The private sector knows more about the future than the public sector.

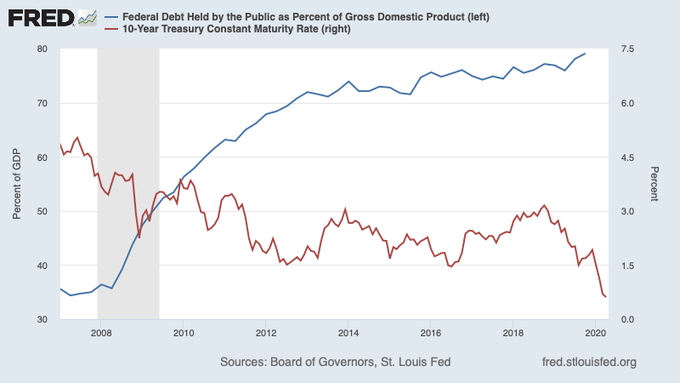

Let's look at the longer period and verify Krugman's discovery.

Same chart below. And we see the ten year consistently drops as we have periodic recessions and increase debt.

So what is causality? Let us add in real growth?

The next chart shows real growth which we presume the private sector is aware of. Note the real growth always drops prior to the recession, hence the drop in rates.

I dunno Krugman's point, or how this favors government borrowings in any fashion, but a flat earther would be confused. Right now that green line has dropped dramatically, the private sector firms know it, they are the one doing less borrowing. It seems highly likely we change regimes when the private sector hits the skids.

It is a flat earther problem because the government sector, like Krugman, assumes programs scale properly in N, the number of participants. It does not, and it is not a two party problem, it is natural.

But the private sector cannot live without a future, and eventually the House will provide a future with a Fed regime change. Then we get mild stagflation, if it done right.

Krugman likes government bailouts after our regularly scheduled recessions, so does everyone.

No comments:

Post a Comment