexpected. I’d come to St. Louis to be Miller and Valasek’s digital crash-test dummy, a willing subject on whom they could test the car-hacking research they’d been doing over the past year.

Monday, July 20, 2015

California's deranged legislature harming the state economy

Business Insider: The California Public Utilities Commission announced today that it issued two cease-and-desist orders to two Silicon Valley ridesharing companies during the last quarter.This is why California spirals down hill and causes global recessions. The state should be banned from international trade until the legislature is fixed.

KangaDo, the "Uber for Afterschool" app that offers to shuttle around children, was not licensed to operate in California, according to the CPUC's statement.

KangaDo's CEO Sara Schaer said that the company received the notice in April while it was still operating in private beta.

"We’re all in favor of following rules and regulations and, as such, we’re actually in pending status. That is why we are officially in private beta," Schaer told Business Insider. "We’re not operating as a rideshare company pending final approval."

The company is now working through the application process, which it submitted in June.

The banker interface

Its important to note, banker bot offers bankers a distributed spreadsheet, with a state dependent change on spread sheet images. Bankers just add the what ifs, set the owner's profile. Bots can sell as a high roller or conservative; becoming a virtual and accurate counting machine. The banker and owner become intimate, and real time coordinated at exactly the pace of transactions.

The bot reserves a portion of bot to bot hardware security. The technology burden is zero, and paid for. Bankers have no need to fear this technology, it is exactly what banker do.

Local discount points:

In their local community bankers set up discount points, 5% off wherever used. He gets these into the consumer smart card. The banker then offers deposit and loan rates on the points. Merchants see obvious improvements in flow volatility, off days vs on days. Merchant fill in the gaps by lending and saving discount points, and using them. Efficiency gainer, the banker does his job. So the points offer local consumers the same goods with less wait in line. Every local banker can be the central bank, even on poker night.

How to trade local points:

Bring up the proper web page and tap once to buy ten dollars worth. The TapnTrade app. A good idea if you go local on slow night, services are cheap. merchants sell complete dinners for points, then trade them for tax payments. Suppliers hold on to them and when transport is slow, they offer points as a discount. The whole supply chains globs onto the idea. Encode and decode for the community becomes more accurate.

What about Banker Coin?

These coins are dedicated to preserving security. The only real transaction cost for smart card is hardware security. Banker coins cover this, keep some on deposit, borrow them when needed. It is perfectly reasonable to have security fees go up or down for some bot protocols, it is an adjustable fee. So we should all be on the look out for good deals to buy Banker Coin.

The bot reserves a portion of bot to bot hardware security. The technology burden is zero, and paid for. Bankers have no need to fear this technology, it is exactly what banker do.

Local discount points:

In their local community bankers set up discount points, 5% off wherever used. He gets these into the consumer smart card. The banker then offers deposit and loan rates on the points. Merchants see obvious improvements in flow volatility, off days vs on days. Merchant fill in the gaps by lending and saving discount points, and using them. Efficiency gainer, the banker does his job. So the points offer local consumers the same goods with less wait in line. Every local banker can be the central bank, even on poker night.

How to trade local points:

Bring up the proper web page and tap once to buy ten dollars worth. The TapnTrade app. A good idea if you go local on slow night, services are cheap. merchants sell complete dinners for points, then trade them for tax payments. Suppliers hold on to them and when transport is slow, they offer points as a discount. The whole supply chains globs onto the idea. Encode and decode for the community becomes more accurate.

What about Banker Coin?

These coins are dedicated to preserving security. The only real transaction cost for smart card is hardware security. Banker coins cover this, keep some on deposit, borrow them when needed. It is perfectly reasonable to have security fees go up or down for some bot protocols, it is an adjustable fee. So we should all be on the look out for good deals to buy Banker Coin.

Can Banker Bot start a company?

It sure can. Let me show you.

I create a coin called the banker coin, used to pay people and individuals who put banker bot securely inside the smart card, with features outlined in these pages.

Whew! A long sentence. Who owns banker coin? Me, but I am now going to give it away. One fourth to Yahoo, CardLogix, and Wal-Mart. One third to my team. and one seventh to Oxford and Cal Tech in trade for the kids. The rest to be at the disposition of the shareholders.

So banker coin is passed out, I have no shares. I predict there will be a banker coin, it is a necessity. Early holders of the coin will become gazillionares.

I create a coin called the banker coin, used to pay people and individuals who put banker bot securely inside the smart card, with features outlined in these pages.

Whew! A long sentence. Who owns banker coin? Me, but I am now going to give it away. One fourth to Yahoo, CardLogix, and Wal-Mart. One third to my team. and one seventh to Oxford and Cal Tech in trade for the kids. The rest to be at the disposition of the shareholders.

So banker coin is passed out, I have no shares. I predict there will be a banker coin, it is a necessity. Early holders of the coin will become gazillionares.

Apple claims a patent on exchange of binary data

In a landmark decisions, the patent office gave Apple a patent on exchanging digital ads for digital personal info. Now, excuse me a moment, the transmission of digital data has this covered as prior art. Or does Apple claim some new innovation on simple protocol graphs?

