The consequence of UK austerity was the slowest recovery from a recession in centuries.

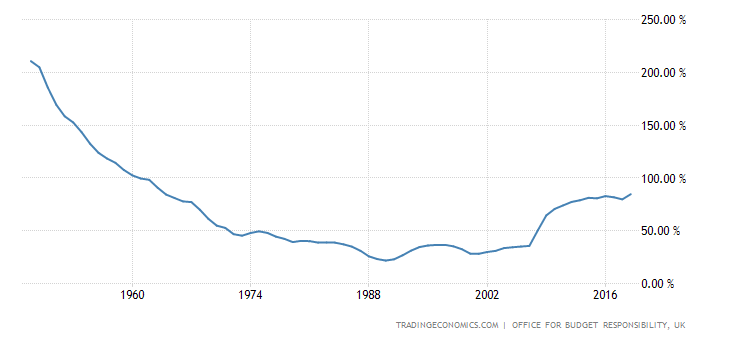

Says Simon. He wanted more debt in 2010, claims that the jumps from 35% of GDP to 85% is not enough. If the multiplier was that good, then it should show up, let us look at growth:

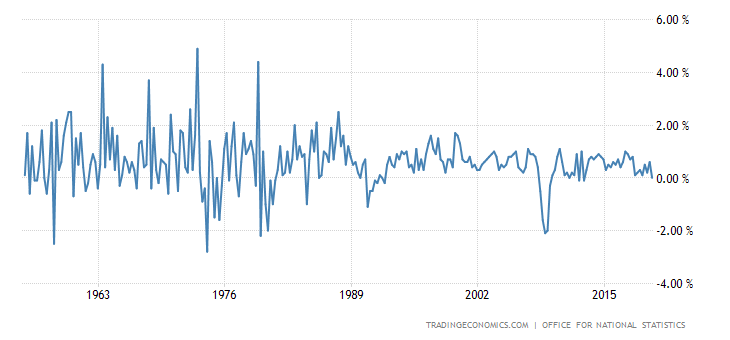

Looks like a V, then growth returned back to the same old sec stags.

Our interest rates low? The ten year cost for government is .69, but interest charges, annually, per gdp are 4%. Did the UK have cheaper rates back in 2010? No, look:

The ten year shows the normal secstags. On what evidence do we have from the past, other then this episode? That was quite the jump, maybe government wants to claim the V, then fine, but that is enough Veeing around. A jump in the ten year will become sudden stop if interest charges hit 7% of GDP.

No comments:

Post a Comment