I have a hard time lining these up to fit any theory of rates and inflation.

If the economy is partitioned, not ergodic, then the 30 year mortgage rate lines up with 30 year home ownership. There should be a noticeable, ex post, relationship. I have no theory, hmmm...

There are a some confounders, local zoning rules, tenant regulations, tax deductions and government mortgage insurance. Local zoning rules make the sales cycle much longer. Government insurance means support for increasing home ownership. Tenant regulations raise rental costs, pushing people into homes. Then there is the bog tax deduction on interest payments.

It is not so much I have no theory, but the confounders are all significant making it nearly impossible to find congestion points in isolation. Another government created nightmare might be the best theory.

In the background are the interest charges dropping almost monotonically over the very long 40 year period.

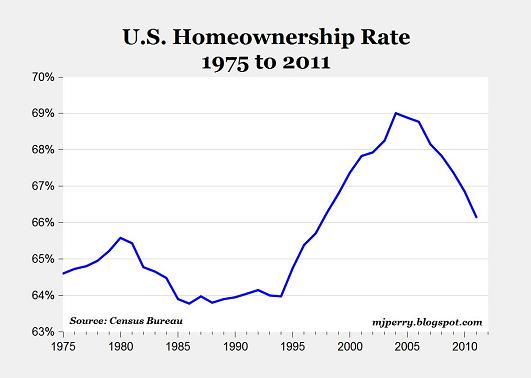

Look:

Home ownership rises to a peak, then drops. A six point variation over all. Basically some 6% of families have been priced out of the market. Price is going up mainly due to more amenities, it is the wealthiest who are buying homes. As the lower incomes drop out, the supply of cheap housing drops and amenities and wealth exaggerate the price inflation. Wealthy are more liquid.

It matters, it matters because we want to know how partitioned we are, and how much of the inflation vs interest theories really work.

Housing starts:

Crashed in 2005 when the lower incomes got priced out of the market. Barely recoverd, and home ownership is still dropping.

For the Antificants, it is a mess, and in the deal, they think it through. Do not sign off on any housing. until the default deal is signed.

No comments:

Post a Comment