Sunday, July 19, 2015

Loading BankBot with applications

The application model is very simple because the bot is all about security. But here is the basic model:

The bot is a state machine that runs a bot communications protocol, traverses a graph, and conducts a functional on any (adjacent) node(s) that determine its relative rank(s). Otherwise, the bot is hardware bound to security and imposes some protections against even its owners fingerprint must be needed.

Take Tap Poker, it is a multi-card game in which the owner taps betting codes, and the bot runs through the multi-peer com protocol to keep the pot straight and take turns. Now, the currency being used has been determined to have low protection, by the owner fingerprint or tap pass code prior to the game. The bot is loose with the betting chips, having fun. But the owner will have to go through more difficult validation to fill the betting coins from the retirement fund.

So we can envisage a small programming interface, allowing the user to specify all the programming parameters, more like a programmable calculator from the old school. But, at its core is security from the hardware key to the tap code to the fingerprint; even a face. Then, access to graphs come with hardware driven restrictions.

Hence the user interface, standard tap; as found in the myriad of other common usage of the tap. The unpatentable, tap interface. Programmers can read count and cadence, and hop along a graph in response. ANd the standard card comes with the multi-colored LED.

Having one of these smart cards will be a life changing event for all users. We will all suddenly realize we will always be protected from bad investments or lousy purchases or rotten deals. Hound your banker to get these things as quickly as possible. If you are a Wal-Mart or Yahoo fan, then by all means harass those companies until you have the full money.

If I were the president of CardLogix.

I am thinking, this Better Economics blog has it right. With those bot features the smart card value goes up from a 1 dollar to 40 dollars. So, why not Yahoo, Wal-Mart, CardLogix; and the team I selected, just go and get this done right? What is stopping them? The fan base of this team, already well known in their fields, is in the millions. It is important to look closely at this team, because I have no deal in this and I know what and how it is happening. So, it is very likely that this team will do a great job.

Bankers know this programming interface

They get that graphs are financial sheets, and the programables are like spread sheet functions. So, all the new applications are standard practice for accountants and banker, the bot just provides Ito's calculus over the graph. So this is the big winner for bankers, they become the personal accountants for their clients.

The bot is a state machine that runs a bot communications protocol, traverses a graph, and conducts a functional on any (adjacent) node(s) that determine its relative rank(s). Otherwise, the bot is hardware bound to security and imposes some protections against even its owners fingerprint must be needed.

Take Tap Poker, it is a multi-card game in which the owner taps betting codes, and the bot runs through the multi-peer com protocol to keep the pot straight and take turns. Now, the currency being used has been determined to have low protection, by the owner fingerprint or tap pass code prior to the game. The bot is loose with the betting chips, having fun. But the owner will have to go through more difficult validation to fill the betting coins from the retirement fund.

So we can envisage a small programming interface, allowing the user to specify all the programming parameters, more like a programmable calculator from the old school. But, at its core is security from the hardware key to the tap code to the fingerprint; even a face. Then, access to graphs come with hardware driven restrictions.

Hence the user interface, standard tap; as found in the myriad of other common usage of the tap. The unpatentable, tap interface. Programmers can read count and cadence, and hop along a graph in response. ANd the standard card comes with the multi-colored LED.

Having one of these smart cards will be a life changing event for all users. We will all suddenly realize we will always be protected from bad investments or lousy purchases or rotten deals. Hound your banker to get these things as quickly as possible. If you are a Wal-Mart or Yahoo fan, then by all means harass those companies until you have the full money.

If I were the president of CardLogix.

I am thinking, this Better Economics blog has it right. With those bot features the smart card value goes up from a 1 dollar to 40 dollars. So, why not Yahoo, Wal-Mart, CardLogix; and the team I selected, just go and get this done right? What is stopping them? The fan base of this team, already well known in their fields, is in the millions. It is important to look closely at this team, because I have no deal in this and I know what and how it is happening. So, it is very likely that this team will do a great job.

Bankers know this programming interface

They get that graphs are financial sheets, and the programables are like spread sheet functions. So, all the new applications are standard practice for accountants and banker, the bot just provides Ito's calculus over the graph. So this is the big winner for bankers, they become the personal accountants for their clients.

Ell Nino came and we got a lot of water

Broke a few records for summer rain. Not enough, but a nice start.

AP: The rains came amid a second day of showers and thunderstorms in southern and central California that were setting rainfall records in what is usually a dry month.Rain fell Sunday afternoon in parts of Los Angeles County's mountains, the valley north and inland urban areas to the east. The city also was expected to get a late repeat of Saturday's scattered showers and occasional downpours as remnants of tropical storm Dolores brought warm, muggy conditions northward."We have a chance of some more heavy rain in LA County this evening, thunderstorms, lightning, possibly some localized street flooding," said National Weather Service meteorologist Joe Sirard.The showers forced the Los Angeles Angels' first rainout in 20 years and the San Diego Padres' first rainout since 2006.

Wal-Mart!

Business Insider: This is why four years ago, Wal-Mart opened its Walmart Labs division in the heart of Silicon Valley's Mountain View, not far from Google, LinkedIn, and Yahoo.Nice work, but banker bot does all this automatically. Suggest your lab buy a great banker bot algorithm team then connect with CardLogix for security. I know your techies read my blog, and they know what to do.

It started from Wal-Mart's acquisition of a 65-person search-and-analytics startup called Kosmix in 2011, but now it employs 2,200 "technologists" — developers, engineers, data experts, and the like — to solve the retailer's biggest digital problems.

California environmentalists are busy warming the globe

Peter Gordon: But MTA data show that estimated daily (weekday; system wide, all bus all rail) in FY 2015 was 1,423,458. In FY 2010 it was a little higher, 1,445,109. In other words, slightly worse than flat. Using the same parameters as above, MTA serves 3.25% of all daily trips.Peter is telling us that the light rail systems in California are huge global warmers, the most energy inefficient transportation systems in the world, end to end; or even on a per ride basis. So, Jerry is perfectly happy, calol it a global warming permit, but he means a permit for government to add global warming to the atmosphere. Aside from causing pollution, what else are the environmentalists up to? Here is a graph of gas prices from McBride of calculated risk:

But look closer. The National Transit Data Base includes the agency's 2013 data. Rail (light + heavy) accounted for just over 24% of the boardings (24% of 3.25%, actually less than 1%!) -- and just over 27% of operating costs but almost 74% of capital costs. This is all too much to shoe horn into a boast to plaster onto the sides of buses. And it's not pretty.

Notice the leap in gas prices in California? Half of this is taxes, and half is regulation. We do not have the refinery capacity, because of legal restrictions. Besides warming the globe, where do gas taxes go? They fund Musk and the electric car. And they also go into unfunded retirement plans so that retirees can drive around on vacation.

But the California private sector is cutting back on activities, they cannot afford to warm the globe. So we are going to get a bit of a slow down this summer, already we see this in the unemployment rate which has jumped. So new and old businesses are moving to Texas.

Who is in charge of the whole stupid thing? California's Floundering legislature. California is going to go spiralling down hill soon, the legislature out here always drives the world economy into the ditch.

Hollande of France is nutty

Bloomberg: French President Francois Hollande said that the 19 countries using the euro need their own government complete with a budget and parliament to cooperate better and overcome the Greek crisis.I do not think that Germany will sign on to cover France's debt, likely just the opposite. So France can sign on to cover Italy's debt, and leave Germany out of it.

“Circumstances are leading us to accelerate,” Hollande said in an opinion piece published by the Journal du Dimanche on Sunday. “What threatens us is not too much Europe, but a lack of it.”

While the euro zone has a common currency, fiscal and economic policies remain mostly in the hands of each member state. European Central Bank President Mario Draghi made a plea this week for deeper cooperation between the euro members after political squabbles over Greece almost led to a rupture in the single currency.

Countries in favor of more integration should move ahead, forming an “avant-garde,” Hollande said.

Is this the elusive Shannon clock rate?

Weyl Fermion: Two separate teams of researchers have found evidence for a theorized type of massless particle known as a “Weyl fermion.” The discovery was made by scientists at Princeton University in New Jersey and the Massachusetts Institute of Technology, and could herald a whole new age of better electronics. Weyl fermions were first hypothesized by German mathematician and physicist Hermann Weyl in 1929. They were proposed as being among the building blocks of subatomic particles, and were also said to be unique in that they would have no mass and also behave as both matter and antimatter – which has the same mass but opposite charge and other properties to regular matter – inside a crystal. Initially, they were wrongly identified as neutrinos, until it was found in 1998 that neutrinos have a very small amount of mass. Now the researchers say they have solved the 85-year-old mystery for good. The research by both teams was published in the journal Science. They found the fermions independently by firing photons at crystals of a semi-metal called tantalum arsenide, which has properties between an insulator and a conductor. They cannot exist by themselves as standalone particles, but instead exist as quasiparticles – a "disturbance" in a medium that behaves like a particle. “In other words, they are electronic activity that behaves as if they were particles in free space,” IEEE explains. But they are important, because Weyl fermions are very stable, and they will also only interact with other Weyl fermions, staying on the same course and at the same speed until they do. This means that, for example, they can carry a charge for long distances without getting scattered and creating heat, like electrons, according to Live Science. “The physics of the Weyl fermion are so strange, there could be many things that arise from this particle that we're just not capable of imagining now,” said co-author Zahid Hasan, a Princeton professor of physics who led the research team, in a statement.

Is this the thing that paces the exchanges of the vacuum? Is this the clock rate of the fine structure?

Gold Star to Randy Waldman

Interfluidity: Downward price stickiness is a coordination problem, plain and simple. It has nothing whatsoever to do with illusions or cognitive biases or failing to spit after staring too intensely at a small child. Economic entities, both firms and humans, have liability structures rigid in nominal terms. A business has made forward-looking contracts — leases of facilities and equipment, price-stabilized arrangements to acquire raw materials, and yes, contracts with employers that cannot be altered without renegotiation. Businesses have also financed themselves in part with debt, and so taken on nominal obligations whose sustainability is based on forward-looking nominal prices of the goods and services they will sell.